Axios Crypto

February 10, 2023

The crackdowns continue, but there is some sign of defiance ahead.

- Send any and all questions or comments: 📧 [email protected]

Today's newsletter is 1,304 words, a 5-minute read.

🦑 1 big thing: Kraken settles

Illustration: Aïda Amer/Axios

Crypto exchange Kraken yesterday agreed to shutter its staking services for U.S. customers, and pay $30 million to the Securities and Exchange Commission as part of a settlement, Crystal writes.

Why it matters: The top U.S. financial regulator has now spoken on staking, a process that compensates retail crypto investors for holding certain digital coins.

- The service is offered on other major crypto exchanges like Coinbase, though they aren't exactly the same. (More on that below.)

What they're saying: "As part of the settlement, Kraken has neither admitted nor denied the SEC's allegations," a Kraken spokesperson said in a statement emailed to Axios.

- "Starting today, with the exception of staked ether (ETH), assets enrolled in the on-chain staking program by U.S. clients will automatically be un-staked and will no longer earn staking rewards," the statement added.

In the weeds: Ether can't be unstaked until Ethereum's Shanghai upgrade is completed (probably later this year), as Kraken's post explains.

Between the lines: The SEC's complaint specifically takes issue with pooled staking, rather than staking at large.

Zoom in: To offer staking services, an exchange like Kraken would pool customer assets transferred by them and stake them on their behalf, the SEC's complaint reads.

- In doing so, there would be a contract between Kraken and their customers, that both transfers the customer's asset, and promises a return.

- “Whether it’s through staking-as-a-service, lending, or other means, crypto intermediaries, when offering investment contracts in exchange for investors’ tokens, need to provide the proper disclosures and safeguards required by our securities laws,” SEC chair Gary Gensler said in the statement.

Context: Ethereum staking validates transactions on the Ethereum blockchain. To do this, a user would lock up their tokens, or "stake" the native coin, in this case ether. They earn rewards in that token, in return for helping secure the network.

- You can do this for any proof-of-stake protocol.

- Kraken is among the top staking service providers, representing 7.6% of all staked ether, behind Lido's 29% and Coinbase's 13%.

Flashback: Kraken acquired non-custodial staking platform Staked in December 2021 in a deal then billed as "one of largest crypto acquisitions to date," according to the company.

The bottom line: It would appear the SEC is intent on proving it can keep the troubled crypto industry in line, by whatever means necessary.

- The intrigue: The IRS wants to look at Kraken's books to identify its customers and is now seeking court approval to do just that.

🪰 2. Culture hash: Dissenters

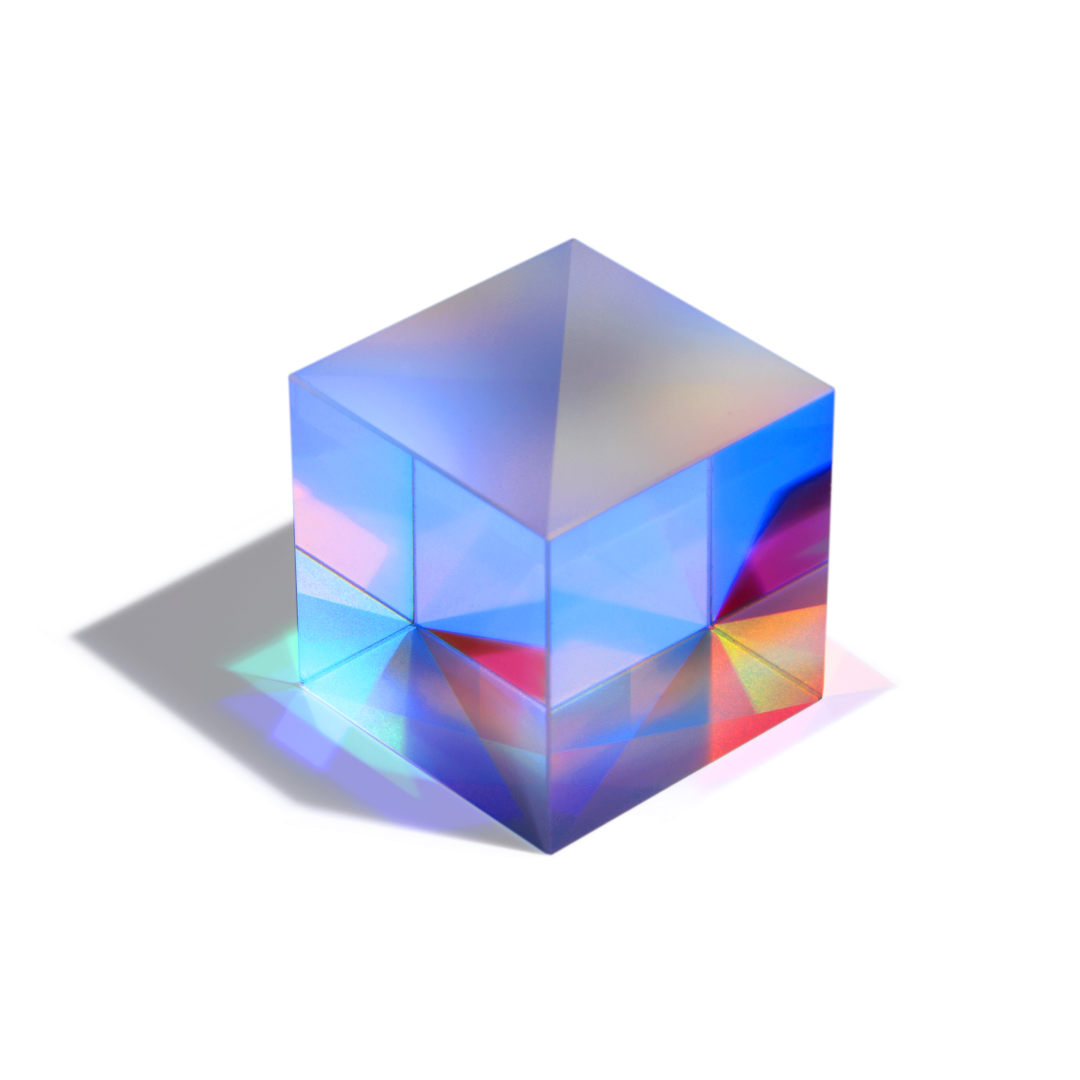

Screenshot: @brian_armstrong (Twitter)

What's happening: The SEC's complaint against Kraken, deeming its staking-as-a-service offering as a security, has shaken up the crypto industry, sparking fear that such analysis would be broadly applied to all staking, Crystal writes.

