Axios Pro Rata

November 01, 2017

Get Smarter, Faster: Axios is launching a movement to help spread trustworthy, shareable news: the Smarter Faster Revolution. Our mission is to help as many people as humanly possible get smarter, faster on the topics that matter. You can help by signing up to be part of the cause, then recruit others to join our campaign and win cool Axios gifts.

Top of the Morning

One year ago this week, an online wedding vendor marketplace called Borrowed & Blue raised $7 million in Series A funding led by Foundry Group. But now the Charlottesville, Va.-based startup is shuttered -- and more than two dozen employees are out of work — after the board discovered financial improprieties from Borrowed & Blue's married co-founders, Adam and Christin Healey.

- What happened: Sources tell Axios that Christin used a company credit card to make large personal purchases, both domestic and international, and that Adam was aware of the financial mismanagement but did nothing to stop it. There also were broader questions about Chirstin's role and compensation, as she originally was introduced to investors as a non-operating co-founder, but that seemed to shift over the past year.

- Scoop credit: Many of these details also appear in a local CBS affiliate report.

- What now? There was still some money in the bank that is being returned to investors, and we hear there is an asset sale process in place.

- Due diligence: Expect this situation to be used by VCs as an example of why they won't back married co-founders, despite notable success stories like Eventbrite.

- For the record: Foundry Group declined comment, and Adam Healey did not return my email.

• Tax talk: House Republicans have delayed their big roll-out of the tax plan, as first reported last night by Axios' Jonathan Swan. It's now supposed to come tomorrow.

- Be smart: One reason there have been relatively few leaks of the plan details is because there haven't been many plan details to leak. That said, word is that the House has backed off its "phase in" plan for the corporate tax rate — perhaps prodded by Trump's comments yesterday — although it could still be operative in the Senate.

• Trumpland: Another announcement we're expecting out of D.C. tomorrow is the President's pick for Fed chair, with all indications that it will be Jay Powell. And we probably shouldn't be surprised, given Trump's penchant for picking private equity executives. Remember, Powell spent eight years with The Carlyle Group before joining his brother-in-law's private equity firm, Global Environment Fund.

- Equilibrium: There is certainly a case for having economic and monetary officials with a knowledge of business issues, and a private equity background can give insight into wide swaths of industry. But, at the same time, Trump picking Powell would tip the board even more unevenly in that direction — particularly given that he already nominated ex-Carlyle exec Randal Quarles to the Fed board.

- Plus: Powell, a registered Republican: (a) Had his 2014 Fed governor nomination by Obama voted against by around half of Senate Republicans (including Mitch McConnell) and (b) Much of his monetary philosophy seems to mirror that of Janet Yellen, whose renomination would also help Trump course correct a bit on the gender disparity in his top-level nominations.

- To be clear: I have no dog in this fight. Picking Powell just seems strange in terms of both politics and policy.

The BFD

Rockwell Automation (NYSE: ROK) has rejected an unsolicited takeover offer of more than $27 billion from Emerson Electric (NYSE: EMR), saying it undervalued the Milwaukee-based industrial automation company.

- Why it's the BFD: Because it's hard to imagine Emerson is going to take its ball and go home. This is not Emerson's first bid for Rockwell, which Emerson believes could introduce $6 billion worth of synergistic savings. But Emerson has had no luck via private negotiations so, now, the offers have conveniently leaked — thus putting possible shareholder pressure on Rockwell to engage.

- Key term: The latest offer reportedly was evenly split between cash and stock, and Rockwell would like to weight that balance toward the former. Not only for shareholder liquidity, but also due to concerns over integration challenges.

