Mar 27, 2019

Jury orders Bayer to pay cancer victim $80 million

Add Axios as your preferred source to

see more of our stories on Google.

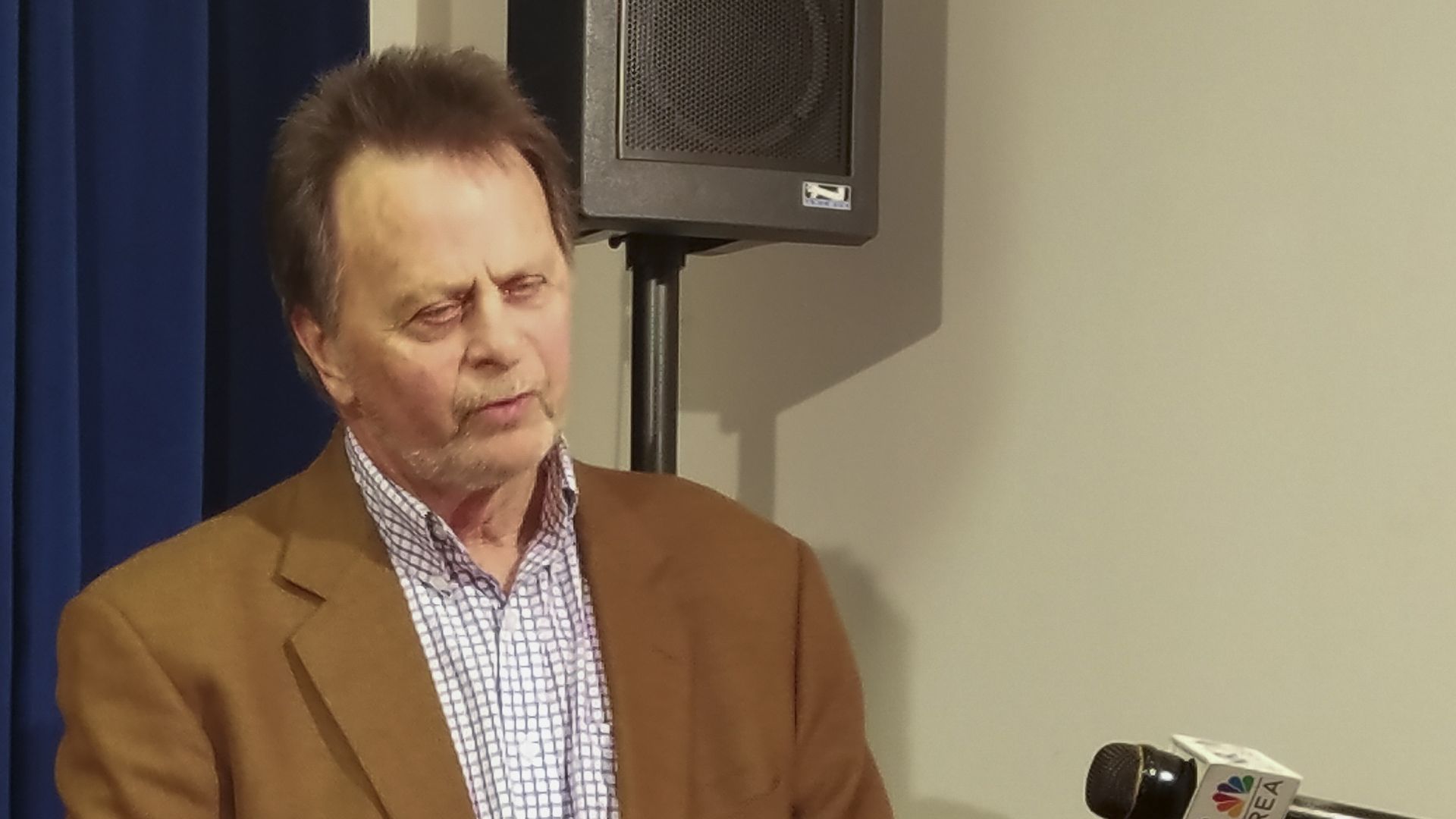

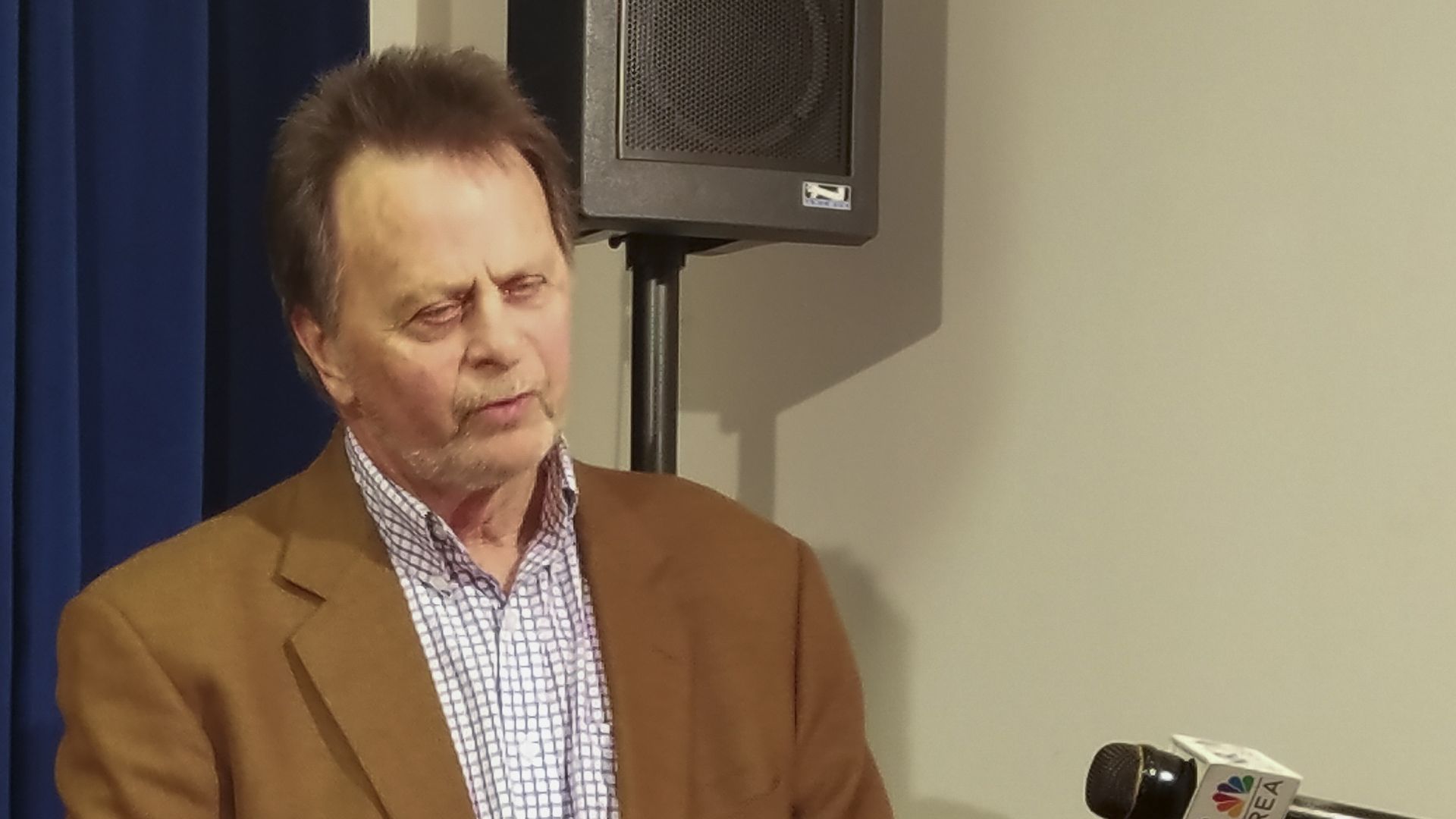

Edwin Hardeman, who sued Bayer. Photo: Julie Charpentrat/Getti Images

Add Axios as your preferred source to

see more of our stories on Google.

Edwin Hardeman, who sued Bayer. Photo: Julie Charpentrat/Getti Images