Axios Generate

November 01, 2018

Good morning and welcome back.

Today marks the 1975 release of The Band's "Northern Lights — Southern Cross," so that album provides today's outstanding intro song...

1 big thing: Energy industry donors favor GOP

Axios data wiz Harry Stevens has an informative feature that closely tracks the congressional contributions of 495 of the country's largest companies — including firms in the oil and power space.

The big picture: The story shows how the petroleum and coal industries (a rough proxy for "energy" in the chart above) heavily favor the GOP, while the utility sector leans Republican too but spreads its money somewhat more evenly.

Why it matters: America's wealthy companies are able to influence elections by financially supporting candidates whose positions align with their values — or who they believe can help their businesses. But even more often, they support both sides, ensuring access to whomever ends up in power.

By the numbers: Employees and PACs affiliated with Fortune 500 companies have given more than $180 million to congressional candidates in the 2017–2018 campaign cycle.

- Republican candidates received nearly $93 million, or 52% of the Fortune 500's spending. About $86 million, or 48%, went to Democrats.

- The energy sector, which includes fossil fuel companies like ExxonMobil and Chevron, gave more than four-fifths of its $8.5 million in contributions to Republicans.

- But the technology sector gave about three-quarters of its $17.7 million to Democrats. The largest overall contributor, Google's parent Alphabet, gave about 86% of its $4.7 million to Democrats.

Click here to access an interactive version of the story that allows you to check total giving levels and party split of specific companies.

2. Shell reports $5.6 billion in Q3 profits

Photo: Cate Gillon/Getty Images

Shell's profit surged to $5.6 billion in the third quarter, up from $4.1 billion in the same period last year, the oil-and-gas giant announced today.

Why it matters: The haul is the latest sign of how the rise in crude oil prices is boosting the fortunes of the industry, although Shell didn't hit analysts' forecasts.

- Shell said higher oil, gas and LNG prices, as well as money from its gas trading unit, were behind the rise.

- But those gains were partly offset by factors including lower margins in refining and "adverse currency exchange effects."

Where it stands: The company used the report to say it's rewarding investors by increasing its share buybacks to $2.5 billion between now and late January.

- That's up from $2 billion in the prior phase of the program that envisions $25 billion in buybacks by the end of 2020.

What's next: Exxon and Chevron, the largest U.S.-based majors, will report their Q3 results on Friday morning.

Go deeper: Reuters breaks down Shell's report here.

3. Perry heads to Europe in LNG push

Axios' Amy Harder scooped last night ... Energy Secretary Rick Perry is heading to Eastern Europe next week to make a series of announcements, including a new liquified natural gas deal with Poland, according to an Energy Department official.

Why it matters: Perry’s trip, which includes Poland, Ukraine, Hungary and the Czech Republic, comes as the Trump administration is seeking to balance its conflicting goals of protectionist trade policies and American energy exports.

Details: LNG will be a big focus of the trip, but Perry is also expected to push American cooperation on nuclear energy, cybersecurity and coal. His trip includes a tour of a Ukrainian power plant that received a shipment of U.S. coal last summer.

- Administration officials, including President Trump, have emphasized that European countries should lessen their dependence on Russian natural gas. The U.S., along with Poland, have criticized construction of an underwater natural-gas pipeline from Russia to Germany. Germany has supported the project.

Reality check: Countries and companies will almost always choose the cheapest natural gas, which is often Russia for much of Europe, given the cost of liquefying and shipping American gas overseas. Asia has been America’s bigger customer.

Go deeper:

4. Breaking in business: Encana buys Newfield

Another big deal in the oil patch: Encana Corp., a big Canadian firm with substantial U.S. operations, said Thursday that it's buying Newfield Exploration in a $5.5 billion stock transaction.

Why it matters: Per Reuters, it will make Encana one of the biggest shale producers in North America.

- Newfield has a big position in Oklahoma's prolific Anadarko Basin, as well as acreage in Utah and North Dakota.

The big picture: It's the latest of several big deals in the U.S. sector this year.

- Earlier this week, Chesapeake Energy announced plans to buy WildHorse Resource Development in a $3 billion transaction.

- In August, the Permian basin player Diamondback Energy said that it's buying Energen via a $9.2 billion deal, while Concho Resources announced the $9.5 billion acquisition of RSP Permian in March.

- BP announced a $10.5 billion deal to acquire most of BHP Billiton's U.S. shale assets in July.