- Bottom line: "Emerson's offer stems from its desire to be a leader in all areas of automation and to present a stronger competitive offering to industrial companies as European giants such as Siemens, ABB Automation Group and Schneider Electric become more aggressive in the field." — David Faber, CNBC

Venture Capital Deals

• SouChe, a Chinese online marketplace for cars, has raised $335 million in Series E funding. Alibaba Group led the round, and was joined by Warburg Pincus, Primavera Capital and CMB International. The company previously raised $305 million. http://axios.link/qgZ7

• InVision, a New York-based digital product design platform, has raised $100 million in Series E funding. Battery Ventures led the round, and was joined by Spark Capital, Geodesic and return backers Accel Partners, Tiger Global Management, FirstMark Capital and Iconiq Capital. http://axios.link/3YDw

• Xingbianli, a Chinese checkout-free convenience store and snack bar operator, has raised $57 million in Series A1 funding. Sequoia Capital China led the round, and was joined by China Renaissance Group, Vision Plus Capital and return backer Lightspeed China Partners. http://axios.link/yfoe

• Achates Power, a San Diego-based developer of reduced-emissions internal combustion engines, has raised nearly $30 million in Series D funding from backers like OGCI Climate Investments. Existing investors include Sequoia Capital, RockPort Capital Partners, Madrone Capital Partners, InterWest Partners and Triangle Peak Partners. www.achatespower.com

• Markforged, a Cambridge, Mass.-based industrial 3D printing platform, has raised $30 million in Series C funding. Next47 led the round, and was joined by Microsoft Ventures, Porsche SE and return backers Matrix Partners, Northbridge Venture Partners and Trinity Ventures. http://axios.link/6zuD

• Kano, a London-based provider of DIY hardware building kits, has raised $28 million in Series B funding. Thames Trust and Breyer Capital co-led the round, and were joined by Index Ventures, Stanford Engineering Venture Fund, LocalGlobe, Marc Benioff, John Makinson, Collaborative Fund, Triple Point Capital and Barclays. http://axios.link/qUBr

• Harry's, a New York-based subscription service for shaving products, has secured $27 million of a $37.6 million funding round, per an SEC filing. Existing investors include Wellington Management, Tiger Global Management, Highland Capital, Harrison Metal, Light Street Capital Management and Bullish.

• Pomelo, a Thailand-based fashion e-commerce startup, has raised $19 million in Series B funding. JD.com and Provident Capital Partners co-led the round, and were joined by Lombard Investments. http://axios.link/oW0a

• BondIT, an Israeli provider of bond portfolio optimization software for fixed-income traders, has raised $14.25 million in VC funding from China's Fosun Group. www.bonditglobal.com

🚑 Quip, a New York-based maker of electric toothbrushes and other oral health products, has raised $10 million in VC funding led by Sherpa Capital. http://axios.link/VcYQ

• TourRadar, an Austria-based provider of several-day tour bookings, has raised $10 million in Series B funding. Endeit Capital led the round, and was joined by Cherry Ventures and Hoxton Ventures. http://axios.link/rDvr

🚑 Ribometrix, a Durham, N.C.-based developer of small molecule modulators of RNA, has raised $7.5 million in seed funding. SV Health Investors and Hatteras Venture Partners co-led the round, and were joined by AbbVie Ventures, the Dementia Discovery Fund, MP Healthcare Venture Management and Alexandria Venture Investments. www.ribometrix.com

🚑 LumiThera, a Seattle-based developer of a non-invasive PBM treatment for ocular disorders and diseases, has raised $5.5 million in Series B funding. WaterStone Capital led the round, and was joined by RPR Venture. www.lumithera.com

• Trilio Data, a Boston-based provider of data protection and recovery-as-a-service, has raised $5 million in Series A funding led by .406 Ventures. www.trilio.io

🚑 VitalConnect, a San Jose, Calif.-based maker of wearable biosensors, has raised $5 million in new Series C funding (bringing the round total to $38m). Company backers include MVM Life Science Partners and Baxter Ventures. http://axios.link/mkJy

• Reali, a San Mateo, Calif.-based "app-enabled real estate company," has raised $3 million in new Series A funding from Oren Zeev (bringing the round total to $9m). www.reali.com

• Waycare, an Israeli developer of transportation management solutions for smart cities, has raised $2.3 million in seed funding. Spider Capital and Innogy SE co-led the round, and were joined by Goldbell Investments, UpWest Labs, janom, Zymestic Solutions and SeedInvest. www.waycaretech.com

