Axios Generate

July 03, 2019

Hello readers! We're taking a break for the holiday and will return Monday. Have a great 4th of July.

Today's Smart Brevity count: 1,136 words (~ 4 min read).

Sunday will mark the 1972 release of a reggae classic: "The Harder They Come" soundtrack, which means Jimmy Cliff takes us into today's edition...

1 big thing: Sizing up Big Oil's clean tech moves

Oil giants face tricky strategic decisions as they move into renewables, vehicle electrification and other tech beyond their very dominant fossil fuel lines, argues a new analysis released via the Oxford Institute for Energy Studies.

Why it matters: The OIES analysts argue that giants like ExxonMobil, BP and Shell must navigate 2 large and contradictory global forces:

- Growing political, societal and market pressure to cut global emissions.

- The strong likelihood that "significant volumes of oil and gas will be required well after 2050."

The big picture: "This poses a major challenge for [international oil companies], whose current business models and technologies are incompatible with full decarbonization, but whose future depends on them being part of the solution."

Where it stands: Companies are employing a mix of strategies that involve investments — both directly and via their VC arms — in tech that replaces fossil fuels, as well as ways to find and produce oil-and-gas more efficiently and see it burned it with less pollution.

- The paper is a helpful look at some of the specific kinds of investment that different companies are making, such as Equinor's investment in a company developing solars cells made with perovskite.

The intrigue: The energy transition is a challenge for companies, as the technology may fall outside their core competency or they're getting involved in businesses that may provide lower returns or use unproven technologies.

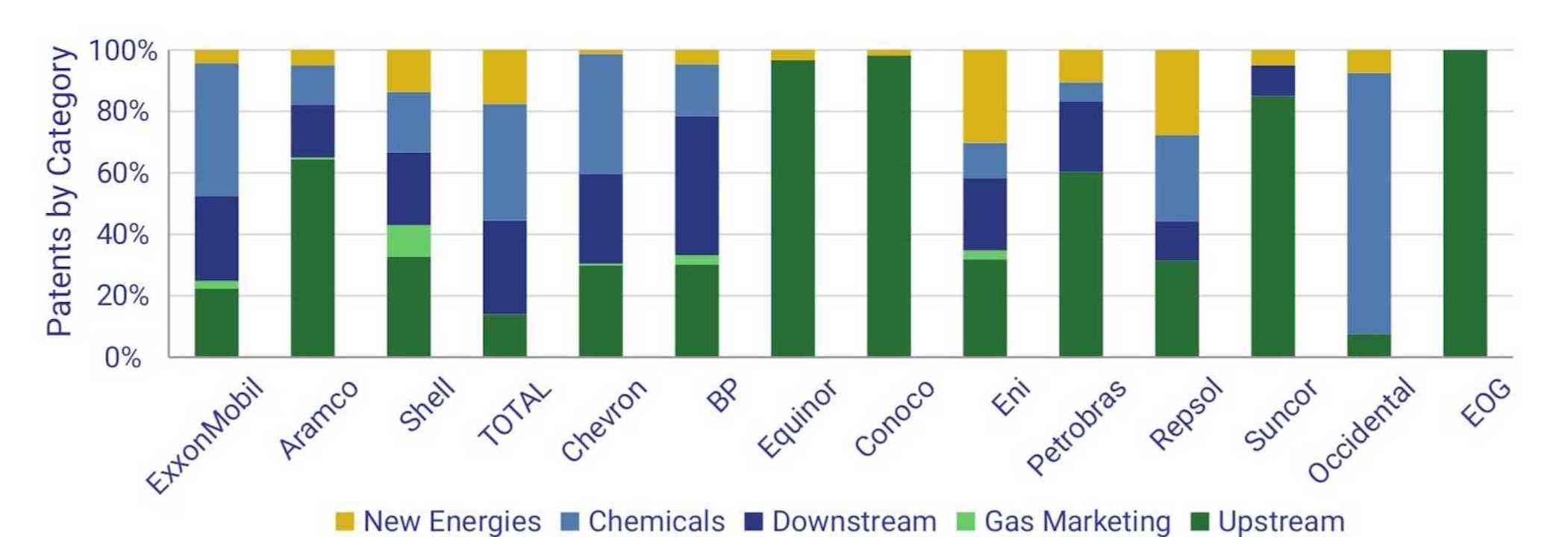

One cool part of the paper breaks down oil majors' patents by broad technology types and technologies. It's c0-authored by Rob West, whose consultancy Thunder Said Energy maintains a patent database that provides a window into companies' positioning

- The high-level takeaway: So far just 8% of the patents are in what's broadly described as "new energies," including renewables.

- The rest are "aimed at improving the efficiency of fossil fuels, which indicates that companies remain focused on their traditional activities."

