Axios Generate

June 18, 2020

Hello readers. Today's Smart Brevity count: 1,210 words, 4.6 minutes.

Heads up: Join Axios Markets editor Dion Rabouin tomorrow at 12:30pm ET for a Juneteenth discussion featuring former senior adviser under President Barack Obama Valerie Jarrett and BET co-founder Bob Johnson. Register here.

🎸And today marks the 1996 release date of Beck's "Odelay," which provides today's intro tune...

1 big thing: The asterisk alongside corporate climate pledges

Illustration: Eniola Odetunde/Axios

Lyft's newly announced plan to go 100% electric by 2030 blends ambition on climate and admission that making good relies on variables it can perhaps influence but can't control.

That acknowledgment is hardly unique in the burgeoning world of aggressive corporate climate pledges.

Driving the news: Lyft outlined a pathway that starts with more near-term electric vehicle deployment through its driver rental program and more slowly spurring electrification of driver-owned cars used for the vast majority of Lyft rides.

(Greentech Media has good coverage here.)

The intrigue: The ride-hailing giant is admirably open about something that can get lost in the avalanche of big pledges over the last two years: They need policy changes to make it work.

Lyft, alongside its multipart plan to boost EVs, cites the need for "unprecedented leadership from policymakers and regulators to align market rules and incentives for businesses and consumers alike."

The big picture: Look closely at various pledges and you'll see that a number — though not all — rely on a mix of corporate decision-making, technology advancements and policy changes to help meet the goals.

- For instance, consider Duke Energy, one of the largest utilities in the nation and among a growing number of power giants pledging net-zero emissions or 100% carbon-free electricity by midcentury.

- Its plan to be net-zero emissions by 2050 is shot-through with policy discussion, such as "permitting reforms" that will enable deployment of new technologies.

One level deeper: All the giant European oil companies are now setting targets for steeply cutting "Scope 3" emissions — that is, emissions from the use of their products in the economy, not just the comparatively small emissions from their own operations.

- This either explicitly or tacitly acknowledges the role of policy in addition to their own business practices (and indeed the companies are also vowing to boost their advocacy).

- Take the French multinational giant Total, which points out that it's aiming for net-zero overall emissions by 2050 "together with society" and that it will develop "active advocacy" around carbon pricing and more.

Why it matters: It's another lens onto something we've written about before that's getting a lot of attention as President Trump scales back federal efforts: The burst of state, local and business emissions efforts can do a lot — but they're not a substitute for national policy.

Go deeper:

2. The roadmap to green pandemic recovery

Governments can create millions of jobs and put carbon emissions into a "structural decline" with a three-year, $3 trillion push to stitch climate-friendly energy into pandemic response packages, the International Energy Agency said.

Why it matters: The analysis out this morning, crafted with the International Monetary Fund, is an effort put analytical weight behind the push for "green" economic recovery measures.

