Axios Pro Rata

April 19, 2019

Top of the Morning

Illustration: Sarah Grillo/Axios

Celebrities participating in venture capital is nothing new, not even peaking when Ashton Kutcher plastered his TV character's laptop with stickers for tech startups. But it does feel that we're seeing new escalation and formalization:

- Serena Williams yesterday revealed the existence of Serena Ventures, which invests in companies "that embrace diverse leadership, individual empowerment, creativity and opportunity." It's capitalized exclusively with Williams' own money, was kept in stealth mode for the past several years, and is aided by former J.P. Morgan and Goldman Sachs analyst Alison Rappaport.

- When e-sports group Gen.G yesterday announced $46 million in new funding, we noted that investors included actor Will Smith and Japanese soccer legend Keisuke Honda. It's true, but more accurate to say that investors included Dreamers, a VC firm that Smith and Honda co-founded last year.

- WaterEquity, co-founded by Matt Damon, just raised $50 million for its debut fund. Rather than focusing on tech or media startups, it's a social impact investor focused on water sanitation in emerging markets.

Bottom line: It's easy, almost tempting, to dismiss these efforts as vanity projects. But that would be a mistake.

Professional venture capitalists always stress the importance of network, and the only thing celebs often have more of than money is network. Plus, remember that Ashton Kutcher's portfolio includes both Pinterest and Uber, while Snoop Dogg launched a cannabis-focused VC firm when recreational marijuana was legal in only one U.S. state.

On that last point...

🌲 Canada's Canopy Growth made headlines yesterday by agreeing to buy U.S. cannabis company Acreage Holdings for $3.4 billion. But there's a catch:

The deal only gets consummated if marijuana is federally legalized in the U.S.

- This provides a road-map for how other foreign cannabis companies could get toeholds in the U.S. market.

- It also gives former House speaker John Boehner 1.59 million reasons to cajole his former colleagues.

- Axios' Courtenay Brown goes deeper.

🚗 Surge: Uber last night confirmed that it's raised $1 billion for its self-driving unit at a $7.25 billion post-money valuation, from SoftBank Vision Fund, Toyota and Japanese auto parts maker DENSO.

- Uber could launch its IPO road-show as soon as next Friday, and this infusion should soothe investor jitters over the self-driving group's cash burn.

- It's also a reminder that CEO Dara Khosrowshahi, and some other senior execs, have personal financial incentives for Uber to be valued at $120 billion, as we discussed on Tuesday. These sorts of deals help, as could additional acquisitions.

- In terms of M&A, don't be surprised if Uber kicks the tires on food delivery companies, particularly outside the U.S.

🔺 IPO pops: Zoom Video finished its first day of trading up 72.22%, giving it a market cap of $15.9 billion. It also had some coattails for a Chinese wireless company called Zoom Technologies, which laid first claim to the ZOOM ticker symbol.

- Pinterest finished up 28.42%, raising its market cap to $12.92 billion and putting all of its private investors in the black.

• Today in Abraaj: Sev Vettivetpillai, a former managing partner with the collapsed private equity giant, was arrested in London on fraud charges and faces possible extradition to the U.S. This comes shortly after the British arrest of former Abraaj CEO Arif Naqvi and the NYC nab of ex-managing partner Mustafa Abdel-Wadood.

- Former managing partner Waqar Siddique and ex-CFO Ashish Dave were also named as co-conspirators in the London case. Bloomberg has more.

🎧 Pro Rata Podcast: We discuss how the gig economy is distorting America's labor data, making job numbers look better than they really are. Listen here.

The BFD

American Media, backed by Chatham Asset Management, agreed to sell the National Enquirer and two sister publications to James Cohen, CEO of airport newsstand operator Hudson News, for a reported $100 million.

- Why it's the BFD: Because Trump? Because Bezos? Because it's being sold by a hedge fund manager who only now decided that the Enquirer practiced unethical journalism? Pick em.

- Bottom line: It's a very high price for a supermarket tabloid with shrinking circulation and expanding scandal.

