Axios Pro Rata

January 05, 2018

Top of the Morning

"I've never wanted a vacation more than I want one right now."

That was a limited partner in venture capital funds, speaking to me near the middle of 2016. A record amount of fund capital had been raised by brand-name funds in the first half of that year, as the cycle had condensed from four years to two years — and firms were seeking added amounts of capital to deal with unicorn-level valuations (both in terms of new investments, and maintaining pro rata stakes).

And now it's happening again.

Limited partners tell me that most of the firms that raised in early 2016 are returning to market in the first half of this year. For example, Dow Jones this morning reports that General Catalyst is in market with a $1 billion ask for its ninth fund. And, like last time, the fund sizes are larger (GC raised $845 million last time around).

- When venture firms raised outsized funds in 2016, a lot of them said one reason for the extra cash was to re-extend investment cycles. Wonder if we'll hear that one again, or if VCs have now internalized how fund size tails wave investment size/pace dogs.

• Look inside: Intel is refusing to give an explanation for why CEO Brian Krzanich sold around $39 million of stock and options at the end of November 2017, months after the company had been made aware of a fundamental design flaw in its chips that could result in security vulnerabilities.

- Intel says the sale was "unrelated" to the design flaw, and based on an automated stock trading plan.

- But the trading plan in question was set up just weeks earlier, which also was after Intel (and presumably Krzanich) was aware of the security hole. It also resulted in an outsized sale, with Krzanich only holding onto the minimum number of shares that Intel requires him to hold.

- When the SEC comes knocking, Intel likely will say that the design flaw isn't material, thus the trading program change/sale were kosher. But that's a steep hill to climb, given that we still don't know if it will prove material, and it's several months later. For example, what if Intel is hit with class-action lawsuits by everyone with Intel chips in the phones and laptops?

- But at least the SEC probably could learn how Intel sets up and approves such plans, as it isn't commenting publicly on that yet either.

- Here's a timeline

• Seed stuff: Fortune yesterday reported that Los Angeles-based seed investor Arena Ventures told LPs that it is taking a seed investing break due to inflated valuations.

- My understanding is that Arena, led by Paige Craig, is in early talks to raise a new fund focused instead on "pre-seed" opportunities. For Craig, this means backing teams that have an idea, rather than teams that already have an early product and a data point or two.

• All hail breaks loose: Former Uber CEO Travis Kalanick tendered half his 10% stake in the ride-hail giant to Japan's SoftBank, as first reported by Bloomberg and confirmed by Axios. The offer was oversubscribed by 42%, so he ultimately will be allowed to sell around 29% of his holdings.

- This was a big reversal for Kalanick, who had never sold any Uber shares and who initially told friends that he wouldn't participate in the tender.

- Kalanick has regularly been referred to in media reports as a billionaire, but now it actually will be true.

- This obviously makes sense for Kalanick. Not only in terms of personal portfolio diversification, but also because his lack of historical sales was (in large part) a bet on his own leadership of a company he no longer leaves. Plus, this gets that Benchmark lawsuit off his back.

- Bottom line: If Kalanick's primary goal was to kneecap new CEO Dara Khosrowshahi (as some have argued), then he wouldn't have participated in the tender. This was a deal that Khosrowshahi badly wanted, in large part due to the governance changes that will go into effect once it closes.

• Have a great weekend. Stay warm...

The BFD

The Weinstein Co. is "nearing the end of a sale process" that may garner less than $500 million, per the WSJ. Bidders reportedly include Lions Gate Entertainment, Vine Alternative Investments and a group led by former U.S. Small Business Administration head Maria Contreras-Sweet. It is unclear if most offers or for the entire company or for select assets.

- Why it's the BFD: This could mean a total equity loss for the scandal-plagued film studio's shareholders, which include SoftBank, WPP Group and Goldman Sachs.

- Bottom line: "Weinstein Co. has been in a state of limbo since accusations against Harvey Weinstein began mounting this fall. He has denied the allegations of nonconsensual sex. The studio has a number of films whose release plans have been shelved until its future is determined, including drama Current War, comedy The War with Grandpa and a remake of French hit Intouchables starring Kevin Hart." — Ben Fritz & Keach Hagey, WSJ

Venture Capital Deals

🚑 Gossamer Bio, a San Diego-based biopharma startup led by the former CEO and CMO of Receptos (acquired by Celgene for $7.2 billion), has launched with a $100 million Series A funding co-led by Omega Funds and ARCH Venture Partners. http://axios.link/Ou6m

🚑 Personal Genome Diagnostics, a Baltimore-based cancer diagnostics startup, has raised $75 million in Series B funding. Bristol-Myers Squibb and return backer NEA co-led, and were joined by Inova Strategic Investments, Co-win Healthcare Fund, Helsinn Investment Fund, Windham Venture Partners and the Maryland Venture Fund. http://axios.link/VJai

• Wealthfront, a Redwood City, Calif.-based robo-advisor, has raised $75 million in new VC funding. Tiger Global led, and was joined by return backers Benchmark, DAG Ventures, Greylock Partners, Index Ventures, Ribbit Capital, Social Capital and Spark Capital Growth. http://axios.link/Kryk

