GrubHub CEO talks competition and controversy after Q2 earnings

Add Axios as your preferred source to

see more of our stories on Google.

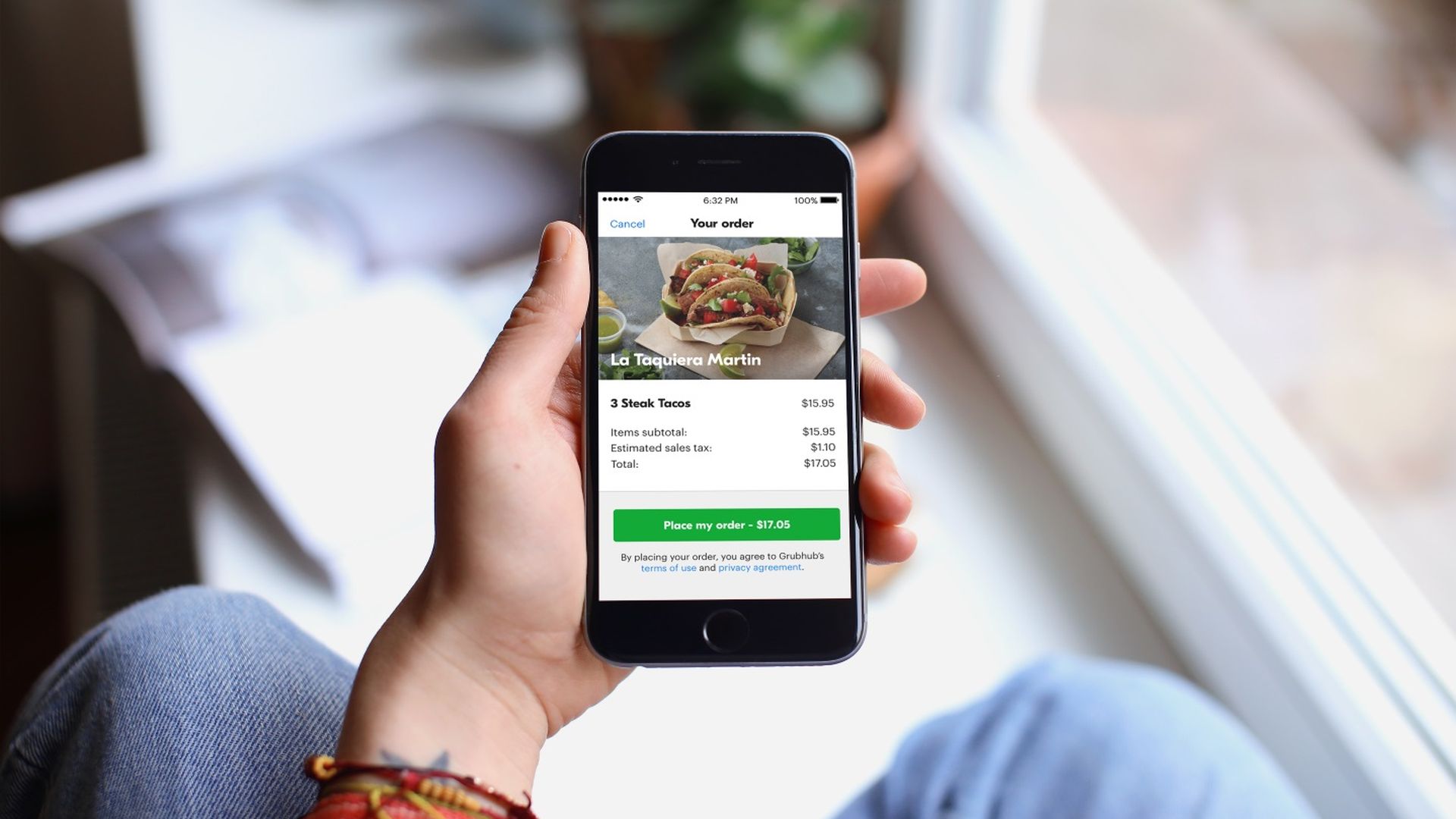

Photo: GrubHub

After his company posted mixed quarterly earnings results Tuesday, GrubHub CEO Matt Maloney didn't shy away from accusing competitors of tricking customers with hidden delivery fees in an interview with Axios.

Why it matters: A recent controversy over the driver pay policies of some companies like DoorDash highlighted the exact challenge food delivery companies face: building a sustainable business despite high delivery costs.

- When customers order via most other services, they find multiple charges ("delivery fee," "service fee," etc.) when they reach the final checkout steps, and these can add up to much more than the advertised delivery charge, he points out. Some services also mark up items to make up for their very low delivery fees.

- 'The price gouging in our industry...I'm concerned that it will dramatically slow the growth of our industry," he said.

Yes, but: GrubHub also got its share of negative headlines recently over its since-ended practice of charging restaurants for telephone food orders and setting up websites for some restaurants on its marketplace.

- During a call with analysts, Maloney said that these orders represent "low single digit percentage" of GrubHub's orders, and reiterated that the company always disclosed to restaurants its practices and always transferred website domains if requested.

Addressing why he thinks GrubHub will remain competitive against its rivals, Maloney says that as long as the company can provide restaurants with high volumes of orders, they'll be happy to subsidize some of the delivery costs.

- This is the key to keeping its fees to consumers low, he adds.

- GrubHub's latest push is to provide more tools for loyalty programs to restaurants on its marketplace.

- Currently, about 35% of GrubHub orders are delivered by the company — the rest of deliveries are fulfilled by the restaurants themselves.

On partnering with restaurant reservation company OpenTable, which will now let customers order food from its app: "I think it's just another way to reach diners," says Maloney.

- GrubHub will split with OpenTable the commission it takes from restaurants.

On potential acquisitions: "We have bought a lot of companies and the consistent rationale has been reasonable valuation," said Maloney.

- And since his rivals' current valuations are higher than GrubHub's market cap, it's improbable we'll see the company acquire any of them in the foreseeable future, he hints.

- As for the reverse: "We are a public company so we're for sale every day... but we are a self-sustaining business. We will be around for 50 years," said Maloney.

- Postmates, which is working on an IPO, is also rumored to be shopping itself around.