Axios Pro Rata

March 30, 2018

Hey Columbus: You're invited to join Axios at Ohio State University on Monday for a discussion about the future of work. Our guests include Mark Cuban and Gov. John Kasich. More info and RSVP by going here.

Top of the Morning

The markets are closed for Good Friday, so here's the Q1 report card:

- M&A: Busiest Q1 ever for global deal-making, according to prelininary data from Thomson Reuters. Up 67% from last year, driven by large deals (>$1b deals up 109%) and energy and power deals (14.5% market share). U.S. activity was up 63% and dollar volume was at its highest mark since 2000.

- IPOs: 44 priced in the U.S. (+76% over Q1 2017) and raised $15.5 billion (+57.4%). New filings are up 33%, per Renaissance Capital.

- Stocks: Dow Jones Industrial Average and S&P 500 both down, representing their first quarterly losses since Q3 2015. Nasdaq barely in the black, thanks to yesterday's rally. The FANGs split, with Facebook and Google down for the quarter. The VIX jumped 81%.

- Go deeper: Trump's volatility problem

- Private equity: Global activity hit $79.7 billion, which is a 30% jump from last year and the strongest first quarter since 2013, per Thomson Reuters. The U.S. piece was $46.4 billion (+52%).

- Debt: Leveraged lending was down 31% from Q1 17, mostly owing to a decrease in refinancings.

• It gets worse: Abraaj Group plans to lay off around 15% of its 350-person team, according to Bloomberg. But no partners. Instead, the pink slips go to back office and junior staffers, because apparently they caused the problems.

• In the trees: Yesterday we discussed the VC mega-fundraising boom. A couple additional notes about Sequoia Capital, which is raising between $6 billion and $8 billion for its new global growth fund (which will focus almost exclusively on late-stage rounds for existing portfolio companies).

- It's not charging any fees on committed capital, per a source who's seen the proposal. There's a 1% fee on called capital and a 20% carried interest. That's more LP-friendly than its typical fund terms, including for a new $500m U.S. early-stage fund it's also raising, which makes sense since Sequoia already knows the companies.

- Sequoia has spoken with some U.S. public pensions about investing, although it's unclear if any have agreed to become LPs.

- Reader email: "I'm surprised Sequoia cares so much about dilution. It didn't used to buy into IPOs for its companies, and these later-stage rounds today are serving a similar purpose, particularly when they include secondaries."

The BFD

Walmart (NYSE: WMT) is in early talks to buy health insurer Humana (NYSE: HUM), according to the WSJ.

- Why it's the BFD: Because this would be doubly defensive, with Walmart trying to protect itself from both CVS (which agreed to buy Aetna) and whatever Amazon is planning for pharmacy. It also would raise major regulatory questions about consolidated pricing power.

- Dollars: Humana had a market cap of around $37 billion at the time of the report, but its shares then jumped more than 10% in aftermarket trading.

- Bottom line: "A combined Walmart and Humana would control pharmacies, health insurance and a pharmacy benefit manager. It’s almost identical to the CVS-Aetna deal, except Walmart and Humana would be geared heavily toward seniors and those living on more fixed incomes." — Bob Herman, Axios

Venture Capital Deals

• Goop, Gwyneth Paltrow's lifestyle content and commerce company, has raised $50 million in Series C funding. Lightspeed Venture Partners and Fidelity were joined by return backers like NEA and Felix Capital. http://axios.link/hnkO

• BetterUp, a San Francisco-based leadership coaching platform, has raised $26 million in Series B funding. Lightspeed Venture Partners led, and was joined by return backers DFJ, Freestyle Capital and Crosslink Capital. http://axios.link/kfm9

• Electric AI, a New York-based provider of automated IT support for SMEs, raised $9.3 million in Series A funding. Bessemer Venture Partners led, and was joined by Bowery Capital and Primary Venture Partners. www.electric.ai

• Wondery, a Los Angeles-based podcast network, has raised $5 million in a Series A funding co-led by Greycroft, Lerer Hippeau and Advancit Capital. Other backers include BAM Ventures, Water Tower Ventures, Fox Networks Group and BDMI. http://axios.link/YrZD

• Cubigo, a Belgian provider of digitization solutions for senior living communities, has raised $4.5 million in Series A funding led by Urbain Vandeurzen. http://axios.link/rkiM

• Flipside Crypto, a Boston-based cryptocurrency investment service, has raised $3.4 million in first-round funding. True Ventures led, and was joined by The Chernin Group, Resolute Ventures, Boston Seed Capital, Converge and Founder Collective. http://axios.link/ZN6K

Private Equity Deals

• American Securities has acquired Prince Erachem International, a manufacturer of mineral-based specialty additives, from Palladium Equity Partners. www.princeminerals.com

• Ankura, Washington, D.C.-based portfolio company of Madison Dearborn Partners, has agreed to acquire c3/consulting, a Nashville-based management consulting firm. http://axios.link/X2nG

• Ascensus, a portfolio company of Genstar Capital and Aquiline Capital Partners, has agreed to acquire Asperia, a Worcester, Mass.-based third-party administrator for defined contribution and defined benefits plans. www.ascensus.com

