Axios Generate

October 12, 2017

Good morning and welcome back! Yesterday we missed Daryl Hall's 71st birthday, so let's make up for that mistake here, and with a song snippet buried in the newsletter today.

Big today: Perry's FERC plan in the spotlight

Energy secretary Rick Perry will testify late this morning before an Energy and Commerce subcommittee, where he's sure to face questions about his push for changes in wholesale power market regulation that would boost revenues for coal and nuclear plants.

Why it matters: With the rationale for the proposal — that helping keep nuclear and coal plants afloat is needed for grid resilience and reliability — coming under intense criticism, Perry is under pressure to mount a strong defense.

What he'll say: Perry's prepared remarks for the hearing are here. He touts the plan to allow greater cost recovery for plants that have 90-days worth of fuel stored on-site.

- "I asked FERC to change the market rules to make sure that fuel-secure generation is valued for what it is worth to our Nation — not forced into early retirement leaving the grid at risk during the next disaster," the testimony states.

No can do: Yesterday FERC denied requests for a longer comment period on the proposal by a suite of energy industry trade groups representing oil-and-gas and renewables companies.

- Comments are still due Oct. 23, which a series of parties — including state regulators nationwide — say is far too little time to provide adequate input. Perry has tasked FERC with completing the rule in 60 days, which is very fast in the world of federal regulation.

- Perspective: "Providing sufficient time to comment would be important if FERC were interested in defending a final rule in court," Ari Peskoe, a Harvard expert in electricity law, tells Axios.

IEA: Big crude players must show 2018 "discipline"

