Axios Markets

February 26, 2020

Good morning! Was this email forwarded to you? Sign up here. (Today's Smart Brevity count: 1,263 words, 5 minutes.)

1 big thing: Reassessing the global impact of the coronavirus

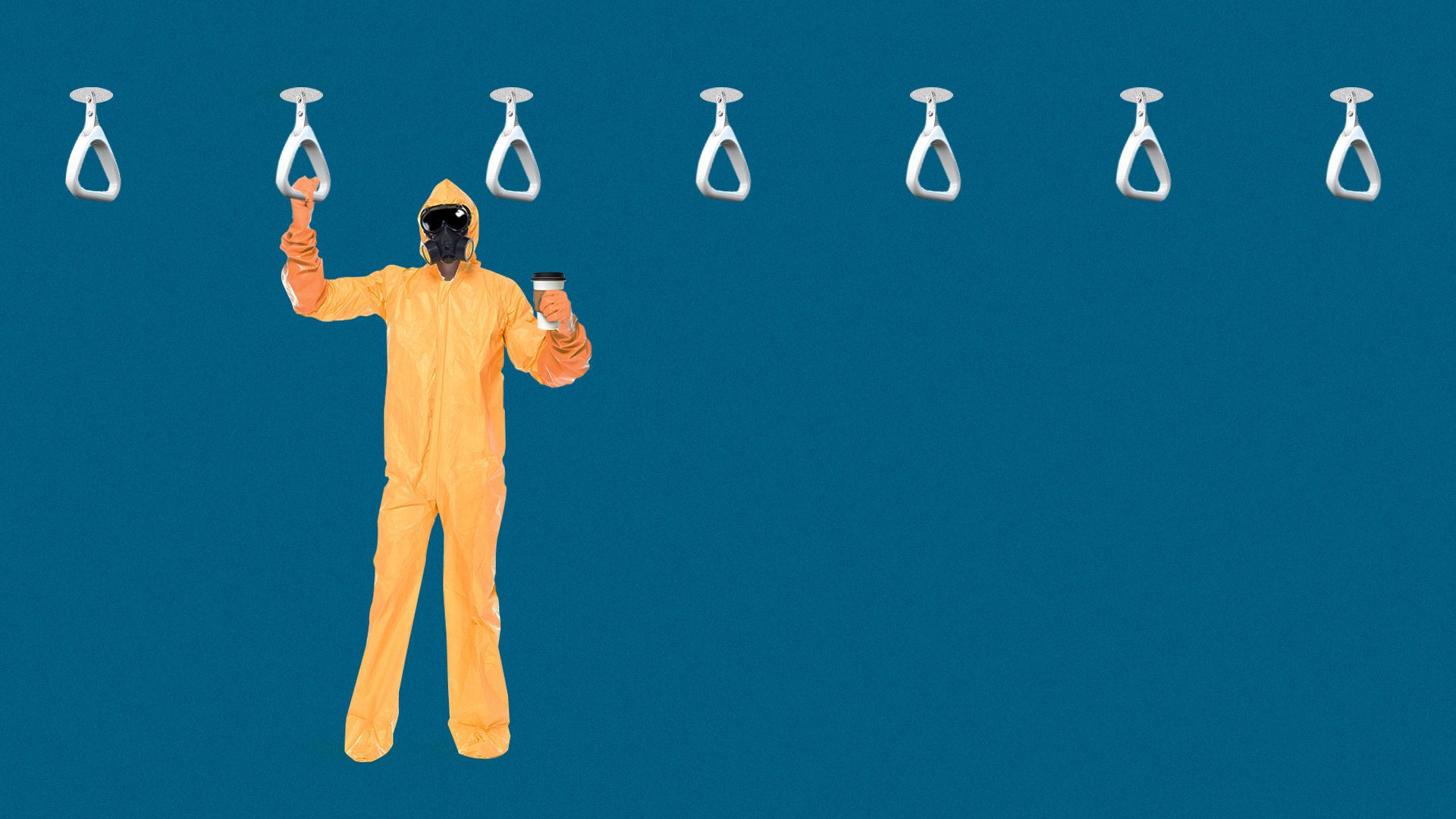

Illustration: Aïda Amer/Axios

Economists are rethinking projections about the broader economic consequences of the coronavirus outbreak after a surge of diagnoses and deaths outside Asia and an announcement from a top CDC official that Americans should be prepared for the virus to spread here.