Venture Capital Deals

🚑 Arrakis Therapeutics, a Waltham, Mass.-based developer of RNA-targeting drugs, raised $75 million in Series B funding. VenBio Partners and Nextech Invest co-led, and were joined by Omega Funds, HBM, GV, WuXi, Alexandria Venture Investments and return backers Canaan Partners, Advent Life Sciences, Pfizer Ventures, Celgene, Osage University Partners and the Henri Termeer estate. http://axios.link/ocAw

• Stord, an Atlanta-based network of warehouses and distribution centers, raised $12.3 million in Series A funding. Kleiner Perkins led, and was joined by seed backers Susa Ventures and Dynamo. http://axios.link/ImDS

• StockX, a Detroit-based online sneaker resale marketplace, is raising new funding from DST Global and GGV Capital at a valuation north of $1 billion, per Recode. http://axios.link/le70

Private Equity Deals

⛽ ConocoPhillips (NYSE: COP) agreed to sell its British North Sea oil and gas assets to Chrysaor, a London-based portfolio company of Global Natural Resource Investments and NGP, for $2.68 billion. http://axios.link/gDpY

• Sumeru Equity Partners invested in 3Gtms, a Shelton, Conn.-based provider of transportation management software. http://axios.link/NVOI

🚑 Surge Private Equity acquired Access Dental, a network of nine specialty dental practices in Texas. www.accessdental-tx.com

Public Offerings

• Ancestry.com, the Lehi, Utah-based genealogy company, is prepping a second-half IPO, per Bloomberg. The company previously scuttled IPO plans in 2017. Shareholders include Silver Lake, GIC, Spectrum Equity and Permira. http://axios.link/5sfw

• Fastly, a San Francisco-based content delivery network, filed for a $100 million IPO. It plans to trade on the NYSE (FSLY) with BAML as lead underwriter. The company reports a $31 million net loss on $144 million in revenue for 2018, and raised around $220 million firms like August Capital, Iconiq, Amplify Partners, OATV, Battery Ventures, Deutsche Telekom, Sozo Ventures and Swisscom Ventures. http://axios.link/2y9U

More M&A

⛽ Austin Energy agreed to buy the Nacogdoches Generating Facility, a 115-MW plant in Austin, Texas, from a subsidiary of Southern Co. (NYSE: SO) for $460 million. http://axios.link/vPw5

• CloudBees, a San Jose, Calif.-based provider of continuous delivery solutions, bought Electric Cloud, a San Jose-based continuous delivery and automation platform. CloudBees has raised around $50 million in VC funding. http://axios.link/3r0w

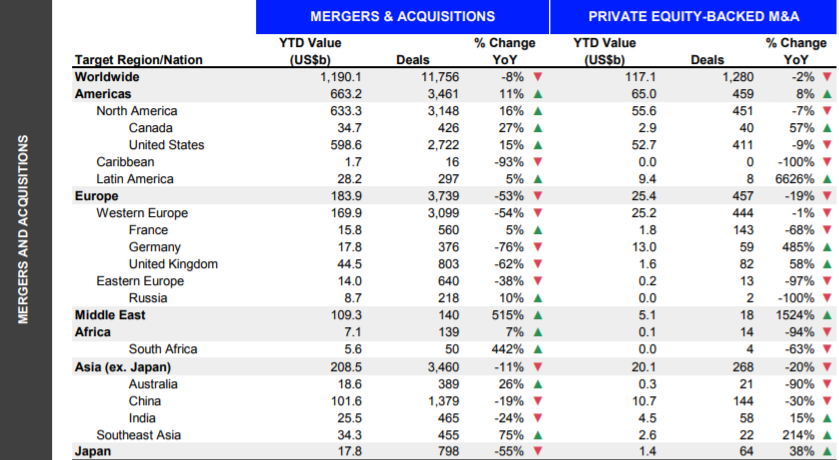

Final Numbers

Sign up for Axios Pro Rata

Dan Primack’s briefing on VC, PE & M&A for dealmakers.