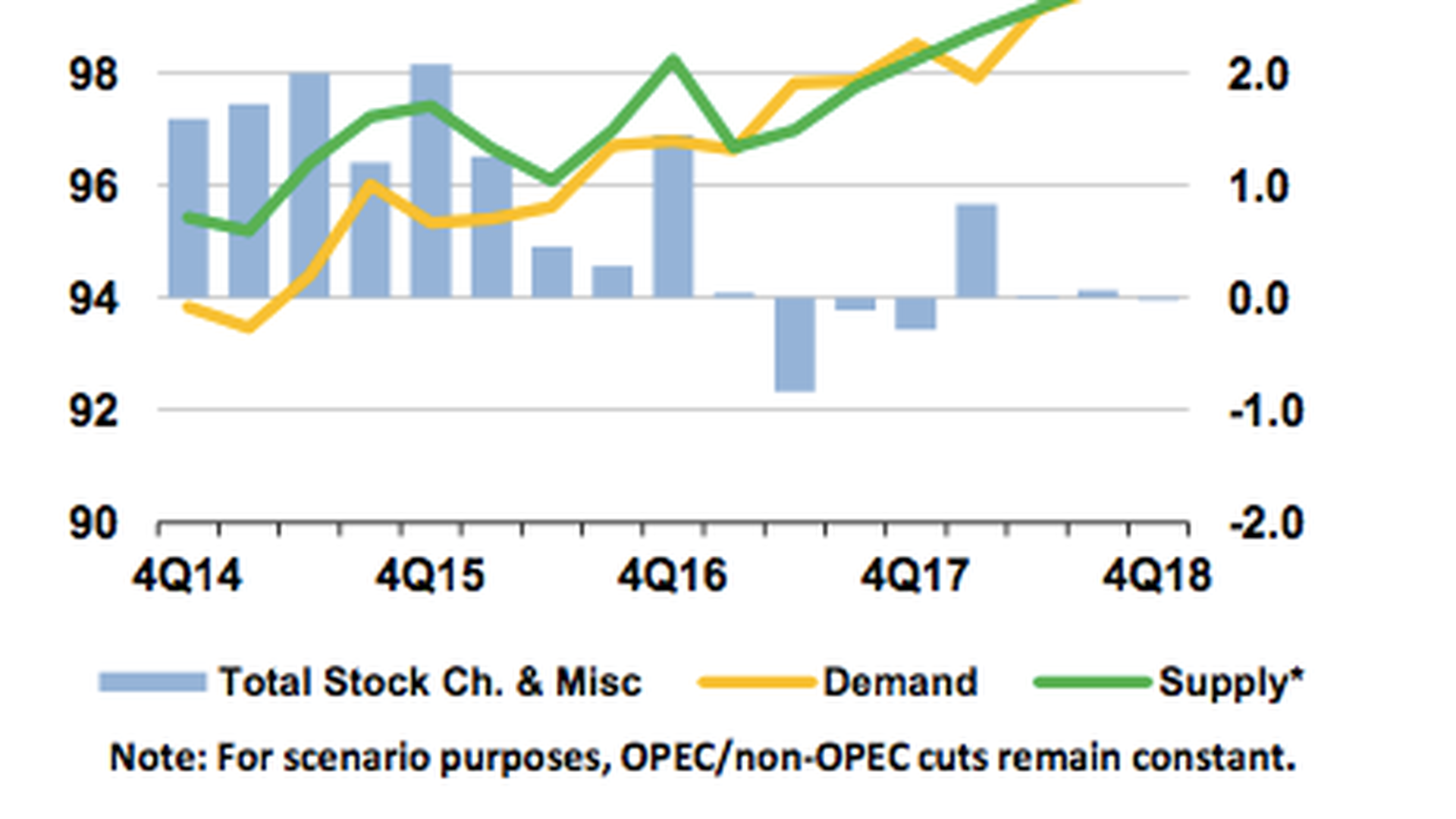

You can do it: The International Energy Agency sees strong potential for some stability in global crude markets next year — if OPEC and Russia re-up their production-limiting deal beyond the first quarter (check out the chart above).

- "Looking into 2018, we see that three quarters out of four will be roughly balanced — again using an assumption of unchanged OPEC production, and based on normal weather conditions," they said in the latest closely watched monthly outlook.

- "The next few weeks ahead of the producers' meeting in Vienna on 30 November will be crucial in shaping their decision on output. A lot has been achieved towards [stabilizing] the market, but to build on this success in 2018 will require continued discipline."

By the numbers: The IEA expects supply from outside of OPEC to grow by 1.5 million barrels per day next year, alongside similar growth in crude demand of 1.4 million.

They note that there has been progress in cutting the glut of global inventories, with a "major reduction in floating storage, oil in transit, and stocks held in some independent areas."

- At the end of August, combined stocks of crude oil and refined products in industrialized countries were slightly over 3 billion barrels, dropping down to 170 million barrels above the five-year average, a sign of progress in clearing the global glut.

Go deeper: Reuters has much more on the report here.

Looking further ahead on global oil thirst

Contrary to Yoda's comment above, analysts consistently try to forecast energy trends. Here's an interesting one...

Crystal ball: A new HSBC research note seeks to project some big oil supply and demand trends in the coming decades. The growth of electric vehicle sales and the improved efficiency of fossil fuel-powered engines means that oil global demand in the light-duty vehicles sector will peak as soon as 2025, they note.

- Yes, but: The report makes the important point that cars are hardly the only game in town when it comes to total global crude demand. An overall peak is somewhat further off, "driven by more durable growth in demand for heavy goods freight, aviation and petrochemicals."

- For instance, modeling EVs at 40% of new light duty vehicle sales in 2040 (which is below the Bloomberg New Energy Finance projection of 54%), they project that oil demand for the vehicles will be 3 million barrels below what it was in 2016, but total global demand for all sectors will be 10 million barrels higher.

- They also note that the trajectory of oil demand is at least as sensitive to changes in efficiency of internal combustion engines as it is to EV penetration growth rates.

The big picture: HSBC notes that uncertainties abound (because it's the future!), but that said, they look at some big-picture possibilities, including what happens under more aggressive climate policies and with projected constraints on supply based on declines in mature fields and falling levels of investment in new projects.

"Most of the more progressive demand scenarios now point to a peak in global oil demand somewhere between 2025 and 2035, and a peak somewhere in this range looks quite possible to us. However, we think the availability of adequate supply will become a visible issue a long way before this — potentially before the end of this decade."

The reasons why Trump can't thwart renewables

Let's follow up a little on what the Environmental Protection Agency's new proposal to repeal the Clean Power Plan and other Trump administration energy policies might mean for renewable power, a topic we explored yesterday.

Tailwinds: A new S&P Global Ratings report takes stock of the multiple forces driving growth of wind, solar and other renewables, including falling costs and federal tax credits that don't expire for several years.

