Axios Capital

March 26, 2020

The greatest decade in the history of mankind is over. (Well, the greatest bull market, anyway.) The old order changeth, yielding place to new.

- If you have any idea what the 2020s will bring us, let me know at [email protected]. Otherwise, maybe dust off that '53 Margaux and sit back with the next 1,549 words. They'll take you about 6 minutes to read.

1 big thing: Keep it shut

Illustration: Sarah Grillo/Axios

We've gone on holiday by mistake. And we're going to have to stay here for a while.

- During normal, scheduled holidays — the period between Christmas and New Year's, for instance, or all of August in France — GDP plunges to well below normal levels, no one much minds, and then economic activity bounces happily back again.

The best hope for some countries hit by the novel coronavirus, like Denmark or New Zealand, is that a shutdown might work a bit like that. People stay home for a number of weeks, the pandemic is brought under control, and then life can revert to something approaching the status quo ante.

- That's not going to happen here. Just last week, 3.3 million workers lost their jobs and filed for unemployment. There's no switch that can be flipped to magic them back into their old jobs.

- Much worse than that, hundreds of thousands of Americans are going to die of COVID-19, millions more could find themselves with debilitating and permanent lung damage, and an unknowable number will suffer or die as a result of a health care system so overburdened that it can no longer effectively treat other injuries and diseases.

The optimistic scenario is one in which we stay isolated from one another for as long as it takes to equip the U.S. with the resources necessary to fight this plague: masks, tests, contact tracing protocols, open ICU beds, ventilators, maybe even effective therapeutics.

- There will still be economic activity. The internet has made it possible for a broad range of white-collar jobs to be done from home, and the list of essential workers — from police officers to grocery store clerks — is very long. On top of that, nonessential industries from carmakers to shirtmakers are making themselves essential by pivoting to producing ventilators and masks, and other companies are hiring aggressively.

- JPMorgan estimates that GDP will be about 10% below normal in the second quarter, which means an annualized drop of 25%.

- Then there can be a recovery, with GDP growing at a 6% pace in the second half of 2020 and unemployment falling from a peak of 8.5%.

The pessimistic scenario is much worse. NYU economist (and my ex-boss) Nouriel Roubini is warning of "a new Great Depression, worse than the original," while Jim Bullard, the president of the St. Louis Federal Reserve, sees unemployment rising to an unprecedented 30% in just the next couple of months.

- Context: In the Great Depression, unemployment started at 3.3% in 1929, and rose to a peak of 24.9% four years later, in 1933.

The bottom line: A strong economy requires confidence. None of us is as confident today as we were a month ago, and it's impossible to see that confidence returning so long as the pandemic rages. The economic imperative is therefore to buy time — which means all of us living under effective quarantine.

Bonus: Jerome Powell's straight talk

Photo illustration: Sarah Grillo/Axios. Photo: Scott Olson/Getty Images

What they're saying: “If we get the virus spread under control fairly quickly, then economic activity can resume," the Federal Reserve chairman, Jerome Powell, told NBC this morning. "The virus is going to dictate the timetable here.”

2. Thank you, markets

Illustration: Sarah Grillo/Axios

One of the biggest silver linings of the current crisis is the fact that the U.S. has the deepest capital markets in the world.

Why it matters: The stock and bond markets are places for people to store their wealth in case they need it in the future. We're currently experiencing a major global crisis in which millions of individuals and businesses need liquidity. By selling investments, those fortunate enough to have stored wealth can access much-needed cash almost immediately.

- Think of the market as a rainy-day fund, and the COVID-19 pandemic as a thunderstorm of unprecedented magnitude.

- The global selling pressure has driven down the prices of stocks and corporate bonds, which is exactly how markets should work. They went up when people were saving their money, and now they're going down when people are withdrawing it.

The big picture: Wealth is deferred consumption, a way of storing your income so that you can use it in the future. That storage always comes with risks, to both the upside and the downside.

- Sometimes investments rise impressively in value, as stocks broadly did over the past decade. Sometimes they are eroded by inflation, or get hammered by a low-probability event such as a global pandemic.

How it works: The Federal Reserve has effectively unlimited capacity to provide the liquidity needed to keep the markets functioning. Meanwhile, risk-averse global investors have similarly unlimited desire to buy Treasury bonds to fund any U.S. stimulus.

- This isn't a financial crisis. Markets aren't the problem; they're the solution. They provided the money that companies and entrepreneurs needed to grow, and, thanks to the Fed, the markets now providing the same companies with cash to get them through the current crisis.

The bottom line: Thanks to the markets, $454 billion in the just-passed stimulus bill will be leveraged up to more than $4 trillion of total lending to needy companies. At the median wage of $936 per week, that's enough to support 50 million workers for well over 18 months.

Bonus: The government makes markets work

Markets would have collapsed over the past couple of weeks if it weren't for the "whatever it takes" attitude of the Fed.

- The Fed's muscle memory from 2008-09 kicked in, and almost every financial crisis program was resuscitated. (Similarly, one big reason for the success of Hong Kong and Singapore in navigating this crisis is that their own memories of SARS and H1N1 kicked in very quickly.)

- Banks didn't need to be rescued this time around because after the financial crisis they were forced to take on much more capital. America's banks now have more than $1.7 trillion of "tier 1" capital — basically the amount of losses that they can easily absorb without going insolvent.

- The banks' strength has made them an important part of the government's rescue package. They are being asked to lend trillions of dollars of bailout money to small- and medium-size businesses across the country, with the loans guaranteed by the government.