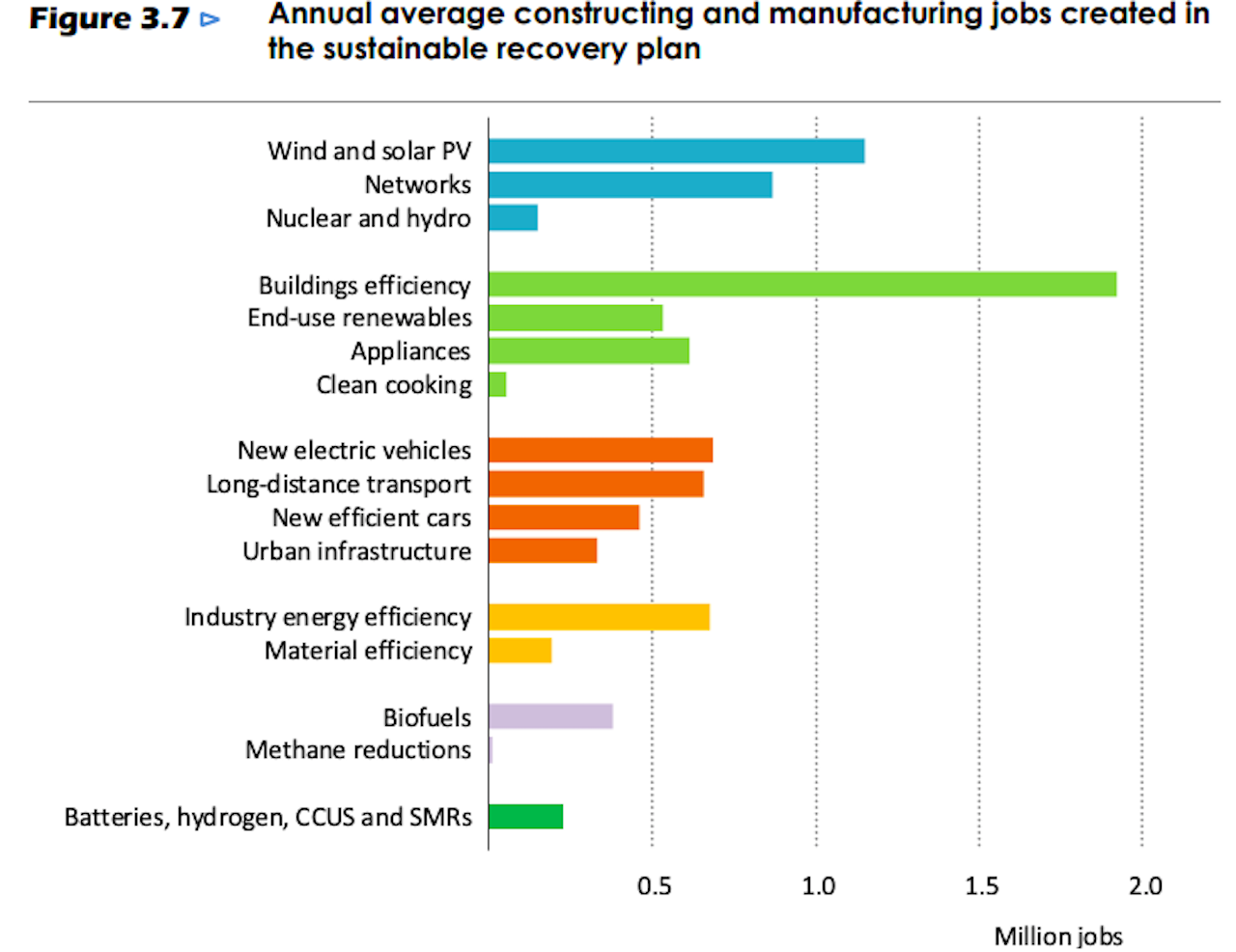

The big picture: The report looks at potential job creation across an array of energy sectors, floating policy ideas around power, transportation, industry, buildings, fuels and "emerging low‐carbon technologies."

- Overall, they see the "sustainable recovery plan" creating or saving 9 million jobs annually worldwide over three years, while adding over 1% annually to global economic growth.

- Most of the $3 trillion would come from private finance "mobilized" by government policies, according to IEA head Fatih Birol, who is tweeting about the findings.

- If enacted, the plan would mean that 2019 was the "definitive peak" in global emissions, IEA said.

Where it stands: IEA points out that globally, energy has not yet been a prominent part of the trillions of dollars of economic response packages worldwide, which have been more focused on emergency stabilization.

- But it's part of some plans, including some European nations looking to boost electric vehicle sales and make aviation cleaner, and low-carbon energy provisions in recently proposed EU-wide recovery plan.

- The site Carbon Brief is doing yeoman's work compiling a detailed compendium of energy and climate provisions in pandemic response packages.

What's next: IEA is trying to organize a global coalition behind the idea and convening a July 9 meeting of government officials from dozens of nations, CEOs, investors and others.

Go deeper: IEA outlines three-year plan for sustainable recovery (S&P Global Platts)

3. VC heavyweight returns with new climate fund

Photo Illustration: Aïda Amer/Axios. Photo: Photo by Nicola Gell/Getty Images for SXSW

Axios' Dan Primack reports that Chris Sacca was one of the past decade's most successful venture capitalists, with a run that included early bets in such companies as Instagram, Twitter and Uber. Then, in 2017, he quit.

Driving the news: Sacca is good at investing but bad at retiring. He's now running a new firm called Lowercarbon Capital, focused on startups that are developing "technologies to reduce CO2 emissions, remove carbon from the atmosphere, and actively cool the planet."

"Cleantech" remains a dirty word for many venture capitalists, due to the mountains of cash lost on such deals in the late aughts.

- Sacca argues that the sector today is akin to internet tech in 2005 when Y Combinator launched, in terms of lower startup costs and clearer paths to scale.

- This is not, he stressed to Dan yesterday during a CB Insights conference interview, a charity case. Sacca also says he welcomes the investment participation of oil majors like Chevron and ExxonMobil, even though that's blasphemy in some clean-tech investment circles.

- Portfolio companies include a startup focused on lithium extraction tech, a carbon credits marketplace and an oyster hatchery in Maine.

Details: Lowercarbon currently is structured as a family office — Chris' wife, Crystal, is co-founder — in the tens of millions of dollars. It hasn't yet accepted outside money save for a few special-purpose vehicles with institutional investors from Sacca's prior funds, but there's a growing possibility that it will do a formal fundraiser.

The bottom line: Sacca's participation could prompt others to tip their toes back in, or for the first time, but a stampede is unlikely until the new generation of cleantech companies produces a massive hit.

4. Catch up fast: Congress, Arctic, shale

Legislation: "The Senate on Wednesday approved a major land conservation bill that activists have sought for years, delivering a rare bipartisan win propelled by the election-year interests of endangered Republicans." (New York Times)

Shale: "U.S. shale producers are expected to restore roughly half a million barrels per day (bpd) of crude output by the end of June, according to crude buyers and analysts, amounting to a quarter of what they shut since the coronavirus pandemic cut fuel demand and hammered oil prices." (Reuters)

Arctic drilling: "Alaska’s congressional delegation is asking federal regulators to investigate whether several banks have unlawfully discriminated against Alaska Natives by refusing to fund Arctic oil and gas projects." (Anchorage Daily News)

5. An electric bus for our times

Image courtesy of Arrival

CNET reports that the newly unveiled electric bus from the U.K. startup company Arrival has some features that make it suitable for the pandemic age by enabling social distancing.

Driving the news: "[T]he interior of the bus is customizable, with removable seats, so you can create additional space between passengers. It's a pretty novel way to increase or decrease seats to meet reopening guidelines," CNET reports.

Here's a little more...

"In addition to the social distancing-approved seating configuration, the bus uses touchless technology. Riders can request a stop via smartphone before they even set foot on the Arrival Bus, plexiglass screens separate riders and no-touch bells let them signal for a stop."

6. Number of the day: 220%

Via Axios' Amy Harder...

That's the increase in share price since 2016 of Denmark-based Orsted, which over that same time period transformed from an oil company to an offshore wind developer, per Bloomberg.

Orsted's CEO Henrik Poulsen, who oversaw those changes, is stepping down in 2021.

Why it matters: Europe's other, far larger, oil and gas producers like BP and Shell are trying to undertake similar big changes, albeit on slower timelines because they're so much bigger.

The intrigue: The 220% increase is just short of the share price gains of tech giants Amazon and Apple, Bloomberg notes.

Sign up for Axios Generate

Untangle the energy industry’s biggest news stories