But, but, but: The picture looks somewhat different when you turn to the majors' VC arms. They looked at 200 VC investments by the largest oil companies, and new energies had the second-highest total

- One thing West and OIES director Bassam Fattouh emphasize is that for all the attention renewables and electrification, that won't be nearly enough to decarbonize the energy sector.

- "The [international oil companies] have an opportunity to develop non-electric zero carbon technologies to help fill this gap," they note.

The bottom line: "IOCs should ramp up on technologies where they see real opportunities and they are in a good position to exploit. But it remains very unclear whether these investments are being pursued as part of a long-term vision or as part of an ad-hoc approach," the paper states.

Bonus: Big Oil's patents

Here's a little more detail on those 3,000 oil-and-gas company patents described in the report I wrote about above.

2. Tesla's big day and uncertain future

Photo: Nicolas Liponne/NurPhoto via Getty Images

Tesla's stock is up 7% in pre-market trading after the Silicon Valley electric automaker yesterday reported delivering a record 95,200 vehicles in Q2, beating many analysts' expectations.

Why it matters: It's a bright spot for the company that's struggling to become profitable amid questions about long-term demand for its product in the increasingly competitive EV market.

- The production and delivery totals, in addition to beating the prior highs in Q4 of 2018, are a big jump over a disappointing Q1 of this year.

- "[W]e made significant progress streamlining our global logistics and delivery operations at higher volumes, enabling cost efficiencies and improvements to our working capital position," the company said.

What's next: All eyes now turn to the company's Q2 financial report slated for release in coming weeks — looking to see if Tesla reports losses (as expected).

- Tesla reported a $702 million loss in Q1, which saw much lower deliveries, ending a mini-streak of 2 consecutive profitable quarters.

The big picture: Bloomberg's resident Tesla ace Dana Hull reports...

- "While the results go a long way toward contradicting Tesla’s doubters, it remains to be seen whether this level of demand is sustainable — or profitable. The $3,750 U.S. federal tax credit buyers were eligible for was cut by half beginning July 1, and deliveries tailed off the last time the incentive shrank."

The intrigue: One question facing Tesla is whether growing sales of its Model 3, which the company hopes can be a mass-market product, are coming at the expense of its more expensive and higher-margin models.

By the numbers: Compare total deliveries in April–June to the Q4, the prior record-holder.

- In Q2 of 2019, Tesla delivered 77,550 Model 3s, compared to 63,150 in Q4.

- But, but, but: Combined deliveries of the Model S and Model X were 17,650 — down from 27,550 in Q4.

3. Hot June shatters records

June was by far the warmest on record in Europe and, by a smaller amount, beat the global record for the month, per a new analysis from Europe's Copernicus Climate Change Service.

The big picture: Copernicus said the late June European heatwave, caused by an air mass that originated over the Sahara Desert, "led to the month as a whole being around 1°C above the previous record for June, set in 1999."

- Copernicus, which provides data to the European Union, also reports that June's global average temperature was 0.1°C higher than June of 2016.

Why it matters: Climate change! A separate analysis by a science collaborative called World Weather Attribution finds that human-induced warming has made this kind of heatwave much more likely and severe compared to the beginning of the 20th century.

- "For the average over France we find that the probability has increased by at least a factor five. ... However, the observations show it could be much higher still, a factor 100 or more," they note in yesterday's report.

Go deeper: June was Europe’s hottest on record as climate change bites (AP)

4. Catch up fast: oil, IPO, climate, LNG, Oregon

Oil markets: Via Reuters, "Oil prices rebounded slightly on Wednesday after a steep fall in the previous session as OPEC and its allies’ decision to extend output cuts was not enough to counter investors’ concerns about the slowing global economy."

Solar: Per Greentech Media, "Sunnova, a leading U.S. residential solar and energy storage company, has filed paperwork to go public on the New York Stock Exchange, in what could be one of the biggest U.S. renewable-energy initial public offerings of recent years."

Climate: "Finland will make it its mission to turn the EU into a climate hero, its prime minister said, as the country took up the six-month rotating presidency of the European Council on Monday," Climate Home News reports.

Natural gas: S&P Global Platts breaks down a Moody's report which finds that growing U.S. LNG exports will create a floor under domestic natural gas prices by relieving some of the glut.

- "Analysts at the credit rating agency said global demand for US LNG will not be enough to force US gas prices beyond the agency's projected range of $2.50/MMBtu to $3.50/MMBtu for the foreseeable future," they report.

- "But the LNG demand will be sufficient to prevent gas prices from dropping below that as gas production continues to increase, Moody's said."

States: Via the Oregonian, "Gov. Kate Brown vowed on Monday to take aggressive action on climate change following the surprise, last-minute defeat of Democrats’ high-priority cap-and-trade bill that would have mandated such action."

Sign up for Axios Generate

Untangle the energy industry’s biggest news stories