• Eco-Site, a Durham, N.C.-based wireless tower and infrastructure platform, has raised $30 million in funding from MSouth Equity Partners. It also secured a $60 million credit facility. http://axios.link/BXeO

• Investcorp has invested in ICR, a strategic communications and advisory firm with offices in the U.S. and China. www.icrinc.com

• PAI Partners has completed its previously-announced purchase of Albéa, a Luxembourg-based packaging company for the beauty and personal care sectors, from Sun Capital Partners. www.albea-group.com

• Platinum Equity has completed its $3.85 billion purchase of Husky Injection Molding Systems, a Canadian supplier of injection molding equipment to the plastics market, from Berkshire Partners and OMERS. www.husky.co

Public Offerings

🚑 Unum Therapeutics, a Cambridge, Mass.-based developer of cancer immunotherapies, raised $69 million in its IPO. The company priced nearly 5.8 million shares at $12 (low end of $12-$14 range), and closed its first day of trading at $11 (Nasdaq: UNUM). Morgan Stanley was lead underwriter. Shareholders include Atlas Ventures (13.9% pre-IPO stake), F-Prime Capital Partners (9.9%) and New Leaf Venture Partners (5.3%). http://axios.link/LuOz

More M&A

⚓Chinese regulators have given preliminary approval for a merger of the country’s two largest shipbuilders, China State Shipbuilding and China Shipbuilding Industry, according to Bloomberg. http://axios.link/MT70

• GKN (LSE: GKN) shareholders narrowly approved an $11 billion hostile takeover bid from Melrose Industries (LSE: MRO). http://axios.link/RSRg

• The New York Stock Exchange is in talks to buy the Chicago Stock Exchange, per the WSJ. http://axios.link/vUQr

Fundraising

• AngelPad, a San Francisco-based startup accelerator, has secured $35 million for a new $50 million-targeted VC fund, per an SEC filing. http://axios.link/Wl4u

• Lead Edge Capital, a New York-based growth equity firm, is raising its fourth fund, per an SEC filing.

It's Personnel

• Farooq Abbasi has joined Costanoa Ventures as a principal. He previously was with Mosaic Ventures. www.costanoavc.com

• Emmanuel Jaclot, a veteran of both Schneider Electric and EDF Energies, has joined Caisse de dépôt et placement du Québec as EVP of infrastructure investing. www.cdpq.com/en

Final Numbers

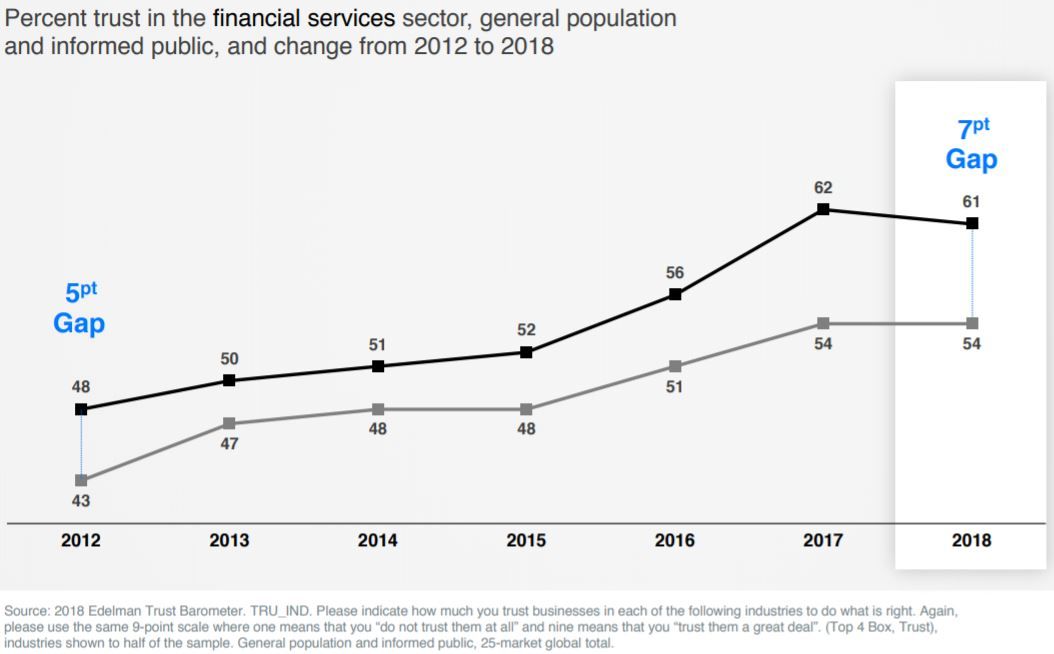

- Trust in financial services had been rising for five years, but has now stalled among both the general population (bottom line) and what Edelman refers to as "informed public" (top line).

- The gap between those two groups is slightly increasing.

- Read the full report.

Sign up for Axios Pro Rata

Dan Primack’s briefing on VC, PE & M&A for dealmakers.