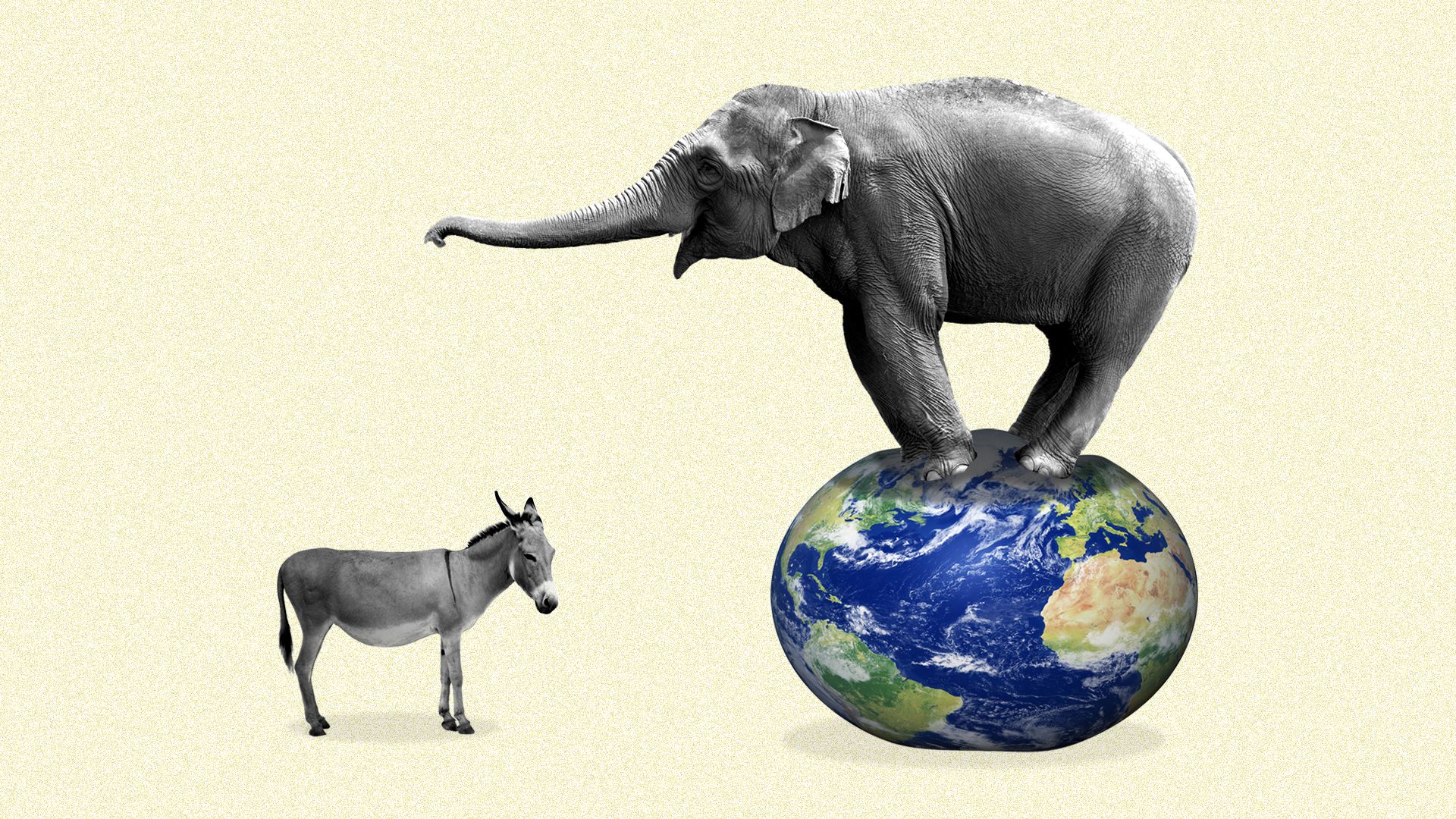

5. GOP ad flips the climate script in Florida

Illustration: Sarah Grillo/Axios

Things have turned upside down in the closely-watched House race on the tip of Florida: Republicans are running an advertisement alleging that Democratic candidate Debbie Mucarsel-Powell is beholden to “dirty coal money” and is blocking action on climate change, Amy reports.

Why it matters: The ad shows how climate change is becoming a political concern for the GOP in a district experiencing the real-world effects of it through more frequent flooding. It’s also one of the starkest examples of how climate and environmental issues are resonating a bit more this election than previous ones.

Driving the news: The race at hand is the swing district currently represented by 2-term Republican Congressman Carlos Curbelo, who has parted from most of his GOP colleagues to introduce legislation taxing carbon emissions. Polling shows the race between him and Mucarsel-Powell is a toss-up.

