Axios Pro Rata

August 02, 2017

Top of the Morning

• PE earnings: The Carlyle Group this morning reported nearly $275 million in Q2 2017 economic net income, which was more than twice the year-earlier ENI and easily beat analyst estimates. Rival Apollo Management Group went in the opposite direction, with Q2 2017 economic net income of nearly $184 million, which is less than half of the firm's ENI in Q2 2016. Apollo also announced that it has secured $24.7 billion for its latest flagship fund, which is the second-largest private equity fund ever raised (behind SoftBank Vision Fund).

- LP concentration: Carlyle co-CEO David Rubenstein said during an earnings call this morning that 60% of the firm's limited partners are in at least six Carlyle funds. Moreover, 10% of Carlyle LPs are in 20 or more of the firm's funds.

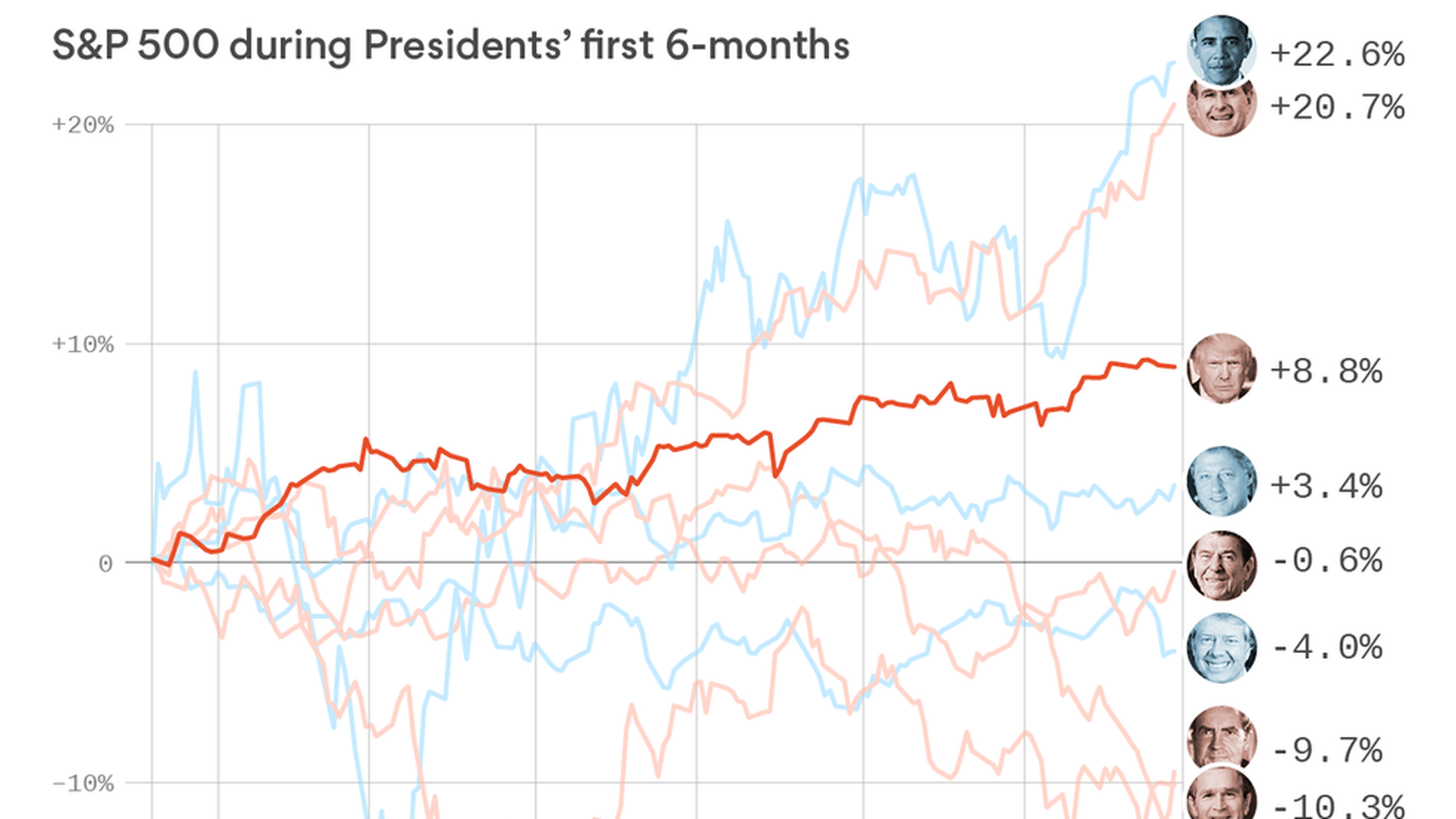

• Market movers: President Trump regularly boasts about the stock market's strong performance since his inauguration, including how the Dow Jones Industrial Average is at a record high. What Trump hasn't noted, however, is that Barack Obama and George H.W. Bush oversaw greater stock market expansion during their first six-plus months in office, as judged by percentage growth of the S&P 500. Check out the details in today's Final Numbers section, or by going here.