Private Equity Deals

• AE Industrial Partners has acquired FMI, a Park City, Kan.-based manufacturer of large, complex structural components and subassemblies. www.fmi-incorporated.com

• The Blackstone Group has purchased a 4 million square foot portfolio of warehouses and distribution centers in Southern California for around $500 million from a unit of Principal Financial Group (NYSE: PFG), according to the WSJ. http://axios.link/9YIj

🚑 New Mountain Capital has invested in Cytel, a Cambridge, Mass.-based provider of analytical software and services to the life sciences industry. www.cytel.com

• Permira has agreed to acquire Duff & Phelps, a -based valuation and corporate finance advisory, for $1.75 billion from The Carlyle Group, Neuberger Berman, Pictet & Cie and the University of California Regents. http://axios.link/D25S

🚑 Shore Capital Partners has acquired Advanced Animal Hospital Group and Progressive Pet Animal Hospitals, and merged them into a single company (Midwest Veterinary Partners) that will have 22 general practice veterinary clinics in Michigan, Wisconsin and Illinois. www.shorecp.com

• Woodlawn Partners has acquired Truesdell, a Tempe, Ariz.-based provider of repair and restoration services for concrete structures. www.truesdellcorp.com

Public Offerings

• Altair Engineering, a Troy, Mich.-based provider of engineering software, raised $156 million in its IPO. The company priced 12 million shares at $13 (top of range), and will trade on the Nasdaq under ticker symbol ALTR. J.P. Morgan served as lead underwriter. www.altair.com

• Grupo Mexico this month plans to raise more than $1.2 billion via an IPO of its rail unit. http://axios.link/FSH4

• Loma Negra, an Argentina-based cement producer controlled by InterCement Participações, raised $840 million in its IPO. The company priced 44.2 million American depository shares at $19 (high end of range), and will trade on both the NYSE and BYMA under ticker symbol LOMA. BofA Merrill Lynch was listed as left lead underwriter. http://axios.link/npEq

Liquidity Events

⛽ Galena Private Equity Resource Fund has agreed to sell Louisville, Ky.-based coal producer Bowie Resource Partners to an investor group that includes Bowie chairman John Siegel and Murray Energy. http://axios.link/045X

More M&A

🚑 Halyard Health (NYSE: HYH) has agreed to sell its Surgical and Infection Prevention business for $710 million to Owens & Minor (NYSE: OMI). www.owens-minor.com

Fundraising

• Alsop Louie Partners is raising up to $125 million for its fourth VC fund, per an SEC filing. www.alsop-louie.com

• Brighteye Ventures, a Paris-based venture firm focused on edtech startups, has raised €50 million for its debut fund. http://axios.link/XFq2

🚑 Frazier Healthcare Partners has closed its latest VC fund with $419 million in capital commitments. http://axios.link/wOe0

• Neuberger Berman is raising upwards of $500 million for its fifth private equity fund-of-funds, per SEC filings.

• Prelude Growth Partners has launched as a New York-based growth equity firm focused on consumer brands. It's led by Neda Daneshzadeh (ex-L Catterton) and Alicia Sontag (ex-global president of beauty at Johnson & Johnson Consumer Cos.). www.preludegrowth.com

• Vertical Venture Partners is raising up to $80 million for its second early-stage VC fund, per an SEC filing.

It's Personnel

• Alireza Zaimi has agreed to take a senior management role with Saudi Arabia's $230 billion Public Investment Fund, according to the FT. He has spent the past three years as a London-based managing director with BofA Merrill Lynch. http://axios.link/rBAk

• Wilson Sonsini Goodrich & Rosati has elected Palo Alto-based partner Katie Martin as chair of its board, effectively succeeding Larry Sonsini. www.wsgr.com

