Axios Markets

April 11, 2019

Was this email forwarded to you? Sign up here.

Situational awareness:

- Amazon CEO Jeff Bezos challenged other retailers to raise wages in his annual shareholder letter. (SEC filing)

- Republican senators Mitt Romney, Lisa Murkowski and Cory Gardner say they will vote against Herman Cain if he is nominated to the Fed. Given expected united Democratic opposition, Cain cannot lose one more Republican vote and be confirmed. (CNBC)

- “Undermining central-bank independence would be dangerous,” Tobias Adrian, director of the IMF’s monetary and capital-markets department, said when asked about President Trump's recent calls for the Fed to cut interest rates. (Bloomberg)

- Recently bankrupt California utility company PG&E is in talks with BlueMountain Capital Management to possibly expand its board. (Reuters)

1 big thing: How China is shaking up the global financial order

Illustration: Lazaro Gamio/Axios

China's growth and size are setting the country up to be not just a power in global financial markets, but The Power in global financial markets.

That means things are going to change.

What's happening: Right now China is adapting its economy and financial system to fit the U.S.-led capitalistic financial model. But given the way China has operated as a rising military and geopolitical power, its ascent likely means that things will change in global financial markets.

- "China sees itself less as slotting into some global financial system and more that it’s going to create its own system and shape the global financial markets," Keyu Jin, an associate professor of economics at the London School of Economics, tells Axios on the sidelines of the IMF-World Bank meetings.

- China is "very much disillusioned by the financial crisis and the so-called financial wisdom that everybody thought the West had and also by the slow recovery since."

Jin joined IMF managing director Christine Lagarde and 3 other economists Wednesday for a discussion of the current state of international monetary cooperation.

Catch up quick: The U.S. dollar is the world's funding currency, dominating global trade and currency reserves, giving the U.S. the ability to use the dollar as a weapon to enforce its interests. China is actively challenging that.

- China’s central bank in 2009 called for a global move away from the dollar after the market turbulence caused by the U.S.-induced global financial crisis, and it renewed those calls in 2013 after the U.S. government shutdown.

- President Trump's trade war, tariffs and unilateral attempts to renegotiate agreements are accelerating movement away from the dollar. Its share of currency reserves has fallen for 9 of the last 11 quarters — though dollars still account for more than 60% of global reserves.

The big picture: Last week Chinese yuan-denominated bonds entered the Bloomberg Barclays aggregate bond index, and global index maker MSCI in February quadrupled its indexes' exposure to China's onshore A share stocks.

- "These are pre-conditions for China to have greater influence on the world," Jin says. In particular, opening access to the bond market is part of a larger effort to increase the yuan as an international currency.

- "This isn't a 5-year thing, this is a decade thing," she cautions. But then, "a decade isn't all that much time."

2. Venezuela's situation continues to worsen

Venezuela's oil production fell 500,000 barrels per day in March from the previous month, the country reported yesterday. Despite being home to the world's largest proven oil reserves, Venezuela now pumps around 1/10th of OPEC leader Saudi Arabia's output, and about half of what it produced as recently as 2017.

- In 2014, Venezuela pumped nearly 3 million barrels of oil daily.

Context: The incredible production recession is the result of crippling U.S. sanctions, which, as Bloomberg reported in February, have half a billion dollars' worth of Venezuela's oil sitting in ships off its coast, and the rapid debilitation of its state oil company under President Nicolás Maduro.

3. S&P's ratings downgrade ratio is the worst in 3 years

The ratio of U.S. companies that S&P Global has downgraded to the number it has upgraded this quarter is the highest on an annualized basis since 2016, the ratings agency reported this week.

- Globally, S&P downgraded 173 corporate issuers and upgraded 67 in the first quarter, noting the high downgrade ratio in the U.S. and emerging markets.

The big picture: "While 2018 generally showed benign rating activity, 2019 has already seen pronounced downgrades, especially at speculative-grade rating categories, while downgrades among higher-rated issuers remain muted," said Diane Vazza, head of S&P Global Fixed Income Research, in a press release.

There's more: S&P's net downgrade rate (number of total downgrades minus upgrades) is also at the worst level on an annualized basis since 2016, the agency said in a release.

- "Many of the global risks seen in 2018 are likely to continue in 2019, including slowing global economic growth, fading fiscal stimulus, moderately elevated interest rates, and persistent equity volatility."

What to watch: S&P also noted that companies in the consumer sector are particularly vulnerable to downgrades, with weak ratings and "high negative bias, which are poised to continue deteriorating this year."

4. Brexit gets delayed

European Union leaders agreed to give Britain until Oct. 31 to reach an agreement to leave, 4 months longer than Prime Minister Theresa May requested.

What they're saying: European Council President Donald Tusk noted at a press conference, “Until the end of this period, the UK will also have the possibility to ... cancel Brexit altogether."

Why it matters to the market: It doesn't. The British pound was almost unchanged yesterday following the decision.

Our thought bubble, from Axios chief financial correspondent Felix Salmon: "A catastrophic no-deal Brexit has been averted, certainly for now and probably forever."

- "Even better: The European Union’s 28 leaders — including both Theresa May and Emmanuel Macron — have managed to come to a unanimous agreement, which is no mean feat."

- "Even if that agreement just means kicking the can down the road to Oct. 31, Europe has shown an admirable level of unity in the face of Britain’s utter chaos. Whatever happens with Brexit, that ultimately bodes well for the European project."

5. The S&P 500 has rallied on optimism

The S&P 500 is 1.4%, or 43 points, away from the all-time high it hit in September thanks in large part to this year's strong first quarter, which was the best 3-month start since 1998, Axios' Courtenay Brown writes.

The index has history on its side. Per LPL Research, when the S&P has stayed above its low point in December during the first quarter, it has ended the year higher 34 out of the last 34 times.

Between the lines: That's a strong track record, but stocks so far have been relying on some optimistic assumptions.

- “The market has priced in” some semblance of a U.S.-China trade deal that would ease tariff pain as well as an orderly end to Brexit, Randy Frederick, vice president of trading and derivatives at the Schwab Center for Financial Research, tells Axios. Investors are also optimistic about lower-for-longer interest rates.

The problem: These are all far from sure bets.

What to watch: The market is not pricing in an escalation of U.S.-E.U. trade tensions, Frederick says.

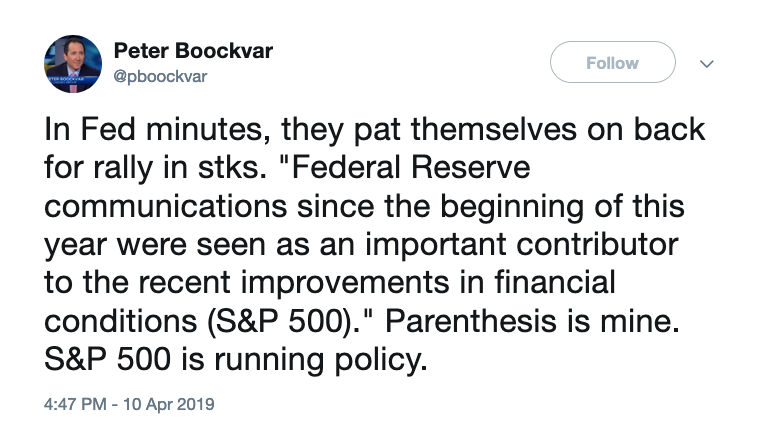

6. March's FOMC minutes in a tweet

The Federal Reserve released the minutes of its most recent policy meeting Wednesday.

Sign up for Axios Markets

Stay on top of the latest market trends and economic insights