Axios Pro Rata

December 09, 2019

Top of the Morning

Elizabeth Warren last week introduced a bill to strengthen oversight of bank mergers, arguing that the current construct is a rubber stamp.

- The Federal Reserve acknowledges that it declined none of the 3,819 bank merger applications it received between 2006 and 2017. And there's no indication that it's objected since then, including the $66 billion tie-up of BB&T and SunTrust that closed earlier this morning (albeit with some required divestitures).

- It's unclear how the Fed might have ultimately ruled on 503 applications, included in the above number, that were withdrawn before deal completion.

The basics of Warren's proposal, per The NY Times:

It would demand more extensive testing for vulnerabilities when two banks want to merge, a bid to slow financial sector consolidation and lean against the formation of huge banks. And it would require the Consumer Financial Protection Bureau, which Ms. Warren helped create, to approve any merger in which one of the banks offers consumer financial products.

Like most of Warren's plans, this one isn't becoming law with a GOP-led Senate and Trump-led White House.

But she's looking toward 2021. Were Warren to become president, or get sign-on from a more successful rival, then legacy banks might find it harder to merge, just as digital, branch-less banks become more popular.

- Online bank Chime on Friday raised $500 million in Series E funding at a $5.8 billion valuation, up from a $1.5 billion valuation in March.

The bottom line: Warren and other progressive Democrats are intent on protecting brick-and-mortar retailers, but show no such affinity for brick-and-mortar banks.

⚖️ On the docket: Today is the start of a trial that will determine the future of American mobile carriage, as a group of state attorneys general will make opening arguments in their case to prevent T-Mobile US from buying Sprint.

💰 New direction: The SEC on Friday rejected an application by the New York Stock Exchange to allow companies to raise capital during direct listings. Go deeper.

🎧 Pro Rata Podcast digs into the controversy over Pete Buttigieg's time with McKinsey & Co., and the NDA that's keeping details under wraps. Listen here.

The BFD

Institutional Shareholder Services recommended that Hudson's Bay Co. (TSX: HBC) shareholders vote against a C$1.9 billion, or C$10.30 per share, takeover offer led by company chairman Richard Baker.

- Why it's the BFD: Hudson's Bay was already drowning in limbo, and this might pull away its life preservers. ISS argues that there's no legitimate reason for shareholders to accept Baker's bid, which also includes Rhone Capital and WeWork Industrial Trust, over an C$11 per share offer from Catalyst Capital Group. But Catalyst can't proceed without Baker's blessing, and the ISS recommendation likely means Baker will also fall short.

- Hudson's Bay brands include Saks Fifth Avenue and Lord & Taylor.

- Bottom line: "Hudson’s Bay shares closed at C$9.13 on Friday, in a sign that investors do not expect either bid to succeed." — Bhargav Acharya, Reuters

Venture Capital Deals

• WalkMe, a San Francisco-based digital adoption platform for enterprises, raised $90 million. Vitruvian Partners led, and was joined by return backer Insight Partners. www.walkme.com

🚑 Gelesis, a Boston-based developer of an oral hydrogel for treating obesity and chronic GI tract diseases, raised $63.4 million in new equity funding led by Vitruvian Partners. www.gelesis.com

🚑 Jasper Therapeutics, a Palo Alto-based developer of safer, non-chemo conditioning and therapeutic agents for hematopoietic stem cell transplants and gene therapies, raised $35 million in Series A funding. Abingworth and Qiming Venture Partners USA co-led, and were joined by Surveyor Capital and Alexandria Venture Investments. http://axios.link/brZ9

⛽ Crusoe Energy Systems, a Denver-based flare migration startup that converts gas into energy for bitcoin mining, raised $30 million in new equity funding led by existing backer Bain Capital Ventures. Other backers include The KCK Group, Founders Fund, Winklevoss Capital, and Polychain Capital. Crusoe also secured $40 million in new project financing. http://axios.link/oCce

• Jow, a French e-grocery app, raised $7 million led by Stride.VC. http://axios.link/Gze2

• Flowhaven, a Finland-based brand licensing startup, raised €4.8 million in seed funding led by Global Founders Capital. http://axios.link/7LNZ

Private Equity Deals

• AerSale, a Coral Gables, Fla.-based aviation aftermarket products and services company owned by Leonard Green & Partners, will go public via a reverse merger with a SPAC called Monocle Acquisition Corp. (Nasdaq: MNCL). www.aersale.com

🥨 Boathouse Capital acquired Coral Gables, Fla.-based Fresh Dining Concepts, the third-largest Auntie Anne's franchisee with over 50 stores.