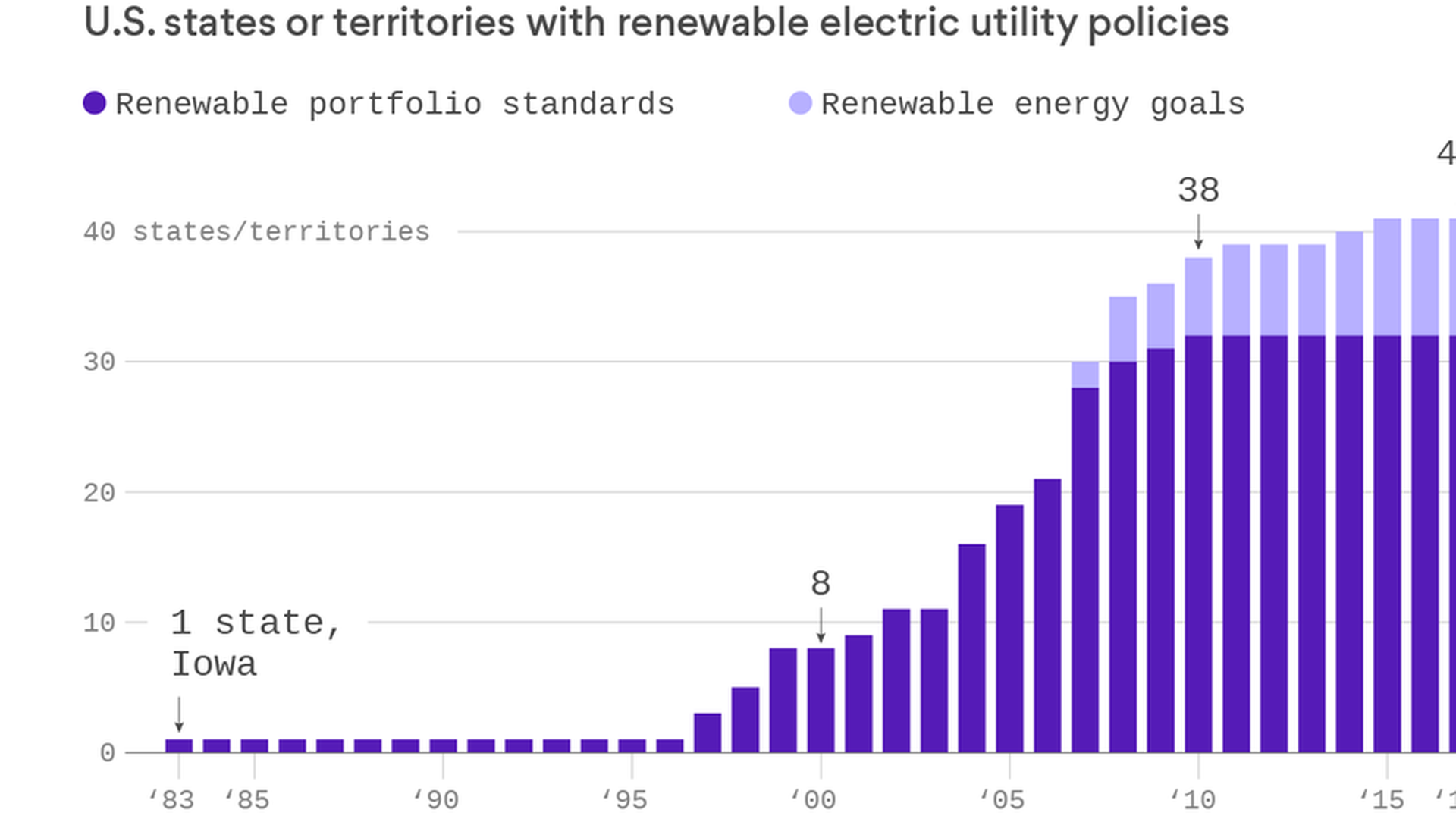

Check out the chart above: One factor that the S&P report delves into is the proliferation of state-based policies called renewable portfolio standards, which mandate that utilities supply escalating amounts of power over time from wind, solar and other sources.

Quick take: "[D]evelopment and expansion of renewable portfolio standards in the U.S. in recent years, in our opinion, crowds out a mixed message from Washington on the necessity of renewable energy as part of the American grid," S&P says.

- The report concludes that "federal efforts to revive languishing coal and nuclear assets may prove fruitless."

Latest in the solar trade fight

First Solar, a major player in the U.S. industry, has come off the sidelines and announced it supports the bid by two financially distressed panel makers — Suniva and SolarWorld — for new trade restrictions on cheap imports.

The details: Check out their letter to the U.S. International Trade Commission here. It calls for a "fair and effective" remedy but does not provide specific suggestions on tariffs. The ITC is preparing to recommend policies to the White House next month.

- Go deeper: Utility Dive unpacks the move, which represents a rupture with the broader Solar Energy Industries Association, in this piece. Greentech Media reports on the letter here.

- Context: Greentech's piece notes, "First Solar's position doesn't come entirely by surprise. Because the company makes thin-film solar modules, it is exempt from trade remedies on crystalline silicon PV (CSPV) products. Furthermore, while First Solar manufactures the majority of its products in Malaysia and is in the process of ramping up production in Vietnam, it also has a meaningful U.S. manufacturing presence in Ohio."

Of note: Tesla — which is more famous for its cars than its solar business — has waded more directly into the case with its own letter to the ITC opposing the Suniva/SolarWorld petition for tariffs and other penalties, calling it harmful to the U.S. solar industry.

- The company, which has an integrated solar business that includes manufacturing, is building a big crystalline silicon photovoltaic cell and module plant in New York but still opposes the petition. Their letter says it could harm the solar industry "at large" and their production plans.

- Tesla, which has previously been on the record opposing the petition, says in the letter that it backs SEIA's push for alternative forms of aid like trade adjustment assistance and technical help for U.S. companies.