Final Numbers

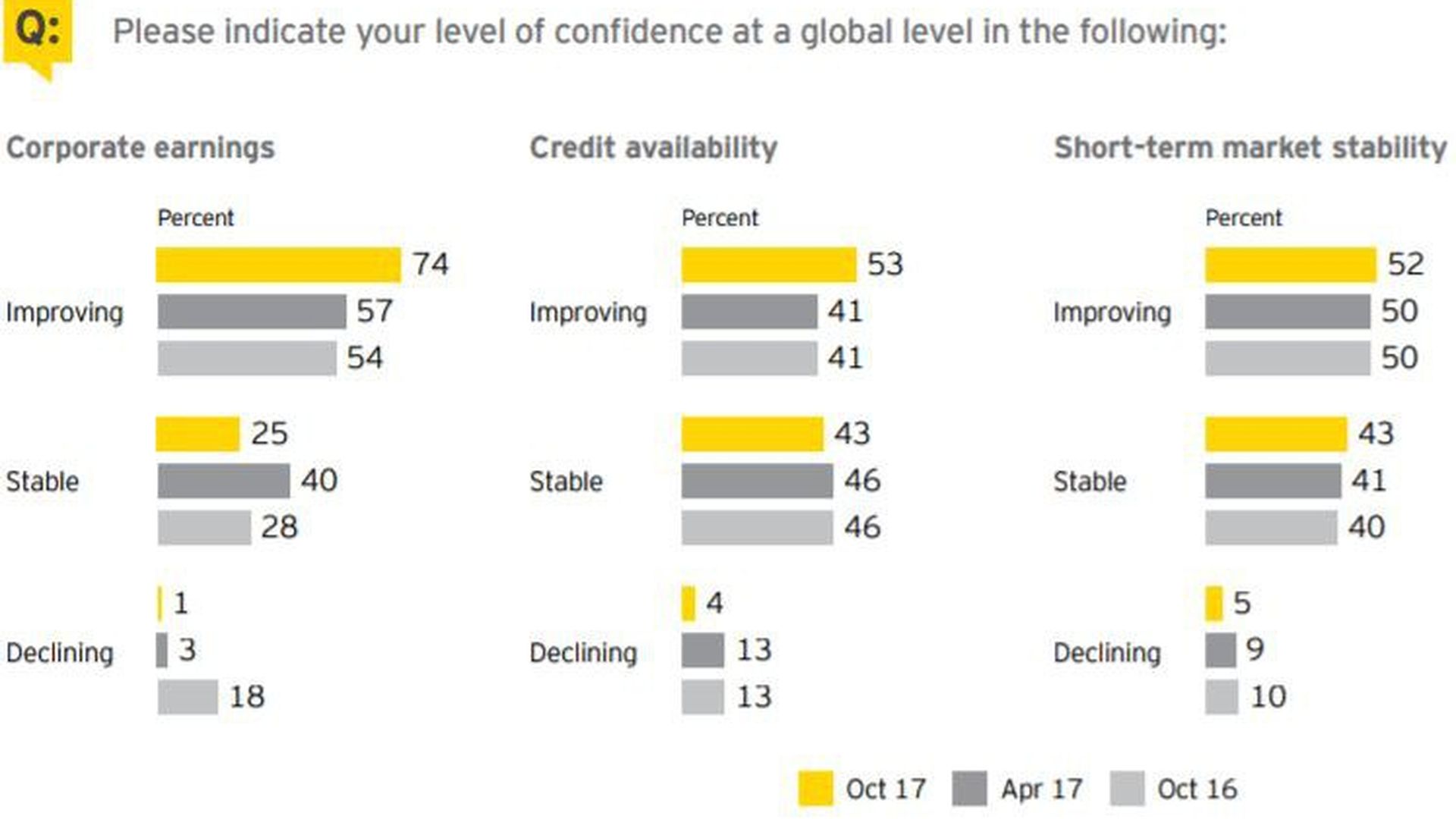

More from EY, which surveyed around 3,000 global executives:

"With benign volatility measures, such as the Chicago Board Options Exchange Volatility Index, executives are not anticipating any sudden deterioration in capital market conditions. The biggest risks to growth could be policy missteps, such as central banks raising rates too quickly or removing too much liquidity from global financial markets."

Sign up for Axios Pro Rata

Dan Primack’s briefing on VC, PE & M&A for dealmakers.