Axios Macro

June 28, 2023

It was an exciting morning for central bank watchers! After all, it isn't every day central bankers from the U.S., Europe, the U.K. and Japan share a stage, but that was the case today in Sintra, Portugal. We have the takeaways from the panel below.

- And back stateside, a look at an intriguing shift in how consumers are feeling about the economy. 😎

Today's newsletter, edited by Javier E. David and copy edited by Katie Lewis, is 666 words, a 2½-minute read.

1 big thing: The big four central bankers prepare for higher-for-longer era

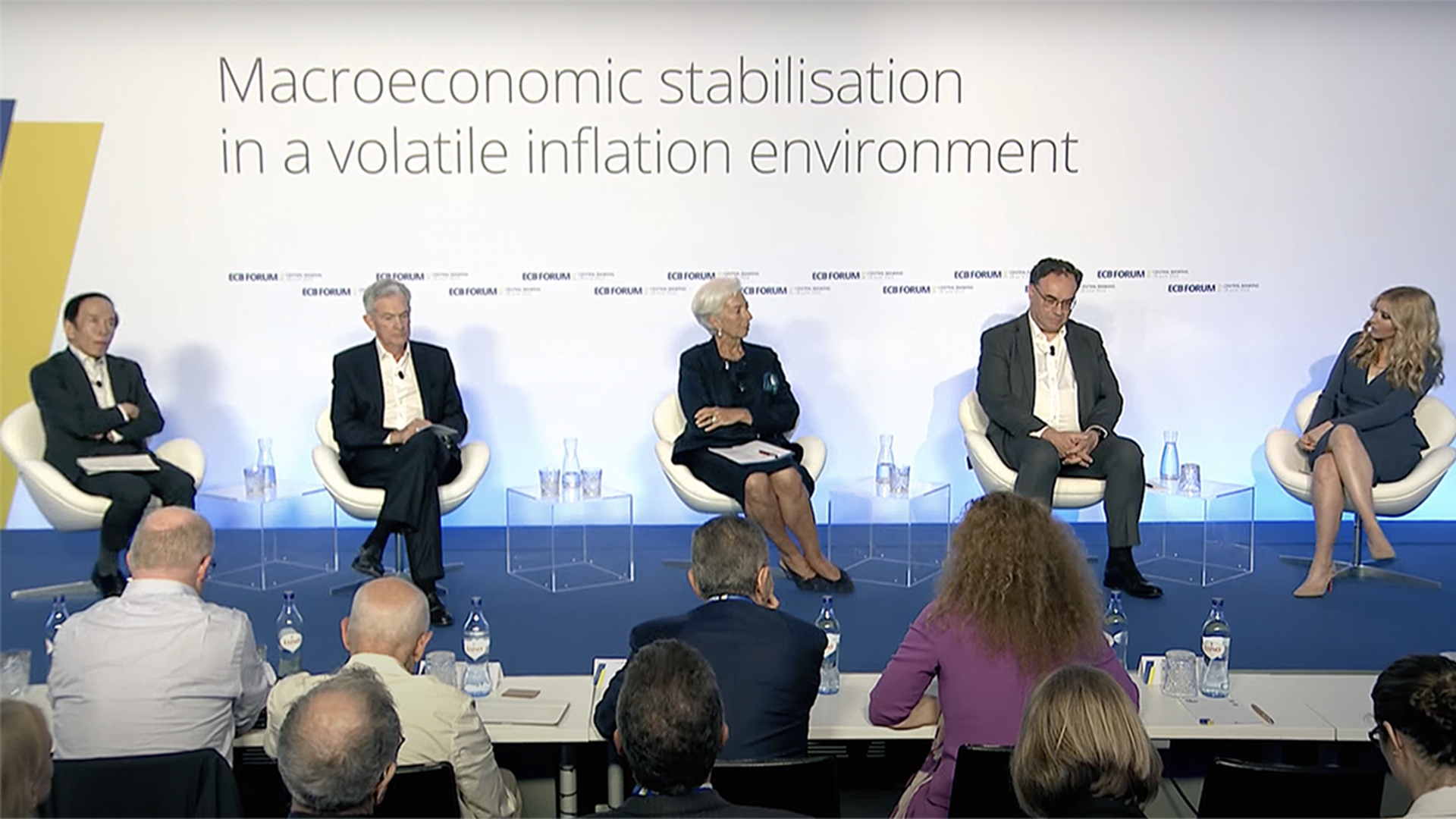

From left to right: Bank of Japan governor Kazuo Ueda, Federal Reserve chair Jerome Powell, European Central Bank president Christine Lagarde and Bank of England governor Andrew Bailey speak on a panel Wednesday morning with CNBC's Sara Eisen. Screenshot: European Central Bank/YouTube

When the world's leading central bankers last gathered in the ancient resort town of Sintra a year ago, they had plenty in common: very high inflation and rapidly hiking interest rates to get control of it.

- One year later, they can agree on this: Their aggressive tightening campaigns are taking much longer than expected to bring price pressures back down to target.

Why it matters: The respective outlooks for major economies have begun to diverge, with the U.S. looking best positioned to avoid a recession. But the clear message is that policy may need to be more restrictive — and stay that way — for each central bank to achieve its goals.

What they're saying: "I've always been interested that the market thinks that the peak will be quite short-lived in a world where we're dealing with more persistent inflation," Bank of England governor Andrew Bailey said.

The biggest headline for Fed-watchers was this: Federal Reserve chair Jerome Powell acknowledged the central bank has not definitively switched to an "every-other-meeting" regime — putting both July and September in play for interest rate hikes.

- "I wouldn't take moving consecutive meetings off the table at all," Powell said.

- The European Central Bank, too, has more "ground to cover," with another hike all but guaranteed next month, said president Christine Lagarde.

Between the lines: The outlier was Kazuo Ueda, the new head of the Bank of Japan, which has seen its own burst of inflation — though it has maintained easy policy as rates soar around most 0f the world.

- Aggressive global tightening has, of course, had an impact on Ueda's economy: Japan's yen has depreciated against a basket of currencies as a result of the different policy moves.

