Axios Pro Rata

June 15, 2020

🎧 Axios Re:Cap, my new 10-minute podcast, launches this afternoon. Please subscribe via:

Top of the Morning

Illustration: Rebecca Zisser/Axios

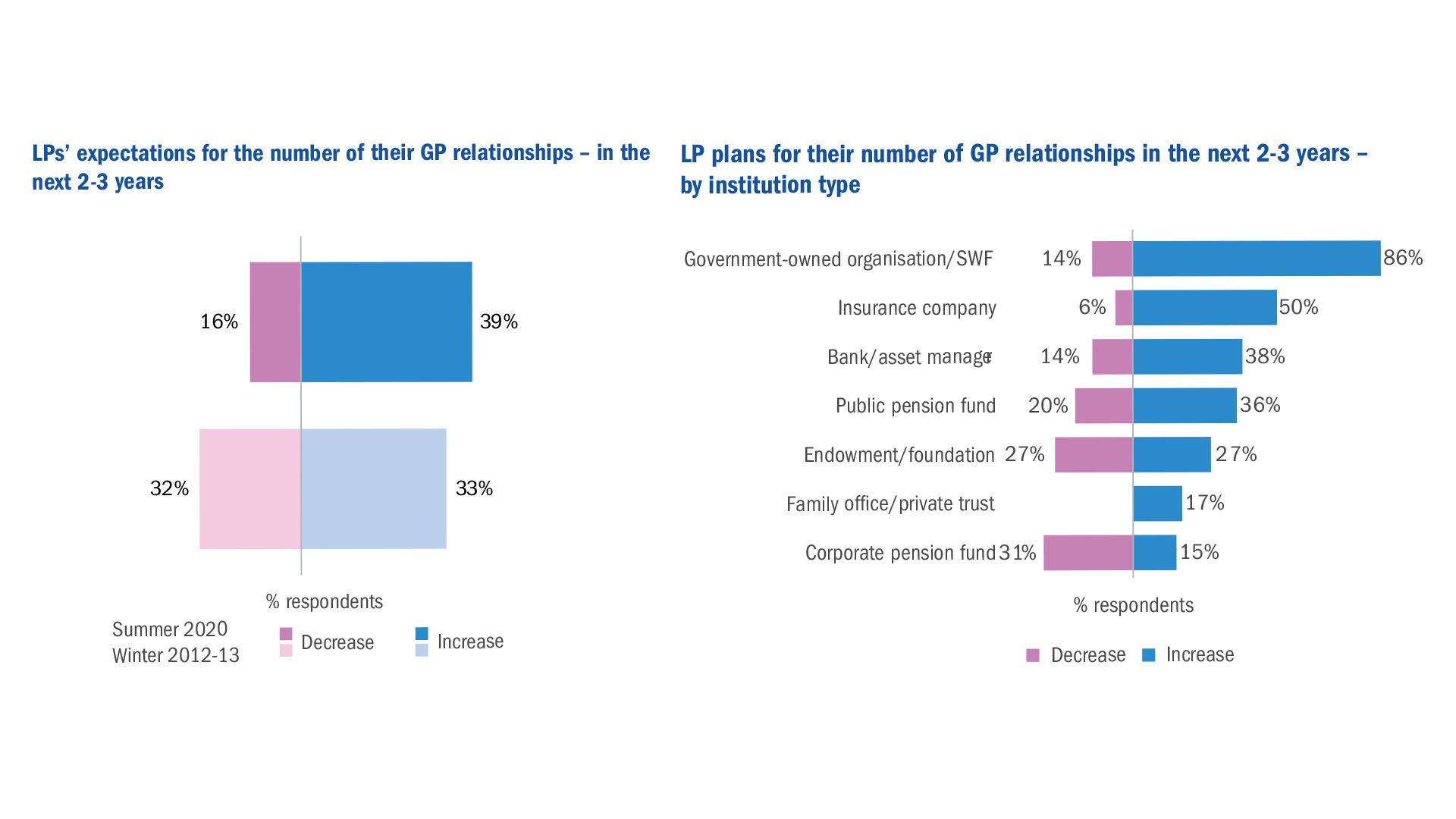

Three quarters of limited partners in private equity funds say they want more opportunities to interact directly with one another, according to a Coller Capital survey released today.

Why it matters: LPs have historically been siloed, thus giving them less leverage and visibility when negotiating terms with general partners.

Flashback: In 2009 I organized something called the LP Congress, a one-day series of working groups in NYC for pension, endowment, family office, and fund-of-funds managers.

