Axios Capital

March 05, 2020

Situational awareness: At least one homebuyer found by the L.A. Times managed to get a 30-year mortgage this week at a rate of 2.75% with just 3.5% down. No wonder there's a refinancing boom going on.

In this week's issue, I talk about how coronavirus is a much bigger deal than anything going on in the markets, no matter what President Trump thinks; I also compare Jack Welch with Jack Dorsey, and wonder whether anybody would be interested in buying Robinhood any more. And I answer the question: Before the financial crisis, when was the last time that the world saw a quarter of negative GDP growth?

- All that and more in this week's 1,619 words, which will take you about 6 minutes to read.

1 big thing: Ignore the markets

Illustration: Sarah Grillo/Axios

We're not in a financial crisis, which means we don't need the full arsenal of weaponry a financial crisis requires.

- Humanity needs to fight a virus, not a credit crunch. Our success or failure on the epidemiological front lines will ultimately determine the medium-term path of the U.S. and global economies.

- Markets are not part of the problem. Insofar as they're reacting to the coronavirus, they simply reflect investors' fears and expectations about the economic damage that the virus will cause. Goosing the stock market does nothing to address the much bigger underlying issue.

The big picture: With stocks whipsawing wildly and yields on Treasury bonds hitting new all-time lows, it's easy for policymakers to find themselves fighting the last war — to react to the current emergency in much the same way as they did to the financial crisis.

- Those responses will help, at the margin. If economic activity slows down as a result of the coronavirus, then lower interest rates will make it easier for individuals and businesses to borrow money to cover short-term losses.

- Fiscal stimulus, similarly, will always cause some kind of extra economic activity, and will therefore help to counteract a virus-related slowdown. But as former White House economic adviser Jason Furman told New York Magazine's Josh Barro, "This is definitely not TARP. I think this is a nice to have."

Why it matters: Political capital is finite, and fighting the virus directly has to be the top priority of any government. If and when the virus can be brought under control, then there's a good chance of a V-shaped recovery in which markets will take care of themselves.

- China provides a good example. The macroeconomic response will come, but first the government had to get to the point at which the rate of new infections was going down rather than up.

IMF chief Kristalina Georgieva has laid out the priorities facing any government fighting coronavirus. First is to "protect people’s wellbeing, take care of the sick, and slow the spread of the virus." Second is fiscal policy, targeted at the hardest-hit sectors and households.

- Monetary policy comes last — but so far it's the only area where the U.S. has taken decisive action, with the Fed's emergency rate cut this week.

The bottom line: Broken markets were a large part of the cause of the financial crisis, and fixing those broken markets was a large part of the necessary policy response. Neither of those things is true this time around.

2. The distracting shiny object

For anyone who gets their economic news from cable TV, we're in the craziest period of the Trump presidency so far.

- The S&P 500 fell by 3.4% last Monday, Feb. 24. It then fell another 3% the following day, and it fell by 4.4% on Thursday Feb. 27.

- This week, it rose 4.6% on Monday, fell 2.8% on Tuesday, and rose 4.2% on Wednesday. It's entirely possible we'll see another 3%+ swing today.

- Making matters worse: With the market still near all-time highs, a 3.7% intraday swing in the Dow corresponds to a 1,000-point move. That's guaranteed to generate banner headlines — and freak out boomers who still think of 1,000 Dow points as being a major milestone.

How it works: The Trump administration explicitly uses the stock market as a barometer of its success, and the coronavirus was a large part of the reason for the recent stock-market volatility. Those factors explain why Treasury Secretary Steven Mnuchin and National Economic Council director Larry Kudlow were appointed to the government's coronavirus task force.

The bottom line: So long as the stock market remains volatile, expect Trump to fixate much more on the Dow than he does on CDC mortality reports.

3. The big economic danger

Here's how serious coronavirus is: With the exception of the global financial crisis, the last time that the world saw a quarter of negative GDP growth was in 1982.

- Back then, China accounted for only about 1% of global GDP. Today, that number is 15%.

By the numbers: Thanks in large part to a massive slowdown in China, the OECD sees global GDP shrinking at a 0.5% pace this quarter.

- The forecast then shows a healthy bump back up to a 3.7% growth rate in the second quarter and an even higher 5.5% rate in the third, as the world starts to recover from the coronavirus shock.

Yes, but: All of these forecasts have much higher error bars than usual. There's a very good chance that the OECD's forecast will turn out to have been far too optimistic or pessimistic. We just have no idea which one it will be.