🚑 Genetron Health, a Beijing-based cancer genomics startup, has raised around $61 million in Series C funding. Zhongjin Kangrui Medical Industrial Fund led, and was joined by V Star Capital and Shenshang Xingye Fund. http://axios.link/l60d

🚑 SoYoung, an online marketplace for aesthetic medical treatments in China, has raised $60 million in Series D funding led by Apax Digital. http://axios.link/KIo9

🚑 Quartet, a New York-based digital collaboration and connection platform for mental healthcare, has raised $40 million in Series C funding. F-Prime Capital Partners and Polaris Partners co-led, and were joined by Deerfield Management, Oak HC/FT and GV. http://axios.link/z8jm

⛽ SolidEnergy Systems, a Woburn, Mass.-based lithium-metal battery company, said that it has raised $34 million in Series C funding. Existing backers include Temasek, Applied Ventures, General Motors and Vertex Ventures China. www.solidenergysystems.com

• BondLink, a Boston-based provider of SaaS solutions for municipal bond issuers, has raised $10 million in Series A funding. Franklin Templeton Investments led, and was joined by Coatue Management. www.bondlink.com

• Frank, an online platform aimed at simplifying the student loan application process, has raised $10 million in second-round funding from investors like Aleph, Reach Capita, Rusk Ventures, Slow Ventures and Apollo Global Management's Marc Rowan. http://axios.link/Kq3r

• Dinghy, a UK-based digital insurance startup focused on freelancers, has raised $1.2 million in seed funding from Balderton Capital. www.getdinghy.com

• Chushou, a Chinese provider of live-streaming for gamers, has raised an undisclosed amount of Series D funding led by Google. Others backers include Qiming Venture, Shunwei Capital and Alpha X Capital. The company did say that it has raised a total of $120 million. http://axios.link/TZQU

Private Equity Deals

• Beautycounter, a Los Angeles-based provider of "cleaner" skin care and cosmetics products, has raised an undisclosed amount of equity funding from Mousse Partners. http://axios.link/E98n

• DeTech, a Palmer, Mass.-based analytical instrument contract design and manufacturing company, has raised an undisclosed amount of equity funding from Ampersand Capital Partners. www.detechinc.com

• MidOcean Partners has acquired BH Cosmetics, a direct-to-consumer cosmetics brand focused on the millennial and Gen Z markets. http://axios.link/3XoX

🚑 North American Dental Group, a New Castle, Penn.-based portfolio company of ABRY Partners, has acquired Atlanta-based TF Dental from Blackford Dental Management. www.nadentalgroup.com

• Oaktree Capital Management has agreed to acquire Australian surfwear brand and retailer Billabong (ASX: BBG) at an enterprise value of around US$155 million. http://axios.link/c0uJ

• One Rock Capital Partners has agreed to acquire Robertshaw Controls, an Itasca, Ill.-based manufacturer of electronic and electromechanical controls for commercial and home appliances, from Sun Capital Partners at an enterprise value of $900 million, according to the WSJ. http://axios.link/1FBm

• Saw Mill Capital Partners has acquired Climate Pros, a Glendale Heights, Ill.-based provider of refrigeration services to grocery retailers and other cold-chain customers. www.climateprosinc.com

Public Offerings

• ADT, a Florida-based home security company owned by Apollo Global Management, set its IPO terms to 111.11 million shares being offered at between $17 and $19 per share. It would have an initial market cap of approximately $13.6 billion, were it to price in the middle of its range. The company plans to trade on the NYSE under ticker ADT, with Morgan Stanley serving as lead underwriter. http://axios.link/5kis

Liquidity Events

• Norwest Venture Partners has sold PCA Skin, a provider of medical-grade skin care products, to Colgate-Palmolive (NYSE: CL). http://axios.link/Bop0

• TorQuest Partners is seeking a buyer for Canadian yarn-maker Spinrite, according to Dow Jones. www.spinrite.com

More M&A

• China Vanke Co. has agreed to acquire 20 Chinese shopping malls from Singapore's CapitaLand for around $1.3 billion. http://axios.link/vAqq

• HNA Group is no longer in talks to acquire a stake in asset management firm Value Partners (HK: 0806), according to Reuters. http://axios.link/P1hd

• Lactalis of France has agreed to acquire Siggi's, a New York-based maker of Icelandic-style yogurt. http://axios.link/ogA1

🚑 Roche (Swiss: ROG) has signed a "biospecific molecule" discovery and development deal with Maryland-based DART biotech MacroGenics (Nasdaq: MGNX) that could be worth upwards of $380 million (including just $10m upfront). http://axios.link/7Oag

🚑 Takeda (Tokyo: 4502) has agreed to acquire TiGenix (Nasdaq: TIG), a Belgium-based developer of stem cell therapies, for around $627 million. http://axios.link/Zoec

• Terminus, an Atlanta-based marketing platform startup, has acquired BrightFunnel, a San Francisco-based provider of B2B marketing analytics and attribution solutions. Terminus has raised over $19 million in VC funding from firms like Edison Partners, Arthur Ventures, Atlanta Ventures and Hyde Park Venture Partners. http://axios.link/FHaf