Go deeper: Axios' Dion Rabouin looks at the Fed's extraordinary actions.

3. Why we need corporate welfare

Illustration: Sarah Grillo/Axios

It can be distasteful to see government bailout funds going to companies that have harmed workers, evaded taxes, degraded the environment and enriched their executives with socially useless financial engineering. But it's still necessary.

Why it matters: Vacations work in capitalist countries because employees remain on the payroll throughout and can seamlessly rejoin their employer upon their return. As millions of Americans embark on an involuntary vacation, the same principle applies.

What they're saying: It is always preferable to redeploy workers rather than lay them off. That's a key lesson we can learn from the Chinese experience of weathering the crisis, as Boston Consulting Group's chief economist Philipp Carlsson-Szlezak told Axios' Bethany Allen-Ebrahimian.

The bottom line: Giving laid-off Americans generous unemployment checks is necessary and humane — but it's always second-best to keeping them employed in the first place. It's much more economically efficient for the government to pay companies to keep workers employed than it is to pay workers only after they've been fired.

- Unless people remain in their jobs, even if they can't produce much right now, America will lose billions or even trillions of dollars' worth of institutional knowledge and organizational capital.

4. Nothing can stop the stock ETF juggernaut

The week ending March 18 was one of the bloodiest in stock market history, with the S&P 500 dropping more than 12.5% and the Dow shedding 3,654 points.

- Every asset class saw outflows, per the Investment Company Institute, with investors withdrawing more than $153 billion from mutual funds and ETFs combined. Of that, the majority ($114 billion) came from bond funds, but another $12 billion left equity funds.

- The single exception — the one asset class that saw inflows, rather than outflows — was domestic equity ETFs. That's overwhelmingly S&P 500 index funds, along with their close brethren.

- By the numbers: The $9.1 billion that flowed into such funds vastly exceeded the $2.6 billion average weekly inflow during 2019.

Why it matters: Actively managed mutual funds have been hemorrhaging cash for years, and bond funds are the first place that Americans look for money when they need it in a crisis. But the set-it-and-forget-it gospel of investing passively in stocks for the long run seems to be impervious even to the threat of a second Great Depression.

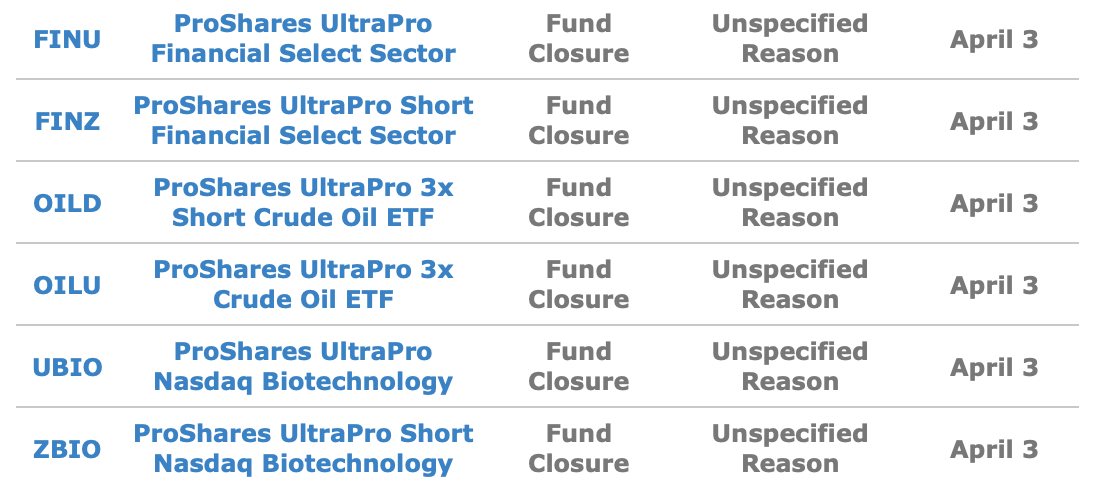

5. Goodbye and good riddance

One group of ETFs that won't be missed is the leveraged and inverse ETFs designed as gambling vehicles for day-traders.

- If you want to bet that a certain sector is going up or down on a certain day, these funds provide an easy and leveraged way to do so. But far too many investors hold them for much longer than a day, which is a recipe for disaster.

- The recent stock market volatility has wiped out a whole swath of these funds. I'm picking on the six here just because they come in pairs: the long ETFs and the short ETFs are both going out of business at the same time.

6. Coming up: Shaken consumer confidence

Illustration: Eniola Odetunde/Axios

A key consumer confidence survey — the one conducted by the Conference Board — is expected to have its biggest monthly drop in at least 10 years when it's released on Tuesday.

Why it matters: Consumer confidence has been trending steadily upward throughout the Trump presidency. That trend has now ended.

7. Building of the week: The Javits Center

Photo: Noam Galai/WireImage

James Ingo Freed of I. M. Pei & Partners designed the monumental Jacob K. Javits Convention Center of New York, on the far west side of Manhattan, in 1979. Named for a longtime member of Congress who represented New York, it opened in 1986 — the year of Mr. Javits' death — with 640,000 square feet of exhibition space.

- The Javits Center was revolutionary, in its time, for its use of glass; up until it opened, convention centers were invariably dark and windowless.

- Few, if any, convention centers are truly loved — do let me know if you can think of one — but the Javits Center does in its way seem to have anticipated the outsized bombasticism of its new neighbor, Hudson Yards.

The Javits Center is now being turned into a COVID-19 hospital.

Sign up for Axios Capital

Learn about all the ways that money drives the world