- More Trumpland: Axios' Jonathan Swan scooped last night that the White House is planning to crack down on intellectual property theft by Chinese companies, with an announcement coming as early as this week: "The Trump administration views this as a political winner from the Rust Belt (with many voters blaming globalization in general and China in particular for their economic woes) to Silicon Valley (which agrees Chinese IP theft is a problem)."

• Today in Theranos: The embattled blood-testing company has settled its lawsuit with former partner Walgreens, which had claimed breach of contract. No terms were disclosed, although the WSJ reports that the amount was north of $25 million. The paper also notes that Theranos had only $54 million in cash as of June and a $10 million monthly burn rate, but it also was seeking to raise new funding and may have insurance policies to help cover the payments to Wallgreens.

• Today in SoftBank: Some sources insist that the Japanese giant has walked away from a deal with Uber, while others say it remains engaged. In short: Everyone is posturing in order to improve their negotiating position.

• New fund alert: NextView Ventures has closed its third seed fund with $50 million in capital commitments, Axios has learned. The Boston-based firm initially was a tech generalist, but is now refocusing thematically around what it calls "redesigning the everyday economy." Per firm co-founder (and early LinkedIn employee) Lee Hower: "We want to fund companies that have first or second degree impacts on problems virtually everyone faces."

• Critical analysis: Many in Los Angeles celebrated earlier this week, with word that it would be hosting the 2028 Olympic Games. Prior to the announcement, I had asked for some thoughts on the LA bid from Chris Dempsey, who successfully stopped Boston's Olympics bid (overcoming the city's entire political and business power structure in the process):

"I'd give the LA organizers credit for putting together a bid that doesn't require building an Olympic stadium or the biggest-ticket item: the Olympic Village. Note that their original bid to the USOC did propose a $2-3 billion Olympic Village, but they scrapped it in August 2015 in favor of hosting at to-be-built UCLA dorms.

I still see some risks. For example, they need to build a media/broadcast center. These are typically around one million square feet. NBC says they will do this for free on their Universal City lot. If NBC backs out, the LA organizers (and taxpayers) will be on the hook. More broadly, this is a bid being put together in a frothy economic environment. If we have a downturn between now and 2028, how will that impact revenue estimates for sponsorships and ticketing? Would a California budget crisis put the construction of the new UCLA dorms at risk? What happens then?"

The BFD

Volocopter, a German developer of autonomous, electric-powered flying taxis, has raised nearly $30 million in new VC funding from investors like Daimler.

- Why it's the BFD: Daimler's participation gives some added legitimacy to the electric vertical take-off and landing (eVTOL) market, which already had gained the attention of companies like Uber and Volvo (maybe). And while it may all still sound like a Jetsons fever dream, Volocopter is promising demonstrations in Dubai by year-end.

- Bottom line: They promised us flying cars and... Well, they're giving us flying cars.

Venture Capital Deals

• Dianrong, a Chinese peer-to-peer lending platform, has raised $220 million in new VC funding. GIC led the round, and was joined by CMIG Leasing and Simone Investment Managers. http://reut.rs/2uViBUx

🚑 Amplyx Pharmaceuticals, a San Diego-based developer of treatments for life-threatening fungal infections, has raised $67 million in Series C funding. Sofinnova Venture Partners led the round, and was joined by Lundbeckfonden Ventures, Arix Bioscience, Pappas Capital and return backers NEA, RiverVest Venture Partners, 3x5 RiverVest II and BioMed Ventures. http://bit.ly/2f7VvVb

• Personal Capital, a Redwood City, Calif.-based digital wealth management company, has raised $40 million in new Series E funding from existing investor IGM (part of Power Financial Corp.). The round total is now $75 million. www.personalcapital.com

• Juvo, a San Francisco-based mobile identity scoring startup, has raised $40 million in Series B funding. NEA and Wing Venture Capital co-led the round, and were joined by SignalFire. http://tcrn.ch/2tWhcds