Fundraising

• Corrum Capital Management of Charlotte has closed an aviation-focused private equity fund with $250 million in capital commitments. www.corrumcapital.com

• Galen Partners, a Stamford, Conn.-based private equity firm, is raising $200 million for its sixth fund, per an SEC filing. www.galen.com

It's Personnel

• Berkshire Partners has promoted both Blake Gottesman and Sam Spirn to managing director. www.berkshirepartners.com

Final Numbers

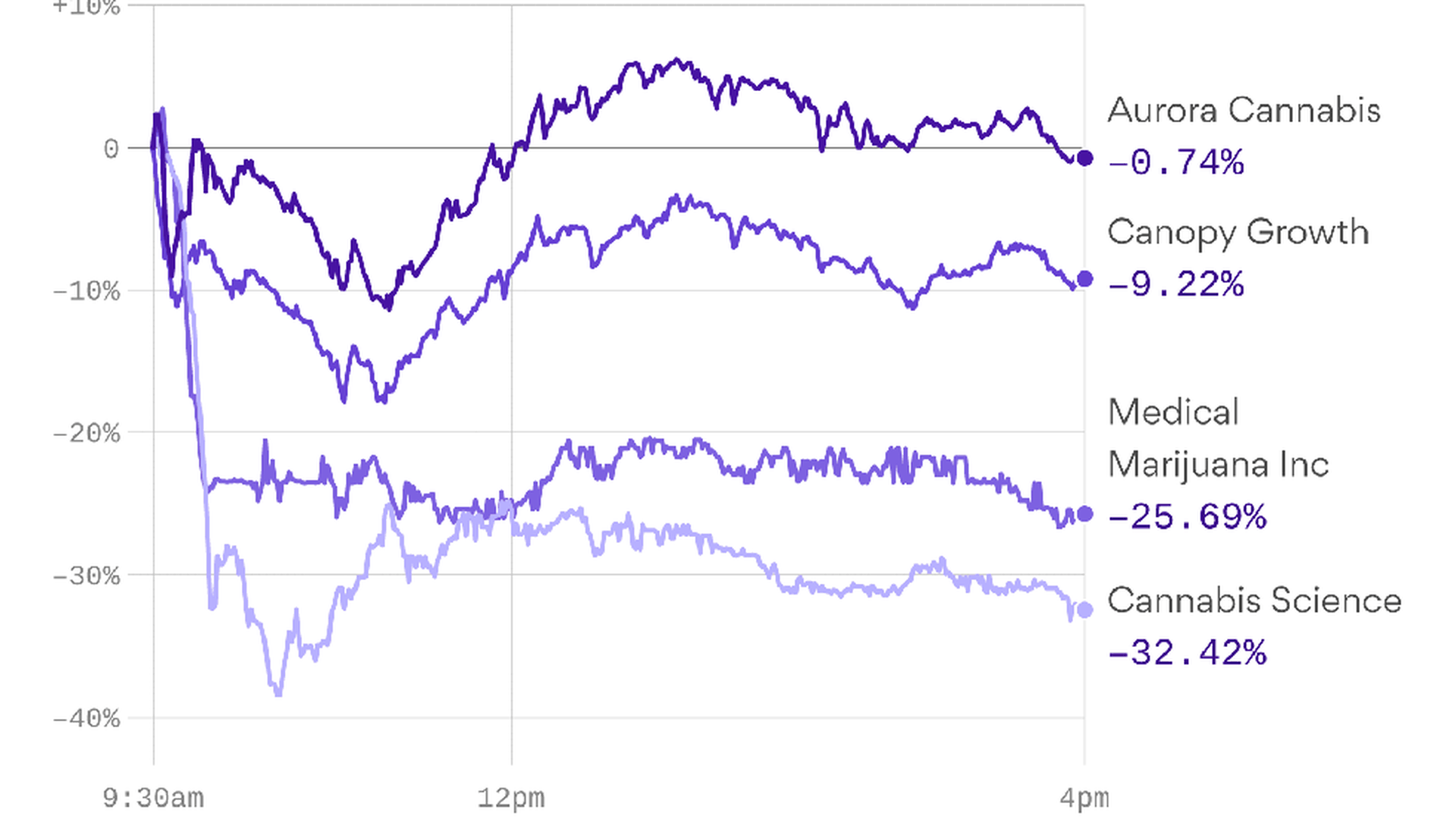

Cannabis stocks tanked yesterday, after Attorney General Jeff Sessions reversed an Obama-era policy that helped states legalize marijuana with little to no law enforcement interference by the federal government.

- PitchBook reports that U.S.-based cannabis startups raised a record $274 million in venture capital funding last year. That's up from $151 million in 2016 and $266 million in 2015. In the prior three years, they raised a total of just $83 million.

- Global venture capital activity for cannabis startups also hit an all-time high in 2017, with $328 million disbursed (inclusive of the U.S. deals).

- Go deeper: Pot stocks fall on Sessions announcement

Sign up for Axios Pro Rata

Dan Primack’s briefing on VC, PE & M&A for dealmakers.