The details: A narrator in the ad, sponsored by the National Republican Congressional Committee, says Mucarsel-Powell's campaign is “flooded with dirty coal money. The very polluters that threaten our way of life in the Keys."

- His voice is set against a CNN article headline: “The Florida Keys...at risk...as a result of climate change.”

Reality check: The ad doesn't specify what "coal money" Mucarsel-Powell is tied to.

- It could be referring to money that billionaire activist Tom Steyer made years ago in hedge funds that invested in coal, according to the NRCC website.

- But that's a stretch at best. Steyer is not affiliated with that hedge fund anymore, and he's an ardent environmentalist opposed to all fossil fuels.

The big picture: The ad shows how electoral maneuvering is out of touch with reality.

- The Republican Party has overwhelmingly opposed action on climate change in Washington while backing fossil-fuel interests. Democrats have to varying degrees tried (but failed) to pursue policy in this area.

- Curbelo is an exception to the GOP, while Mucarsel-Powell has indicated she’ll likely support most climate and environmental policies the Democratic Party is pushing.

Go deeper: Read Amy's full story in the Axios stream.

6. Progress on global electricity access

The number of people worldwide without access to electricity fell below 1 billion for the first time last year, according to newly updated International Energy Agency data.

Why it matters: Expanding essential energy services is a widely recognized worldwide need.

- The United Nations' wider list of Sustainable Development Goals for 2030 includes universal access to "affordable, reliable and modern energy services."

The big picture: Over 120 million people gained access last year, IEA said in releasing a snapshot of data in its upcoming annual World Energy Outlook.

- "However, progress continues to be uneven, with three-quarters of the 570 million people who gained access since 2011 concentrated in Asia," IEA's summary of the data states.

- Power access remains low in large swaths of Africa.

Details: Here are a few snapshots from IEA's update...

- "[O]ne of the greatest success stories in access to energy in 2018 was India completing the electrification of all of its villages."

- "Many other Asian countries have also seen significant progress."

- "In Indonesia, the electrification rate is almost at 95%, up from 50% in 2000. In Bangladesh, electricity now reaches 80% of the population, up from 20% in 2000."

- In Kenya, access has grown from 8% in 2000 to 73% now.

But, but, but: Africa remains a major challenge.

- "The population without access to electricity remains at 600 million in sub-Saharan Africa — totalling 57% of population — and 15 countries in that region have access rates below 25%," the IEA commentary states.

7. The U.S. oil boom gets even boom-ier

Newly released federal data shows that U.S. crude oil production reached 11.35 million barrels per day in August.

Why it matters: U.S. crude production has been at record levels for a while. But this Bloomberg story captures how wild the August data is, noting the 2.1 mbd increase over August of 2017 is the largest year-over-year rise in U.S. history.

The intrigue: S&P Global Platts' Brian Scheid points out something interesting about the new Energy Information Administration figures: Colorado's production has now surpassed California's for the first time.

8. The stakes of state energy ballot fights

A solar farm system on the campus of Arizona State University in Phoenix. Photo: Sandy Huffaker/Corbis via Getty Images

Washington University in St. Louis' Aaron Bobick writes for Axios Expert Voices ... In next week's midterm elections, Arizona and Nevada voters will decide on ballot measures that would require electric utilities to invest in renewable and clean energy sources.

If passed, these initiatives would work toward statewide goals of 50% renewable energy use by 2030.

Why it matters: According to a special report released by the Intergovernmental Panel on Climate Change on Oct. 8, stringent cuts in greenhouse gas emissions are needed to prevent potentially catastrophic impacts if the climate warms above 1.5 degrees Celsius. State and federal legislation is essential to reaching this global climate target.

To meet the goals outlined in the IPCC report, global industries — especially energy, construction and transportation — must make "unprecedented" changes to how they operate. In the U.S., this means increasing investment in renewable energy systems.

- The current, relatively low price of fossil fuels increases the need for legislation to trigger investment in renewables, since shareholders often focus on near-term financial returns.

- But some major companies with longer-term horizons have begun to lead the charge, with Google and Facebook both investing in renewable energy and integrating climate goals into their business models.

Reality check: Only 4 states have energy-focused ballot initiatives, and energy continues to be a relatively unimportant issue for voters, ranking behind the economy, security, health care and education.

- But to address energy-driven environmental challenges, local, state, federal and even international authorities need to be aligned in pursuing climate-positive policies.

Go deeper: Read Bobick's full piece in the Axios stream.

Sign up for Axios Generate

Untangle the energy industry’s biggest news stories