• Booster Fuels, a Seattle-based startup that fills gas tanks in corporate parking lots, has raised $20 million in Series B funding. Conversion Capital led the round, and was joined by Maveron, Madrona Venture Group and RRE Ventures. http://tcrn.ch/2hmOKj1

• Gimlet Media, a Brooklyn-based podcasting studio and network, has raised $15 million in new VC funding at a $70 million post-money valuation, led by Stripes Group. http://bit.ly/2f8lUlT

🚑 Viome, a New York-based "AI-powered wellness service" founded by Naveen Jain, has raised $15 million in Series A funding. Khosla Ventures led the round, and was joined by Bold Capital Partners.

• ProoV, a proof-of-concept platform for businesses, has raised $14 million in Series B funding. Helios Capital and Mangrove Capital Partners co-led the round, and were joined by OurCrowd and Cerca Partners. http://tcrn.ch/2vsB8cf

🚑 Ritual Vitamins, a maker of women's vitamins, has raised $10.5 million in Series A funding. Founders Fund led the round, and was joined by Forerunner Ventures, Norwest Venture Partners and Upfront Ventures. http://tcrn.ch/2uTMhSa

• Hustle, a San Francisco-based text messaging platform, has raised $8 million in Series A funding. Social Capital led the round, and was joined by Olidyar Network, Twilio.org Impact Fund and return backer Canvas Ventures. www.hustle.com

• Ironclad, a San Francisco-based provider of contract management software, has raised $8 million in Series A funding. Accel Partners led the round, and was joined by Greylock, SV Angel and Formation 8. www.ironcladapp.com

• Sawyer, a Brooklyn-based online booking platform for children's activities, has raised $6 million in new VC funding. Advance Venture Partners led the round, and was joined by Chan Zuckerberg Initiative, 3311 Ventures, Female Founders Fund and Collaborative Fund. http://tcrn.ch/2f4v96D

• CommonSense Robotics, an Israeli developer of in-store micro-fulfillment centers for retailers, has raised $6 million in seed funding from Aleph VC and Innovation Endeavors. http://tcrn.ch/2f55lam

• Kin, a Chicago-based home insurance startup, has raised $4 million in VC funding from Commerce Ventures, Omidyar Network, 500 Startups, Chicago Ventures, Portag3 Ventures and individual angels. http://tcrn.ch/2w27rMz

• Bitrise, a Budapest-based mobile CI/CD platform for app developers, has raised £2.5 million in Series A funding. OpenOcean led the round, and was joined by Y Combinator and Fiedler Capital. http://tcrn.ch/2ud9Ce5

• Shiyunji, a Chinese tech-enabled food court operator, has raised "tens of millions of U.S. dollars" in Series A funding. Bertelsmann Asia Investments and Qiming Venture Partners co-led the round, and were joined by Zhen Fund, Lishi Venture Capital, Tongkong Investment Group and Canbailian. http://bit.ly/2wl5k5N

• Helpling, a European home services booking service founded by Rocket Internet, has raised an undisclosed amount of new funding from Unilever Ventures. http://tcrn.ch/2uUTBuZ

Private Equity Deals

🚑 Accuity Delivery Systems, a New York-based provider of revenue cycle management solutions for hospitals, has raised an undisclosed amount of private equity funding from MTS Health Investors. www.accds.com

⛽ Aclara, a Missouri-based portfolio company of Sun Capital Partners, has acquired a majority stake in GE Philippines Meter & Instrument Co., a provider of electric meters in the Philippines, from General Electric (NYSE: GE). No financial terms were disclosed. www.aclara.com

• Centerbridge Partners is nearing an agreement to acquire TriMark USA, a South Attleboro, Mass.-based food services equipment distributor, from Warburg Pincus, according to Bloomberg. The deal could be valued at around $1.35 billion. Rival suitors have included New Mountain Capital. https://bloom.bg/2w40FWt

🚑 KKR has agreed to acquire PharMedica Corp., a Killingworth, Conn.-based pharmacy manager, for $1.4 billion (including assumed debt). Walgreens Boots Alliance also will participate on the buy-side for a minority equity stake. https://usat.ly/2uVz1MA

• MidOcean Partners has sponsored an acquisition of Stack-On Products, an Illinois-based provider of secure storage solutions, by Cannon Safe, a San Bernadino, Calif.-based of residential gun safes. No financial terms were disclosed. www.cannonsafe.com

• Peak 10 Holding, a Charlotte-based portfolio company of GI Partners, has completed its previously-announced $1.675 billion purchase of data center group ViaWest from Shaw Communications.