Report urges safety on oil trains — as shipments plummet

Here's a bit of an item Axios' Amy Harder published in the stream...

Trains hauling oil and other flammable material should be better and more frequently inspected, according to a National Academies of Sciences report out Wednesday.

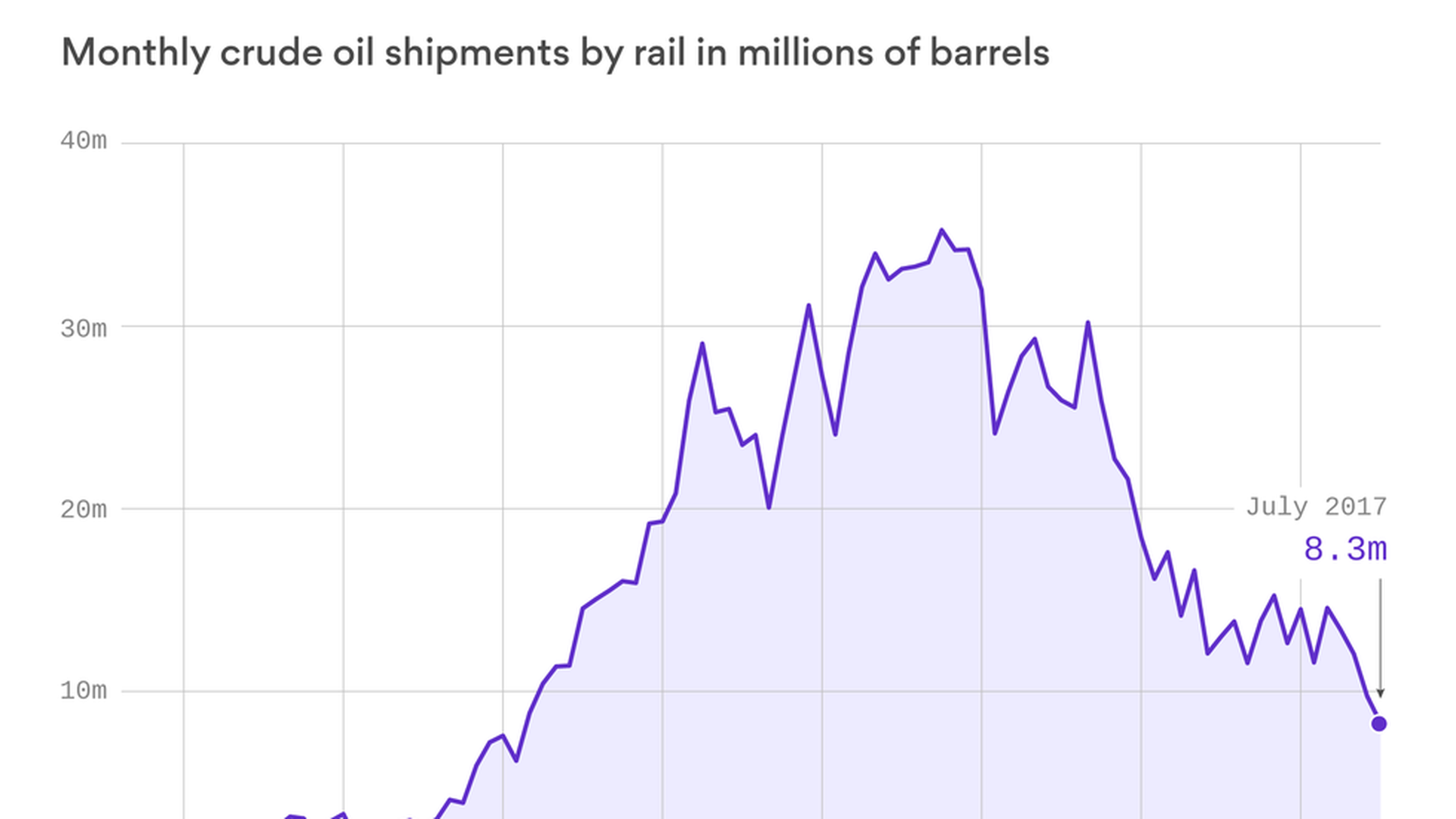

Why it matters less today: The amount of oil shipped by rail has dropped 77% since its high in 2015, according to U.S. Energy Information Administration data, charted by Axios' Lazaro Gamio above.

- Falling oil prices and the growth of pipeline infrastructure helped to drive the decline.

The backstory: A series of fiery oil train crashes over the last few years prompted federal regulators to issue a rule, finalized in May 2015, strengthening requirements for trains hauling flammable material like oil and ethanol. President Trump has targeted most Obama administration regulations for repeal, but so far he hasn't said anything about eliminating or scaling back this one.

Sign up for Axios Generate

Untangle the energy industry’s biggest news stories