- Ueda said that if the central bank becomes reasonably confident that core inflation will rise on a more sustained basis then "that would be a good reason for a policy change."

- Intriguingly, when asked whether his counterparts on stage had overtightened, Ueda responded with a blunt "no."

The backdrop: Lagarde, Bailey and Powell acknowledge the lag effects of monetary policy impacted, in part, by pandemic disruptions in each respective economy. The result is a delayed impact on inflation, and uncertainty around how long it will take for it to fall back to target.

- Ueda joked that given Japan has not actually hiked in decades, the lag effect of policy in the nation could be "at least 25 years," prompting laughter from the crowd.

- Yes, that is what counts as a hilarious joke in a room full of central bankers.

2. The vibes may be shifting

Illustration: Sarah Grillo/Axios

One of the great contradictions of the last couple of years has been that public opinion about the state of the economy has been terrible, while people have been relatively positive about their own financial circumstances and the job market has remained strong.

- That may — emphasis on may — be shifting.

Driving the news: Nonprofit think tank The Conference Board yesterday said its consumer confidence index surged to 109.7 in June, up from 102.5 in May, to its highest level since January 2022.

- The University of Michigan's consumer sentiment index showed a similarly strong surge earlier in June.

Between the lines: It's not difficult to tell a story of what might be changing. Gasoline prices have stabilized in recent weeks, well below last year's highs. The stock market has been rising this year.

- The unemployment rate remains low, and inflation has been falling. And rising prices are now below the rate of wage growth, meaning real wages are, on average, now rising.

What they're saying: "The spread between consumers saying jobs are 'plentiful' versus 'not so plentiful' widened, indicating upbeat feelings about a labor market that continues to outperform," said Dana Peterson, chief economist at The Conference Board, in a statement.

- "Likewise, expectations for the next six months improved materially, reflecting greater confidence about future business conditions and job availability."

Yes, but: These sentiment indexes remain near recession-like levels despite the strong job market. And the surveys can be volatile.

Sign up for Axios Macro

Stay ahead of the curve on the most important economic developments with reporting and analysis on how business, policy, and markets collide.