- The most notable takeaway was how few of the hundred or so attendees had ever met each other before.

Today: Things don't appear to have changed too much, despite a decade in which LP complaints about fund fees have been bolstered by a cavalcade of regulatory fines.

- Coller Capital, which surveyed 107 global LPs between February and March, discovered that 61% of European respondents and 50% of North American respondents want more opportunities to interact with other LPs invested in the same funds as they are.

- A whopping 80% of North American LPs want more chances to interact with LPs outside of their region, while 47% want more chances to interact with LPs inside of their region.

What's the problem? General partners, particularly in how they rarely provide LPs with lists of what other institutions are invested in their funds.

- Such information can eventually be gleaned via attendance at annual LP meetings, but GPs are known to position their own staffers so as to be in the middle of even informal LP conversations during coffee breaks.

- Certain LPs are effectively prevented from even attending such meetings, due to either budgetary concerns or, in the case of public fund managers, regulations against accepting such "gifts" as a high-priced meal.

- And then there's the pandemic, which makes any sort of physical meetings more difficult and international meetings nearly impossible.

Caveat: Coller did find that 82% of LPs are now satisfied by the level of transparency provided to them by GPs, up from a pitiful 40% back in the summer of 2009.

- Plus, LPs today have a whole host of video, networking and encrypted chat options that didn't exist 11 years ago.

The bottom line: General partners may be barriers to LP interaction, but LPs must do a better job at hurdling them.

The BFD

Illustration: Eniola Odetunde/Axios

Jio Platforms, the digital and mobile telecom subsidiary of Indian conglomerate Reliance Industries, secured $598 million in new equity funding from TPG Capital and $249 million from L Catterton.

- Why it's the BFD: There have been more mega-investments in Jio Platforms over the past eight weeks than there have been Mondays. Put together, it works out to nearly $14 billion for less than a 25% stake — all setting up for an IPO.

- The bottom line: Investors want in because Jio already is the largest mobile provider in the world's second-largest country, and seeks to become the dominant pipes for India's shift to digital. Why Jio keeps taking new investors is less clear, particularly given that it doesn't need the likes of TPG or L Catterton for market validation, although speculation is that it's to help Reliance Industries retire debt.

Venture Capital Deals

🚑 Miaoshou Doctor, a Chinese patient management and communications platform, raised $85 million in Series D1 funding from backers like Sequoia Capital China, Qiming Venture Partners, INCE Capital, and CITIC Securities. http://axios.link/eCrZ

🚑 Bit Bio, a British cell reproduction startup, raised $41.5 million from Foresite Capital, Blueyard Capital, and Arch Venture Partners. http://axios.link/EEFz

• Homeday, a German real estate brokerage startup, raised €40 million from Axel Springer and Purplebricks. www.homeday.de

• Tropic Bioscience, a British ag-tech company focused on tropical crops , raised £22.5 million in Series B funding. Temasek led, and was joined by Sumitomo Corporation Europe, Genoa Ventures, Agronomics, Skyviews Life Science, and Pontifax AgTech. http://axios.link/Xfrj

• Tonik Financial, a Philippines-based digital banking startup, raised $21 million in Series A funding. Sequoia Capital India and Point72 Ventures co-led, and were joined by seed backers Insignia and Credence. http://axios.link/iTHJ

🚑 Nanox, an Israeli developer of digital X-ray beds, raised $20 million from SK Telecom. http://axios.link/dYra

• Lane, a Toronto-based workplace experience platform, raised C$10 million in Series A funding. Round13 Capital led, and was joined by Alate Partners and Panache Ventures. http://axios.link/WW4d

• Beta Media, a Vietnamese cinema chain, raised $8 million from Japan’s Daiwa PI Partners. http://axios.link/9qhw

🚑 TeleVet, an Austin, Texas-based mobile telemedicine app for veterinary clinics, raised $5 million in Series A funding. Mercury Fund led, and was joined by Dundee VC, Atento Capital, GAN and Urban Capital Network. www.televet.com

• Noteable, a Cupertino, Calif.-based collaborative notebook platform for teams, raised over $4 million from firms like Wing VC, per an SEC filing. www.noteable.io

• Trade Hounds, a Boston-based online profess, raised $3.2 million in seed funding. Corigin Ventures and Brick & Mortar Ventures co-led, and were joined by Suffolk Construction and CCS Construction Staffing. http://axios.link/Mqf8

