Axios Pro Rata

July 11, 2019

Greetings from D.C., where I'm in town for some Axios meetings. Please remember you can send me scoop or feedback via email ([email protected]) or via my anonymous tip-box: http://axios.com/tips. Okay, here we go...

Top of the Morning

Illustration: Sarah Grillo/Axios

It was just a clerical error.

That's the message from Leon Black, CEO of Apollo Investment Group, after federal tax filings showed that Jeffrey Epstein served as a director of Black's family foundation for six years after pleading guilty to a state charge of soliciting prostitution from underage girls.

- The Black Family Foundation submitted Form 990-PFs for calendar years 2007-2012 that included Epstein as a member of its executive committee.

- 2007 was the year that Epstein struck his highly-controversial plea deal with Alex Acosta, then Miami's lead federal prosecutor and now the U.S. Labor Secretary.

- For the first 24 hours or so after the filings were first uncovered, neither Apollo nor Black provided public comment.

- Then, late yesterday afternoon, media outlets (including Axios) were provided with a January 2015 document, apparently signed by both Black and Epstein, saying that Epstein resigned from the Foundation in July 2007 (several months before the plea was finalized). It also says that a copy of the actual resignation could not be found, and that his continued inclusion on tax forms "was an oversight by the Foundation's tax accountants which was not noticed until 2013."

Black's personal spokesperson declined to answer follow-up questions, including what exactly Epstein did for the Foundation or if he did other work for Black. He's generally referenced as a wealth manager, but there are lots of oddities in that background, with some suggesting he was more of a tax strategist.

- Black's spokesperson also declined to explain why the 2015 document was created in the first place, as it appears to have been attached to another, undisclosed document.

The bottom line: This is, at best, a very bad look for one of private equity's top power brokers. Particularly given that this isn't the first time that Black's judgment in picking business associates has been objectively dubious (see Villalobos, Alfred). It's also unlikely to be the last well-known name tied to Epstein, now indicted on federal sex trafficking charges, as so far Black is one of just two business clients to have been publicly identified.

- Go deeper: Our new Pro Rata Podcast digs into the Epstein mess. I'm joined by investigative journalist Vicky Ward, who wrote the first magazine profile of Epstein back in 2003, but now says some on-the-record allegations didn't make the final edit. Listen here.