• ClearCourse Partnership, backed by Aquiline Capital Partners, acquired Giftpro, a UK-based gift voucher management platform for hotels, restaurants, and spas. www.clearcoursellp.com

⛽ Grammar Industries, a Columbus, Ind.-based portfolio company of Stellex Capital Management, acquired LiMarCo, a Houston-based regional hauler of liquified petroleum gas and natural gas liquids. www.grammarindustries.com

🚑 KKR completed its $685 million purchase of Metro Pacific Hospitals Holdings, the Philippines’ largest hospital chain, in partnership with GIC. www.kkr.com

🚑 Varsity Healthcare Partners acquired Peak, a provider of gastroenterology services and related patient diagnostic and remedial treatment services in Colorado.

Public Offerings

• Five companies expect to go public on U.S. exchanges this week, led by a proposed $1.7 billion offering from Brazilian brokerage XP. Others include OneConnect, Bill.com, Sprout Social, and eHang. http://axios.link/WlFd

• Molecular Data, a MOBASE spinout that provides ecommerce software to the Chinese chemicals industry, filed for a $70 million IPO. It plans to trade on the Nasdaq (MKD) with AMTD Global Markets as lead underwriter. http://axios.link/FguU

Liquidity Events

• First Eagle Investment Management agreed to buy THL Credit, a Boston-based alternative credit manager with around $17 billion in AUM. THL Credit was formed in 2007 as an affiliate of buyout firm Thomas H. Lee Partners, which will exit. www.thlcredit.com

More M&A

🚑 3M (NYSE: MMM) is seeking to sell its drug delivery systems unit, which could fetch around $1 billion, per Bloomberg. http://axios.link/qgLV

• Adobe (Nasdaq: ADBE) agreed to buy Oculus Medium, a 3D virtual reality sculpting tool, from Facebook (Nasdaq: FB). http://axios.link/6xFK

🚑 Merck (NYSE: MRK) agreed to buy Woburn, Mass.-based cancer drug company ArQule (Nasdaq: ARQL) for $2.7 billion in cash, or $20 per share (107% premium over Friday’s closing price). http://axios.link/Vmb5

• S&P Global (NYSE: SPGI) acquired 451 Research, a Boston-based research and data firm focused on high-growth emerging tech segments. http://axios.link/aHIB

🚑 Sanofi (Paris: SASY) agreed to buy La Jolla, Calif.-based cancer drug company Synthorx (Nasdaq: THOR) for around $2.5 billion in cash, of $68 per share (172% premium to Friday’s closing price). http://axios.link/3Kq3

• Senior (LSE: SNR) hired Lazard to find a buyer for its aerostructure unit, which could fetch at least £450 million, per Bloomberg. http://axios.link/RDEa

⚽ David Tepper, the hedge fund billionaire owner of the NFL’s Carolina Panthers, agreed to pay the $300 million expansion fee for a new Major League Soccer franchise in Charlotte. http://axios.link/ytEq

• Tesco (LSE: TSCO), Britain’s largest retailer, is considering a sale of its Thai and Malaysia operations, per Reuters. http://axios.link/JAwX

• Texas Capital Bancshares (Nasdaq: TCBI) agreed to merge with Independent Bank Group (Nasdaq: IBTX), via an all-stock “merger of equals” that creates a Texas regional bank with around $5.5 billion in market cap. http://axios.link/naDS

🚑 UnitedHealth Group (NYSE: UNH) agreed to buy Flint, Mich.-based specialty pharmacy Diplomat Pharmacy (NYSE: DPLO) for around $303 million, or $4 per share (31% discount to Friday’s closing price). http://axios.link/3q71

Fundraising

• Leonard Green & Partners of Los Angeles raised over $12 billion for its eighth flagship buyout fund, and $2.75 billion for its first middle-market fund. www.leonardgreen.com