4. The 2 Jacks

Photo illustration: Aïda Amer/Axios. Photos: Mike Coppola/Getty Staff, Phillip Faraone/Stringer

Jack Dorsey is, in some strange way, the modern-day Jack Welch. Dorsey, the embattled yet sensitive founder and CEO of Twitter and Square, has almost nothing in common with Welch, the corporation man who led GE as it became the largest company in the America. Yet Dorsey exemplifies today's West Coast leaders just as Welch helped to define the celebrity CEO of the 1980s and '90s.

- Welch, who died on Sunday at age 84, was combative and irascible. “You can’t even say hello to Jack without it being confrontational,” said one manager in 1988. Dorsey, by contrast, is introverted and conflict averse.

- Welch was lavishly paid — his severance agreement alone amounted to $417 million — while Twitter pays Dorsey $1.40 per year. Yet Dorsey is much richer than Welch ever was, with a net worth somewhere in the $6 billion range.

- Welch was famously blunt and quotable; Dorsey speaks in annoyingly circuitous generalities.

- Welch acquired his "Neutron Jack" nickname by constantly firing employees, even in good years. Dorsey acquired the #WeBackJack hashtag by creating what staffers characterize as a "caring family" and spending a lot of time listening to employees and supporting them.

- Welch was a loyal company man, who rose up the ranks at GE to become a singleminded CEO; Dorsey left Twitter, started Square, and now runs them both simultaneously while still making time for the occasional 10-day silent vipassana meditation in Myanmar.

Welch obsessively managed GE's quarterly earnings and achieved much of his success through financial engineering, creating billions of dollars of profit from the GE Capital subsidiary that almost blew up the entire company during the financial crisis.

- That kind of thing is very unfashionable these days, but Dorsey is learning that you're only really safe in your job so long as the share price keeps rising.

- No one is agitating for Dorsey's ouster at Square, whose share chart has been gratifyingly up-and-to-the-right. Twitter, by contrast, is still well below the $45 per share at which it started trading after its IPO in 2013.

The bottom line: Activist hedge fund Elliott Associates wants Dorsey out as CEO of Twitter. And as Kara Swisher put it in her NYT column, "a good heart is the one thing that won’t help at all."

5. Robinhood's worst week ever

Illustration: Sarah Grillo/Axios

It was a bad week for buzzy fintechs, as Libra retreated from its grand cryptocurrency plans and decided instead to wait for countries to issue their own digital currencies. (Don't hold your breath.)

The biggest loser, however, was Robinhood, the fast-growing stock-trading app that somehow contrived to go down for all of Monday and two hours on Tuesday.

- The outage probably dashed any hope that Robinhood might get snapped up by a larger rival, like E*Trade and TD Ameritrade before it.

Our thought bubble, from Axios' Dan Primack: "Robinhood does now have a target on its back, but the archers are more likely to be lawyers than potential acquirers."

The big picture: Robinhood has screwed up before, more than once. Any sober acquirer would want to impose a lot more layers of compliance and quality assurance — but trying to impose those layers would surely kill the very spirit they were attempting to buy.

An apology: Last week I had Robinhood and Reddit message boards in mind as I was writing about losses exceeding gains in the stock market, even when it was flat on the month. I expressed myself badly, however, and I'm grateful to everybody who wrote in to tell me, quite rightly, that every trade has both a buyer and a seller.

- While trading losses can certainly exceed gains among fast-twitch millennials on Robinhood, they can't do so overall.