What's happening: The coronavirus quickly went from an also-ran concern to the most talked about issue at the National Association for Business Economics policy conference in Washington, D.C.

- Most major economies in Asia are expected to either slow down significantly, halt or shrink outright in the first quarter, according to Reuters consensus polls.

What they're saying: "The CDC warning is a little bit alarming ... they're basically saying, 'It's coming,'" Julia Coronado, president and founder of Macropolicy Perspectives, tells Axios.

- "The risk that it spills over to consumer confidence is one of the biggest risks, and the other big risk is that you get a major metropolitan area that has to shut down."

- "The spillover to confidence is a much bigger issue than temporary interruptions to activity that can be made up later."

- "It's a psychological thing and that feedback loop is an essential element of every recession."

Fed vice chair Richard Clarida spoke to attendees at the conference and asserted in prepared remarks that the central bank was evaluating the outbreak and did not want to overreact.

- But he also said that decisions about monetary policy now will be made on a “meeting-by-meeting basis,” a notable change from the Fed's previous stance that it plans to remain on the sidelines for 2020.

- “If developments emerge that, in the future, trigger a material reassessment of our outlook, we will respond accordingly,” Clarida added.

Between the lines: Fed fund futures prices show traders now see a 62% probability the Fed cuts U.S. interest rates by its April meeting and an 87% chance of a cut by July.

- In fact, there's a 52% chance of two rate cuts by July.

Don't sleep: The response of the Trump administration also has been a major worry, according to Douglas Holtz-Eakin, president of the American Action Forum, and Harvard professor Jason Furman. (Both previously served as chief economists for the Council of Economic Advisers.)

- "You have to explain in a transparent fashion the nature of the threat that you’re dealing with so people don’t panic. I don’t see enough of that going on," Holtz-Eakin said during a meeting with reporters.

- "This economy has been held up by household spending, consumer confidence has been high and risen, and anything that dings that up changes the way you think about what’s going on."

2. Catch up quick

Nearly all rural areas in the U.S. have experienced substantial loss of businesses in the past decade as small businesses have been almost entirely concentrated in big cities and urban suburbs since the Great Recession. (Axios)

Amazon opened its checkout-free, 10,400-square-foot Go grocery store in Seattle on Tuesday. (WSJ)

3. The intensifying CEO shuffle

Data: Challenger, Gray & Christmas; Chart: Axios Visuals

A wave of CEO departures was announced Tuesday, as the chief executives of Mastercard, Salesforce, Thomson Reuters and Disney all had notice of their impending departures made official.

Driving the news: Disney CEO and Ithaca College alumnus Bob Iger will move into an executive chairman role at the company and be replaced by parks chairman Bob Chapek effective immediately.

- Salesforce Co-CEO Keith Block will step down, leaving Marc Benioff as the company's sole CEO.

- Mastercard announced CEO Ajay Banga will move on at the start of next year and be replaced by chief product officer Michael Miebach.

- Thomson Reuters announced CEO Jim Smith will be replaced by TPG senior adviser Steve Hasker, who formerly served as CEO of entertainment agency CAA and president of data firm Nielsen.

The big picture: The incredibly high-profile turnover announcements are part of what has become an emergent trend at the top of U.S. businesses over the past year.

- CEO turnover hit a record high in January, with outplacement firm Challenger, Gray & Christmas declaring the moves were "skyrocketing to start 2020."

By the numbers: In January, 219 CEOs left their positions, a 37% increase from December when 160 CEOs departed.

- January's new record high also was 27% higher than the previous monthly record of 172, which was set in October, according to Challenger, Gray & Christmas.