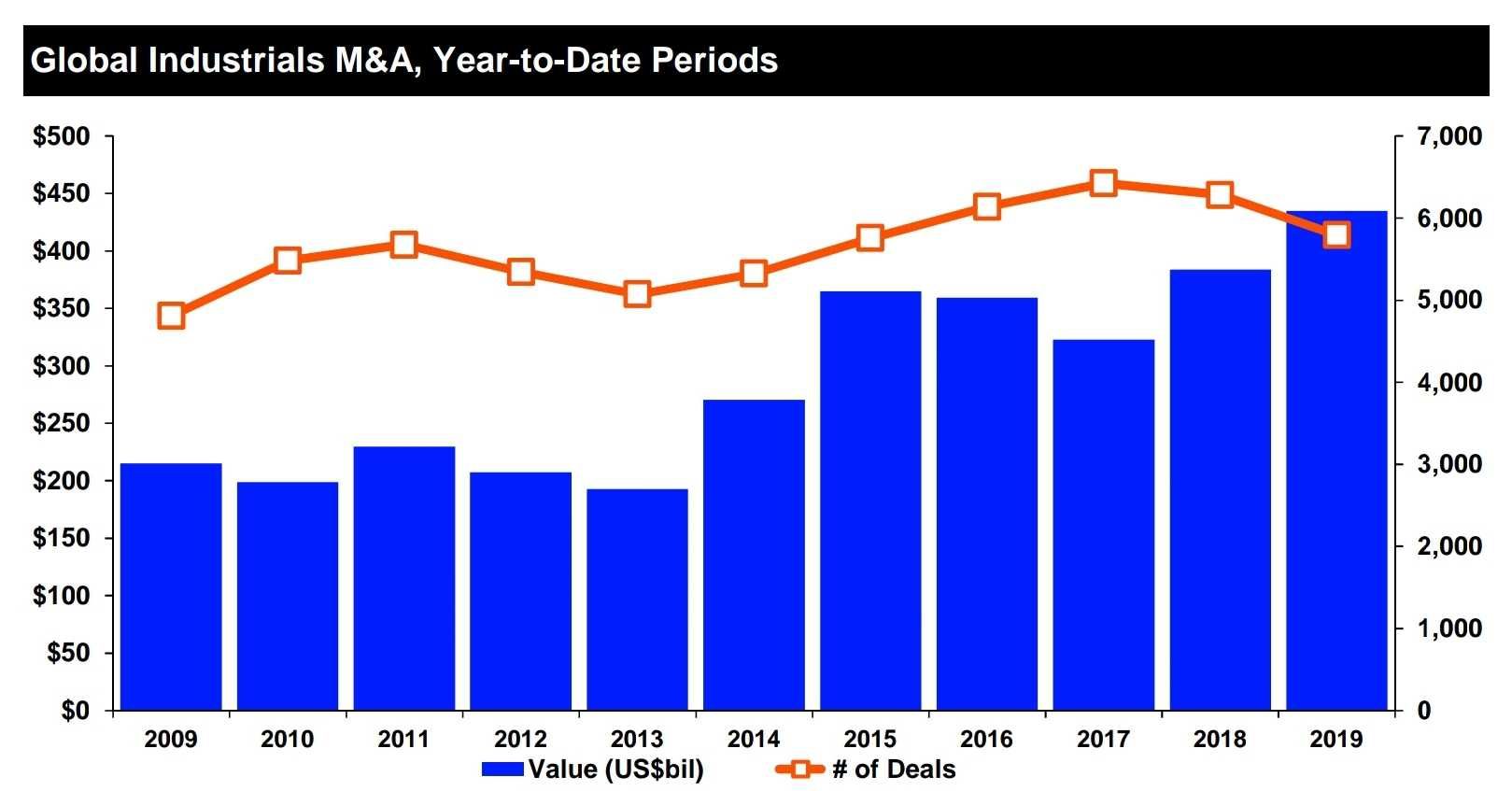

Final Numbers: Industrials M&A hits record

- Global industrials M&A value for 2019 is $435 billion, up 13% from 2018, per Refinitiv.

- The only global sectors with higher percentage increases in 2019 are retail (39%) and healthcare (17%).

🙏 Thanks for reading Axios Pro Rata. Please ask your friends, colleagues, and department store stalwarts to sign up.

Sign up for Axios Pro Rata

Dan Primack’s briefing on VC, PE & M&A for dealmakers.