Go deeper: Expect lawyers to take aim at Robinhood

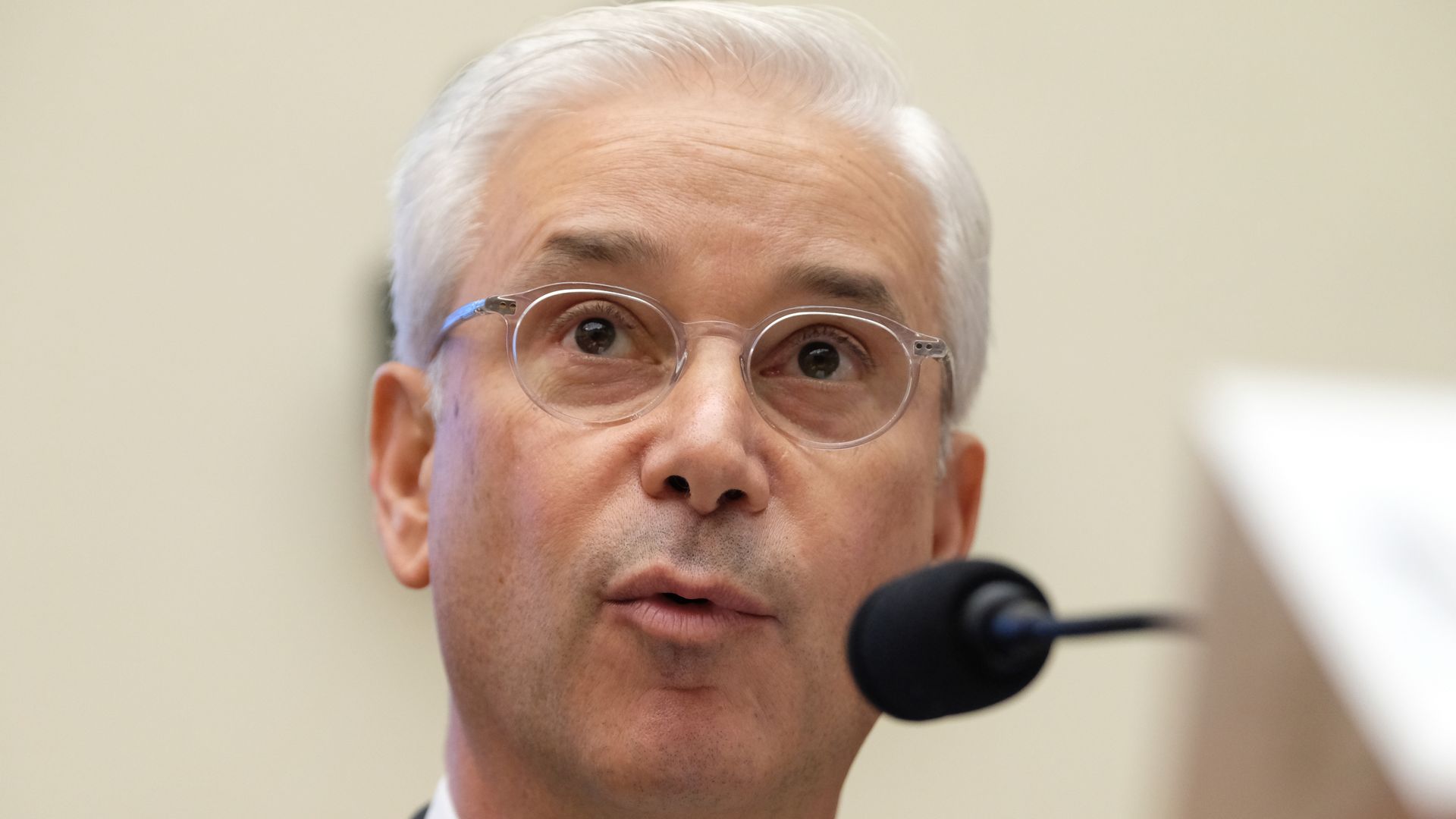

6. Coming up: Wells Fargo back in Washington

Photo: Alex Wroblewski/Getty Images

Wells Fargo's new CEO, Charlie Scharf, will testify before Congress on Tuesday, Axios' Courtenay Brown writes. Betsy Duke, the bank's chair, will appear with fellow board member James Quigley the following day.

Why it matters: It's the fifth time the bank will try to defend itself in front of lawmakers since news of its 2016 fake accounts scandal. Bank leadership will now have to respond to a new congressional report from House Democrats that alleges the company was lax in complying with regulator demands.

- Wells Fargo announced lower-fee bank accounts and higher worker pay this week. But those changes likely won't assuage concerns over the bank's history of customer abuse.

7. Building of the week: 200 West Street

Henry Cobb, who died this week at the age of 93, was a master of the understated skyscraper. When Goldman Sachs wanted to build a new headquarters in 2005, he was a natural choice — this is a bank, after all, that doesn’t even display its name in the lobby of its headquarters, let alone on the exterior.

What they're saying: Paul Goldberger reviewed Cobb's design in the New Yorker in 2010, and he's worth quoting at length:

"The new headquarters is architecture as a well-tailored suit. From a distance, the building looks utterly unexceptional, but as you get closer your eye picks up signs of quality — the drape, as it were, and the stitching. Cobb’s façade of clear, colorless glass and bands of shiny steel is completely flat, and this two-dimensionality might have been dull were it not for the subtle shift of proportions in the quiet plaid pattern of the steel grid as it ascends. By the time you are close enough to touch this architectural garment, you can tell that a lot of money has been spent."

Sign up for Axios Capital

Learn about all the ways that money drives the world