Of note: The timing of the announcements is odd, not just because four large companies announced them on the same day, but because they appear timed to drop while much of the public's attention is focused on the coronavirus outbreak.

4. Weak U.S. debt auction shows market sees even lower rates

The Treasury held an incredibly weak auction of 2-year government debt Tuesday that saw primary dealers, who are essentially on clean-up duty, take home their highest share of the auction since December 2018.

What it means: Even though yields on the 2-year note have fallen by nearly 40 basis points this year, traders are convinced that there is "certainly more room for yields to fall," Ben Jeffery, rates analyst at BMO Capital Markets, tells Axios.

Why it matters: It's the latest evidence that the market is growing more certain the Fed will cut U.S. interest rates this year.

One level deeper: "As for the auction, it suggests that given how far and how fast the move has run, some primary market participants seem to be of the mind more attractive entry points could present themselves over the near term," Jeffery adds.

Another level deeper: The coronavirus outbreak has hurt the buying power of investors in Japan and China, who are direct bidders in U.S. Treasury auctions, a category of buyer that typically takes a substantial percentage.

- "Remember, one of the important reasons for foreign interest in U.S. Treasuries is that they invest the profits from the trade surplus they enjoy with the U.S.," DRW Trading rates strategist Lou Brien tells Axios.

- "But the virus has curtailed a lot of trade, and therefore [there are] fewer profits to invest."

5. Small cap stocks have lost

Data: Investing.com; Chart: Axios Visuals

When President Trump launched the U.S. into a trade war in 2018, many fund managers argued that small cap stocks were poised to outperform because their business would be immune to tariffs and uncertainty.

- They did well over the course of that year but after Tuesday's 3.5% decline, the Russell 2000 index, which tracks many of the nation's small public companies, has fallen to near its closing level from February 2018.

Flashback: "Whereas small companies previously drove innovation by disrupting bigger companies with new technologies and ideas, today many large companies can simply buy competitors to generate growth in-house," I wrote in March 2018.

- "Decreasing regulations play a role but so does the changing nature of big businesses, particularly in the United States and China."

What I was hearing: “If big companies like Alibaba, Amazon, Facebook, Tencent are just going to keep on winning, then the concept of buying small caps changes,” Erik Weisman, chief economist at MFS Investment Management, told me. “In a world where winners take all and just keep on winning, we don’t see small firms that show up on the public playing field.”

6. Exclusive: Rich Clarida's big announcement

Richard Clarida is back in the recording studio cooking up some heat, the Fed vice chair tells Axios exclusively.

Scoop: Clarida is working on a follow-up album to 2016's certified banger "Time No Changes," he says, and has already recorded a number of tracks.

The big picture: He was tight-lipped on when the album would be released or whether there would be a collaboration with Fed chair Jerome Powell.

- The streets have been demanding a Clarida-Powell pairing on wax since word got out about their set together performing an acoustic-alternative medley of “God Rest Ye Merry Gentlemen” and “We Three Kings” at the Fed's 2018 holiday party.

- However, it's unlikely Clarida's album will be released this year, he says.

Straight from the source: "I have been in the studio," Clarida says. "But I've been a little busy lately."

The intrigue: There is concern that the vice chair's status as a federal employee could force him to push back the album's release date, his communication officer tells Axios.

- Government employees aren't supposed to earn outside income.

- That could keep the new music in a vault for some time, as his term on the Fed doesn't end until Jan. 31, 2022.

Go deeper: Listen to Clarida's "Just Can't Wait" on YouTube. His album is also available on Spotify, Apple Music and Tidal.

August Wilson was a Pulitzer-prize winning playwright who changed the face of theater.

- Between 1984 and his death in 2005, Wilson produced what he called the American Century Cycle, an opus consisting of one play for every decade of the 20th century, tracking the black experience in the United States from the aftermath of slavery through the Great Migration and the civil rights movement to the early days of gentrification.

- He was awarded two Pulitzers for that collection of plays.

- Wilson’s total body of work stands as one of the greatest in the history of dramatic literature.

Sign up for Axios Markets

Stay on top of the latest market trends and economic insights