The BFD

Illustration: Sarah Grillo/Axios

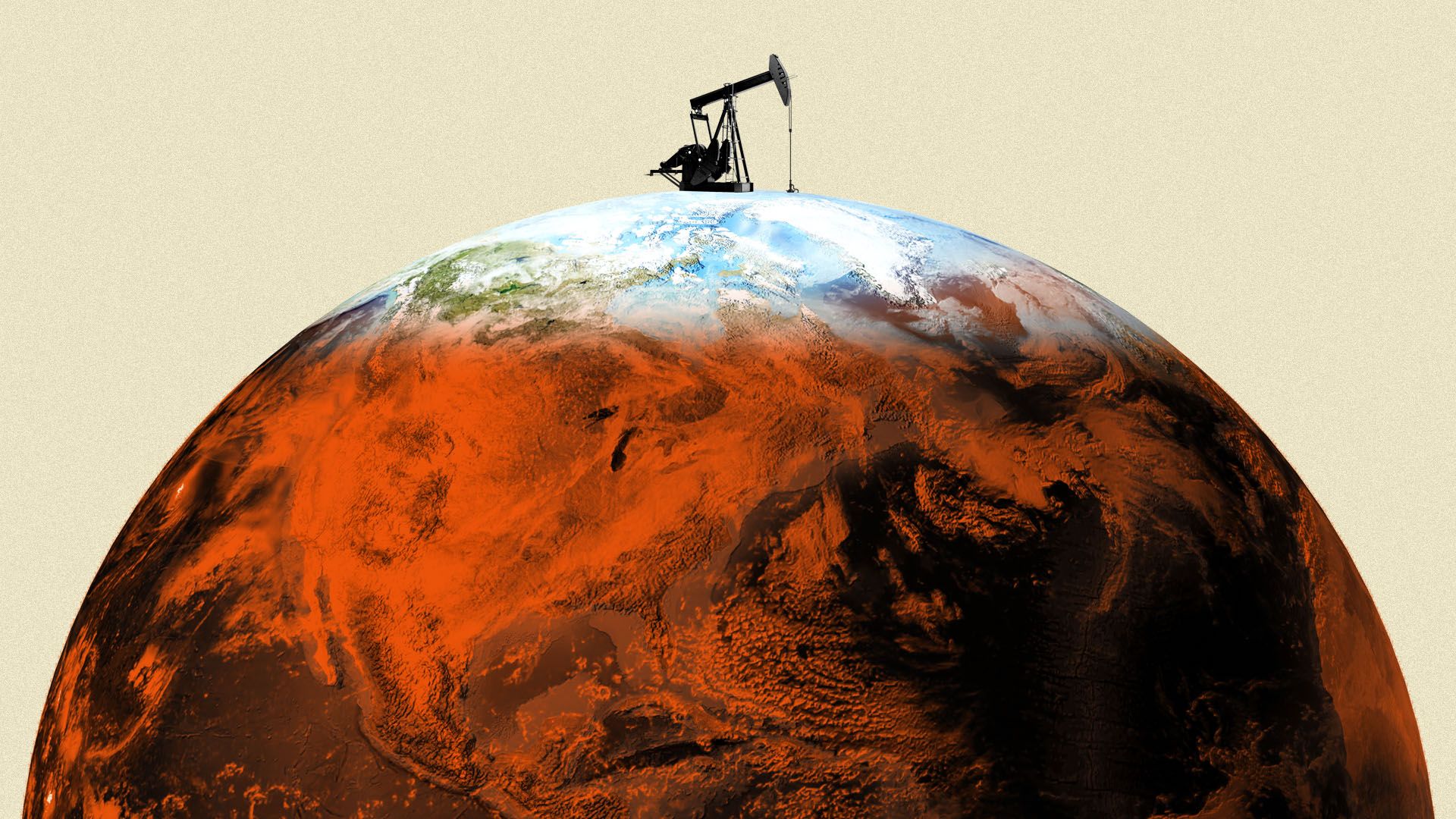

Activist investors have seized control of EQT (NYSE: EQT), the largest U.S. natural gas producer, following an overwhelming shareholder vote that resulted in changes of CEO, chairman, general counsel and seven of the company's 12 board seats.

- Why it's the BFD: Because this is as much about the fiscal viability of shale fracking as it is about Pittsburgh-based EQT, with new management basing most of its argument on using tech to improve drilling efficiency.

- M&A history: EQT became the industry leader via its 2017 purchase of Rice Energy, and Rice's co-founding brothers led the activist group. The brothers hold around a 3% stake in EQT.

- Bottom line: "The dissidents’ victory highlights the urgency for shale producers to demonstrate that they can translate drilling success into shareholder returns. While gas explorers have been remarkably adept at ramping up output and turning the U.S. into a net exporter, their track record of doing so profitably has been spotty at best. Gas prices haven’t helped: They’ve languished near 1990s-era lows amid record production." — Scott Deveau & Naureen Malik, Bloomberg

Venture Capital Deals

• Sonder, a San Francisco-based P2P “services apartments” rental platform, raised $225 million at a valuation north of $1 billion. Backers include Valor Equity, Westcap, Tao Capital, Partners, Fidelity, Atreides, Spark Capital and Greenoaks Capital. http://axios.link/cj2v

• OneTrust, an Atlanta-based data protection and privacy policy software company, raised $200 million in Series A funding at a $1.3 billion valuation led by Insight Partners. http://axios.link/0s2W

• Signavio, a Germany-based provider of business process modeling and management software, raised $177 million. Apax Digital led, and was joined by DTCP. Existing backer Summit Partners will retain an equity stake. http://axios.link/P1Ak

• Rivigo, an Indian logistics network startup, raised $65 million in Series E funding co-led by Warburg Pincus and SAIF Partners. http://axios.link/98KA

• PlanetiQ, a Boulder, Colo.-based weather forecasting startup, raised $18.7 million in Series B funding. New Science Ventures and AV8 Ventures co-led, and were joined by Valo Ventures, Kodem Growth Partners, Access Venture Partners, Virginia Tech Innovation Fund, Hemisphere Ventures, Service Provider Capital, Earth Investments and Moonshots Capital. http://axios.link/GHxw

• Near, a San Francisco-based platform for developing decentralized apps, raised $12.1 million co-led by Metastable and Accomplice. http://axios.link/lOwx

🚑 Vasopharm, a German developer of treatments for traumatic brain injuries, raised €9.5 million. Heidelberg Capital and EF Investors co-led, and were joined by Creathor Ventures and return backers Bayern Kapital, Future Capital, clients of Hanseatic Asset Management and Ringtons Holdings. www.vasopharm.com

• Vyopta, an Austin, Texas-based provider of monitoring and analytics for improving workplace collaboration, raised $7.5 million in Series B funding from Elsewhere Partners. http://axios.link/XGV5

• SynergySuite, a Lehi, Utah-based restaurant management platform, raised $6 million in Series A funding. First Analysis led, and was joined by Oyster Capital. http://axios.link/Velt

🚑 Gateway Learning, a San Francisco-based provider of applied behavioral analysis services for children with autism, raised an undisclosed amount of funding from Norwest Venture Partners.