- That does not appear to be the case, with the details of the complaint pointing to the pooled nature of Kraken's service.

- Coinbase Global, for example, has said that its staking service is not affected by Kraken's settlement. We don't know if the SEC also thinks that.

What they're saying: "Whether one agrees with that analysis or not, the more fundamental question is whether SEC registration would have been possible," SEC Commissioner aka "Crypto Mom" Hester Peirce wrote in a speech, reacting to the settlement.

State of play: Crypto-related stuff isn't exactly making any progress through the SEC's registration pipeline, to Peirce's point.

- And Coinbase's CEO is agreeing with that, saying Gensler's repeated ask for crypto firms to do just that to avoid punitive action, is "disingenuous."

Zoom out: Decentralized alternatives to offerings like Kraken's and Coinbase's saw a rally in their token prices following the news.

The bottom line: Not all staking services are designed the same way, so while the SEC appears to have made an example out of Kraken, that example appears to have added to the confusion and anxiety about what is and what isn't allowed rather than clarifying it.

- Case in point: Coinbase Global's stock.

🏧 3. Charted: Lending on chain

There are many blockchains and lots of applications for lending and borrowing cryptocurrency, but Ethereum remains the home for decentralized finance (or DeFi), Brady writes.

- Lately, a lot of the standard bearers of lending have been making new versions of their savings-and-loan protocols.

- Some of them have been adding features. Others are taking them away. More on all that below.

Of note: Aave v3 is the biggest of all of these protocols, but only if you add in other blockchains.

- Aave decided to test its latest version on other chains first, only just arriving on Ethereum late last month.

By the numbers: There is just about a billion dollars in these four "small" projects. This time in 2020, all of DeFi broke $1 billion for the first time (entirely on Ethereum).

- Today, DeFiLlama puts DeFi at $47 billion, across multiple blockchains.

🐣 4. The new and interesting money markets

Illustration: Shoshana Gordon/Axios

There's been some real innovation in the basic business of on-chain lending, Brady writes.

Recap: In DeFi lending, users entrust assets to a smart contact which has explicit rules about how others can borrow those assets.

- The depositor shares some of the interest earned from borrowers on those deposits.

- For now, most lending is fully collateralized. That is, a borrower needs to deposit a greater dollar value of one asset in order to borrow another.

- All deposits and all loans are viewable on the blockchain, and the rules never shift unexpectedly.

So here's some of the newer money markets out there, with more details on what each of them offers.

Euler has been around a while. The innovation it is known for is its openness and permissionlessness. It also has an approach to enforcing the health of loans that's a little gentler on investors.

Fraxlend is part of the larger frax (FRAX) stablecoin ecosystem. The frax stablecoin works a tiny bit like the doomed stablecoin terra usd did, but it mostly works like a fully backed stablecoin.

- With Fraxlend, holders of frax can earn interest by depositing their stablecoins for others to borrow, but the smart contract can also mint new frax.

Aave v3. As we noted earlier, all of the versions of Aave together are by far the largest of the DeFi money markets. Indeed, when its deployments on other blockchains are included, the total value locked in Aave v3 alone is at $634 million these days, which speaks to its core innovation: deposit on one chain, borrow on another.

Compound v3 went in another direction from every other update. It went... simpler. There's only one thing you can borrow on Compound v3, usd coin (USDC), because it's easy to exchange USDC for anything else anyway.

- Collateral also doesn't earn interest, but investors can borrow more against it.

In addition, there's Morpho Finance, a peer-to-peer protocol built on top of Aave on Compound that allows people on both sides of a loan to earn more.

- Basically, a depositor puts funds in and Morpho deposits them in another money market at first.

- Then, when a borrower comes along, it withdraws the deposits and arranges a direct loan between the two, with better rates on both sides thanks to the direct nature of the transaction.

- That's called "composability" in the crypto world — when one thing relies on another thing. There's over $200 million in Morpho now.

What we're watching: The SEC has cracked down on every lending program at centralized organizations, so it could come for these offerings one day, too.

- Going after a DeFi lending operation would be trickier, but a recent CFTC case suggests it's not impossible to sue a DAO.

🪃 5. Catch up quick

🚨 NYDFS is investigating Paxos, the white-label stablecoin issuer behind Binance's BUSD. (CoinDesk)

💾 Microsoft disbanded its 100-person Metaverse Industrial Core team. (The Information)

🪀 The NFT market is bruised but not beaten, with some collections — especially new ones — doing well in later 2022. (DappRadar)

😵 a16z and friends lost their bid to prevent Uniswap from deploying onto Binance Smart Chain. (The Block)

Top coins

This newsletter was edited by Pete Gannon and copy edited by Carolyn DiPaolo.

Thanks a ton to anyone who forwards these emails to others! —C & B

Was this email forwarded to you? Sign up here to get Axios Crypto in your inbox.

Sign up for Axios Crypto

Brady Dale covers crypto and blockchain impacts on markets and regulation.