🌞Tennenbaum Capital Partners and Goldman Sachs BDC have acquired Singapore-based solar power plant builder and operator Conergy for an undisclosed amount. http://reut.rs/2hnwoyo

• Thomas H. Lee Partners has agreed to acquire a majority stake in Ten-X, an Irvine, Calif.-based online commercial and residential real estate marketplace. Existing Ten-X investors CapitalG and Stone Point Capital will retain minority equity stakes. No financial terms were disclosed. www.ten-x.com

• Warburg Pincus has agreed to acquire a 49% stake in mutual fund manager Fortune SG Fund Management, from France's Societe Generale. No financial terms were disclosed. SocGen's joint venture partners, China state-owned Baosteel Group, will retain the other 51%. http://bit.ly/2vhPvQj

• Woodlawn Partners has acquired BW Manufacturing, a Comstock Park, Mich.-based manufacturer of concrete flooring equipment and industrial vacuums. No financial terms were disclosed. www.bwmanufacturing.com

Public Offerings

⛽ Ranger Energy Services, a Houston-based provider of well service rigs and associated services, has set its IPO terms to 5 million shares being offered at between $16 and $18 per share. It would have a fully-diluted market cap of around $240 million, were it to price in the middle of its range. The company plans to trade on the NYSE under ticker symbol RNGR, with Credit Suisse listed as left lead underwriter. www.rangerenergy.com

Liquidity Events

• Industrial Opportunity Partners has sold Kuss Filtration, a Findlay, Ohio-based maker of air and liquid filtration products, to Italy's GVS for an undisclosed amount. http://bit.ly/2uhDBVh

• Jacobs Engineering Group (NYSE: JEC) has agreed to acquire CH2M Hill Cos., an Englewood, Colo.-based engineering services group, for around $3.27 billion in cash and stock (including assumed debt). Sellers would include Apollo Management Group. http://reut.rs/2uiPiYK

• LogMeIn (Nasdaq: LOGM) has acquired Nanorep, an Israeli developer of AI-based tools for navigating self-service apps. The deal is valued at upwards of $50 million, including $45 million upfront. Nanorep had raised around $7 million from Titanium, Orzyn Capital and OurCrowd. http://tcrn.ch/2tVdMb7

• Wyndham Worldwide (NYSE: WYN) has acquired Love Home Swap, a London-based home-swap platform that was seeded by MMC Ventures. No financial terms were disclosed, but TechCrunch reports a sale price of £40 million. http://tcrn.ch/2f3WoOy

More M&A

• Virtu Financial (Nasdaq: VIRT) is seeking to sell BondPoint, a fixed-income trading platform it acquired via last month's purchase of KCG Holdings, according to Bloomberg. A sale could garner around $400 million. https://bloom.bg/2vpAFaX

Fundraising

• Bain Capital is raising an Asia-focused special situations fund, per SEC filings.

• Tracker, a new seed fund led by Greycroft venture partner Jon Goldman, has raised $15.6 million in capital commitments. The focus will be on AR/VR and gaming, with Greycroft serving as both an LP and business partner. www.greycroft.com

It's Personnel

• Michael Fizzell has joined private equity firm Atlas Partners as a principal. He previously was with Onex Partners. www.atlaspartners.com

• Todd Jaquez-Fissori has joined Structural Capital, a provider of growth credit loans to VC and PE-backed tech companies, as a managing partner (per his LinkedIn account). He previously was a managing director and head of the energy tech group at Tennenbaum Capital Partners. www.structuralcapital.com

• Kunal Madhukar has stepped down as an Internet analyst with SunTrust, in order to join Deutsche Bank.

• Christie Pitts has joined Backstage Capital as a partner and chief of staff. She previously was with Verizon Ventures. http://bit.ly/2w5xqTd

• Geoffrey Paul has joined Deutsche Bank as a managing director and head of Americas natural resources equity capital markets. He previously was with J.P. Morgan. www.db.com

• Alison Ryu (ex-TSG Consumer Partners) and Kiva Dickinson (ex-TPG Capital) have joined equity crowdfunding site CircleUp as a managing director of funds and a partner, respectively. www.circleup.com

Sign up for Axios Pro Rata

Dan Primack’s briefing on VC, PE & M&A for dealmakers.