Private Equity Deals

🚑 Audax Private Equity agreed to buy Aspen Surgical, a Caledonia, Mich.-based maker of single-use surgical products, from Hillrom (NYSE: HRC). www.aspensurgical.com

• Battery Ventures acquired 1WorldSync, a Ewing, N.J.-based SaaS network for brands to share product data with retailers and distributors. www.iworldsync.com

Brookfield Asset Management is prepping a takeover offer for listed Indian wind turbine maker Suzlon Energy, per Bloomberg. http://axios.link/rXHg

• CVC Capital Partners agreed to buy a 30% stake in GEMS Education, a Dubai-based private school network owned by The Blackstone Group. Earlier reports were that CVC would pay north of $1 billion. http://axios.link/ShoG

• Mountaingate Capital invested in RevUnit, a Bentonville, Ark.-based digital strategy and product studio. www.revunit.com

• North Castle Partners invested in CR Fitness, a franchisee group of Crunch Fitness gyms in the U.S. Southeast.

• Permira acquired a majority stake in Los Angeles-based women’s fashion brand Reformation. Word is that existing VC backer Stripes Group is expected to maintain a small stake, while this represents an exit for firms like Forerunner Ventures and 14W. http://axios.link/carK

• Prototek, a Contoocook, N.H.-based portfolio company of Core Industrial Partners, acquired Cal-X, a Grafton, Wis.-based provider of precision machining and sheet metal fabrication rapid prototyping services. www.prototek.com

Public Offerings

• Anheuser-Busch InBev “guided potential investors toward the bottom” of the price range for the $9 billion-plus Hong Kong IPO of its Asia-Pacific business, per Reuters. http://axios.link/nDqC

⛽ Borr Drilling, an offshore drilling company listed in Oslo, filed for a $50 million U.S. IPO. It plans to trade on the NYSE (BORR) with Goldman Sachs as lead underwriter. http://axios.link/zO1J

• McAfee, the cybersecurity company owned by TPG Capital, Thoma Bravo and Intel, is prepping an IPO that could seek to raise around $1 billion at a $5 billion valuation, per the WSJ. http://axios.link/VX9y

• Swiss Re has delayed plans for a $4.1 billion London float of British life insurer ReAssure, citing weak institutional investor demand. http://axios.link/P839

Liquidity Events

• Affinity Equity Partners is seeking a buyer for its 35% stake in Velocity, the frequent flier program of Virgin Australia (ASX: VAH) that it acquired five years ago for A$335 million. http://axios.link/RKgR

• Golden Gate Capital hired advisors to explore strategic options for Clover Technologies, an Illinois-based recycler of inkjets and mobile phones that recently saw major customer pullbacks, per Bloomberg. http://axios.link/6g8H

• Matterport, a Sunnyvale, Calif.-based provider of 3D capture software that’s raised over $100 million in VC, raised Arraiy, a Palo Alto-based production platform for the film and TV industry. Arraiy raised around $13 million from firms like SoftBank Capital and Lux Capital. www.matterport.com

More M&A

⛽ A.P. Moller Holding, the parent company of Danish shipper A.P. Moller-Maersk, agreed to buy Danish wind turbine maker KK Group. http://axios.link/8eGo

• Hitachi (Tokyo: 6501) launched the auction for its $5.6 billion chemicals unit, with first-round bids due August 8, per Reuters. http://axios.link/f7lX

Fundraising

• A91 Partners, a new VC firm led by former Sequoia India partners, raised $351 million for its debut fund. http://axios.link/XOyD

• The Carlyle Group raised $2.2 billion for a fund that will invest in infrastructure assets on OECD countries. It also raised $2.4 billion for its first credit opportunities fund. www.carlyle.com

• Fruition Partners has launched as a Denver-based private equity firm, co-founded by ex-Lariat Partners investors Jay Coughlon, Mac Hampden and Jason Urband. www.fruitionpe.com

• STIC Investments of South Korea is raising $1.6 billion for its second special situations fund, per PE International. http://axios.link/zfsd

• Vista Equity Partners raised $850 million for its second fund focused on early-stage software investments, per Reuters. http://axios.link/6C92

• YL Ventures, a seed-stage VC firm focused on Israeli cybersecurity startups, raised $120 million for its fourth fund. http://axios.link/QjXD

It's Personnel

• Peter Finn stepped down as a managing director of industrials M&A with Nomura, in order to join Cowen & Co., per his LinkedIn profile.

• Andy Freire joined SoftBank Latin America Fund as managing partner and head of its future Buenos Aires office. He is co-founder of Officenet, Axialent and Quasar Ventures.

Final Numbers: Gender gap in British VC

🙏 Thanks for reading Axios Pro Rata. Please ask your friends, colleagues and summer interns to sign up here.

Sign up for Axios Pro Rata

Dan Primack’s briefing on VC, PE & M&A for dealmakers.