Private Equity Deals

• Bain Capital is among several private equity firms lining up bids for up to a 49% stake in Italian toll road payments company Telepass from Atlantia, per Reuters. Bain is working with Advent International, while Warburg Pincus teamed with Neuberger Berman and both Apax Partners and Partners Group are prepping solo bids. http://axios.link/yRod

🚑 BGH Capital agreed to buy the medical centers and dental practices of Australia’s Healius (ASX: ALS) for A$500 million. http://axios.link/9sab

• Cinven is among those kicking the tires on Liverpool Victoria, a privately held British insurer that could fetch £500 million in a sale, per Bloomberg. http://axios.link/qIyi

• General Atlantic and Warburg Pincus agreed to co-lead an $8.7 billion buyout of Chinese classifieds site 58 (NYSE: WUBA). Sellers will include Tencent. http://axios.link/PpV0

• Hopu Investment Management is leading a $1.13 billion buyout of Singapore-listed real estate firm Perennial Real Estate Holdings. http://axios.link/8QEE

• SkillSoft, an Ireland-based e-learning company owned since 2014 by Charterhouse Capital Partners, filed for Chapter 11 bankruptcy protection. http://axios.link/OYNA

Public Offerings

• Only one company, Royalty Pharma, plans to price an IPO in the U.S. this week. http://axios.link/q35Y

• Bindawood Holding, a Saudi Arabian grocery store chain backed by Investcorp, plans to launch an IPO as early as this month, per Reuters. http://axios.link/CCLb

🚑 Burning Rock Biotech, a Chinese developer of DNA sequencing tech for oncology, raised $223 million in its IPO. The company priced 13.5 million shares at $16.50 (above $13.50-$15.50 per share), for an initial market cap of $1.7 billion. It listed on the Nasdaq (BNR) with Morgan Stanley as lead underwriter, and had raised nearly $200 million from firms like Northern Light VC (13.7% pre-IPO stake), Sequoia Capital China (9.1%), CMB International (8.8%), LYFE Capital (7.9%), GIC (6.1%), and Providence Equity Partners. http://axios.link/u8RX

🚑 Vaxcyte, a Foster City, Calif.-based developer of pneumococcal vaccines, raised $250 million in its IPO. The pre-revenue company priced 15.6 million shares at $16, versus original plans to offer 14 million shares at $14-$16, for a fully diluted market value of $841 million. It listed on the Nasdaq (PCVX) with BofA as lead underwriter, and had raised $283 million in VC funding from firms like TPG Growth (12.9% pre-IPO stake), Abingworth (12.7%), Longitude Venture Partners (11%), RA Capital (9.1%), Janus Henderson (9.1%), Roche (7.9%), Pivotal bioVentures (6.5%), Frazier Life Sciences (6.3%), and Medixi (5.8%). http://axios.link/1dJ1

More M&A

• Admiral Group (LSE: ADM) hired Houlihan Lokey to find a buyer for its Penguin Portals price comparison platform, which could fetch around $500 million, per Bloomberg. http://axios.link/92pe

⚽ AS Roma, an Italian soccer club, is seeking new buyers after a planned €750 million sale to Texas billionaire Daniel Friedkin collapsed due to the pandemic, per the FT. http://axios.link/GHOW

🎬 Cineworld (LSE: CINE) terminated its $1.6 billion all-cash deal to buy Cineplex (TSC: CGX). http://axios.link/tjNV

• Sinch, a listed Swedish cloud communications platform, agreed to buy India’s ACL Mobile for £56 million. http://axios.link/LaOa

• Tencent agreed to acquire Chinese car comparison site Bitauto (NYSE: BITA) for $1.1 billion in cash, or $16 per share (12% premium to Thursday’s closing price). http://axios.link/Zx4w

• Zijin Mining of China agreed to buy gold miner Guyana Goldfields (TSX: GUY) for C$323 million. http://axios.link/GT9P

Fundraising

• Macquarie is raising $3 billion for its third Asia-focused infrastructure fund, per DealStreetAsia. http://axios.link/SrKM

• Telescope Partners, a San Francisco-based growth equity firm, is raising $120 million for its second fund.

It's Personnel

• Simon Dingemans, a former GlaxoSmithKline CFO who most recently led the U.K.’s antitrust authority, agreed to join The Carlyle Group as managing director in charge of British buyouts. http://axios.link/xDlD

Final Numbers

🙏 Thanks for reading Axios Pro Rata! Please ask your friends, colleagues, and the next Jio investors to sign up.

Sign up for Axios Pro Rata

Dan Primack’s briefing on VC, PE & M&A for dealmakers.