Potential Tesla rival Lucid Motors makes its move

Add Axios as your preferred source to

see more of our stories on Google.

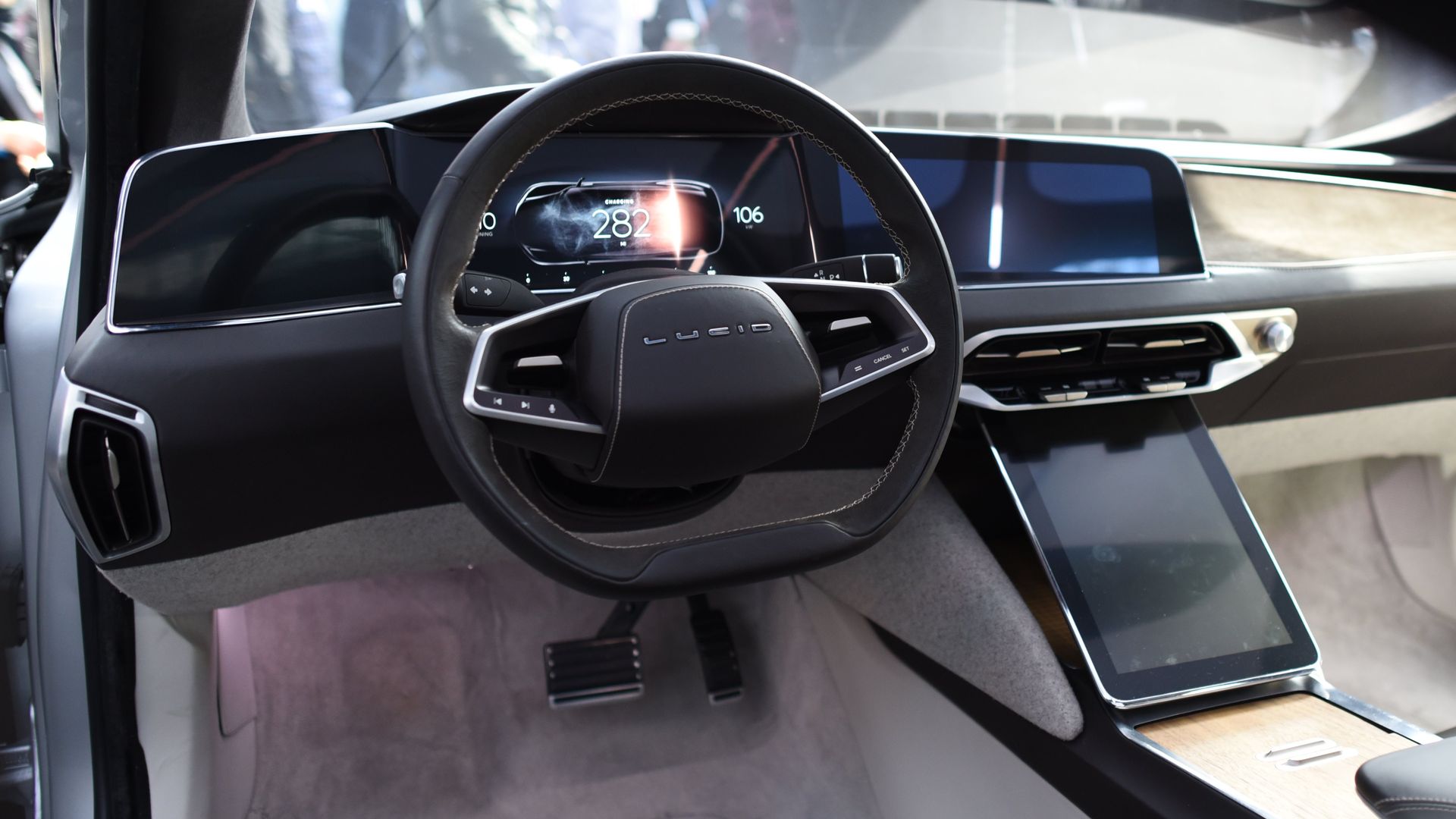

The interior of the Lucid Air. Photo: Timothy A. Clary/AFP/Getty Images

Let's unpack yesterday's news that Saudi Arabia's sovereign wealth fund (PIF) plans to pour over $1 billion into the electric vehicle startup Lucid Motors, a potential Tesla rival which hopes to launch commercial production of a luxury sedan in 2020.

The backdrop: The PIF is, of course, the same fund that Tesla CEO Elon Musk famously said was on the cusp of funding his quickly-aborted, take-private plan. Lucid Motors' CTO Peter Rawlinson, a Tesla alum, went on a PR offensive yesterday to talk up what it hopes to accomplish with the Saudi cash.

The details: Lucid hopes to bring the car into commercial production at an Arizona factory in 2020.

- The initial models are expected to have a price range north of $100,000 and Lucid says they'll have a 400-mile range, with the company eventually planning a base model for around half that cost with shorter range.

Yes, but: The Saudi investment is big, but until Lucid gets into commercial production and all the challenges that entails, potential remains...potential.

On the record: Highlights of some Rawlinson interviews...

- What's next: He told Bloomberg TV that news is coming soon about charging plans. “We are going to announce very shortly a great partner that we are going to partner with for our super-charger, our fast-charging network, right throughout the US,” he said.

- The buzz: Take this one with a large grain of salt, but he's arguing that there's a wholly untapped opening on the high end of the market. “Lucid will offer the first full luxury EV, and that luxury market is huge worldwide,” Rawlinson told CNN.

The big question: Experts have wondered how exactly Saudi Arabia's plans to use investments — including several in the tech sector — to diversify its crude-dominated economy.

- Rawlinson, in the Bloomberg interview, dropped at best a slight hint, noting they would "explore possibilities where we can work together.”

- Last night, I asked Saudi expert Ellen Wald, author of the recent book "Saudi, Inc.," what that could mean. She emailed:

"It is possible that Lucid could collaborate with some Saudi research institutions in the future — possibly [King Adbullah University of Science and Technology] or in the longer-term NEOM, if and when it gets off the ground," referring to plans for a futuristic, high-tech industrial city."At some point in the future, particularly if the PIF were to increase its investment in the company, it would not be surprising if Saudi Arabia would insist that some aspect of production take place in the kingdom."

Go deeper:

- Tesla faces threats from every direction.

- AP wrote a good background piece on Lucid's plans.