Axios Generate

October 31, 2017

Good morning and welcome back! A couple of cool announcements before we dive in.

Get Smarter, Faster: Axios is launching a movement to help spread trustworthy, shareable news: the Smarter Faster Revolution. Our mission is to help as many people as humanly possible get smarter, faster on the topics that matter. You can help by signing up to be part of the cause, then recruit others to join our campaign and win cool Axios gifts.

Don't forget: Axios and NBC are teaming up to host an energy event this Thursday in Washington, D.C. Join "Meet the Press" moderator Chuck Todd and Axios CEO and founder Jim VandeHei for an exclusive discussion with Energy secretary Rick Perry and Sen. Maria Cantwell, the top Democrat on the Energy and Natural Resources Committee. RSVP at this link.

Global emissions projected to blow past Paris temp goals

Two new analyses from the United Nations and from PwC UK show that worldwide efforts to stem greenhouse gas emissions aren't nearly enough to prevent very dangerous levels of warming.

Why it matters: Despite data suggesting a recent plateau in global carbon output, the world is not poised for steep cuts needed to limit warming to 2 degrees (or even 1.5 degrees) Celsius above preindustrial levels, which is a goal of the Paris climate deal. The reports arrive just ahead of the latest round of UN climate talks in Bonn, Germany, next month.

Mind the gap: Today the UN released its latest "emissions gap" report — a yearly look at the difference between emissions trajectories needed to have a good chance of staying at the 2°C ceiling and what's expected under nations' current policies.

- Full implementation of nations carbon-cutting pledges to the UN, called nationally determined contributions (NDCs), make a temperature rise of at least 3°C by 2100 very likely.

- Ticking clock: If the emissions gap isn't closed by 2030, it's "extremely unlikely" that temperatures can be held well below 2°C. Even if all pledges are enacted, the "carbon budget"—or total amount of emissions that can be spewed to stay within a given target—for the 2°C ceiling will be 80 percent depleted by 2030.

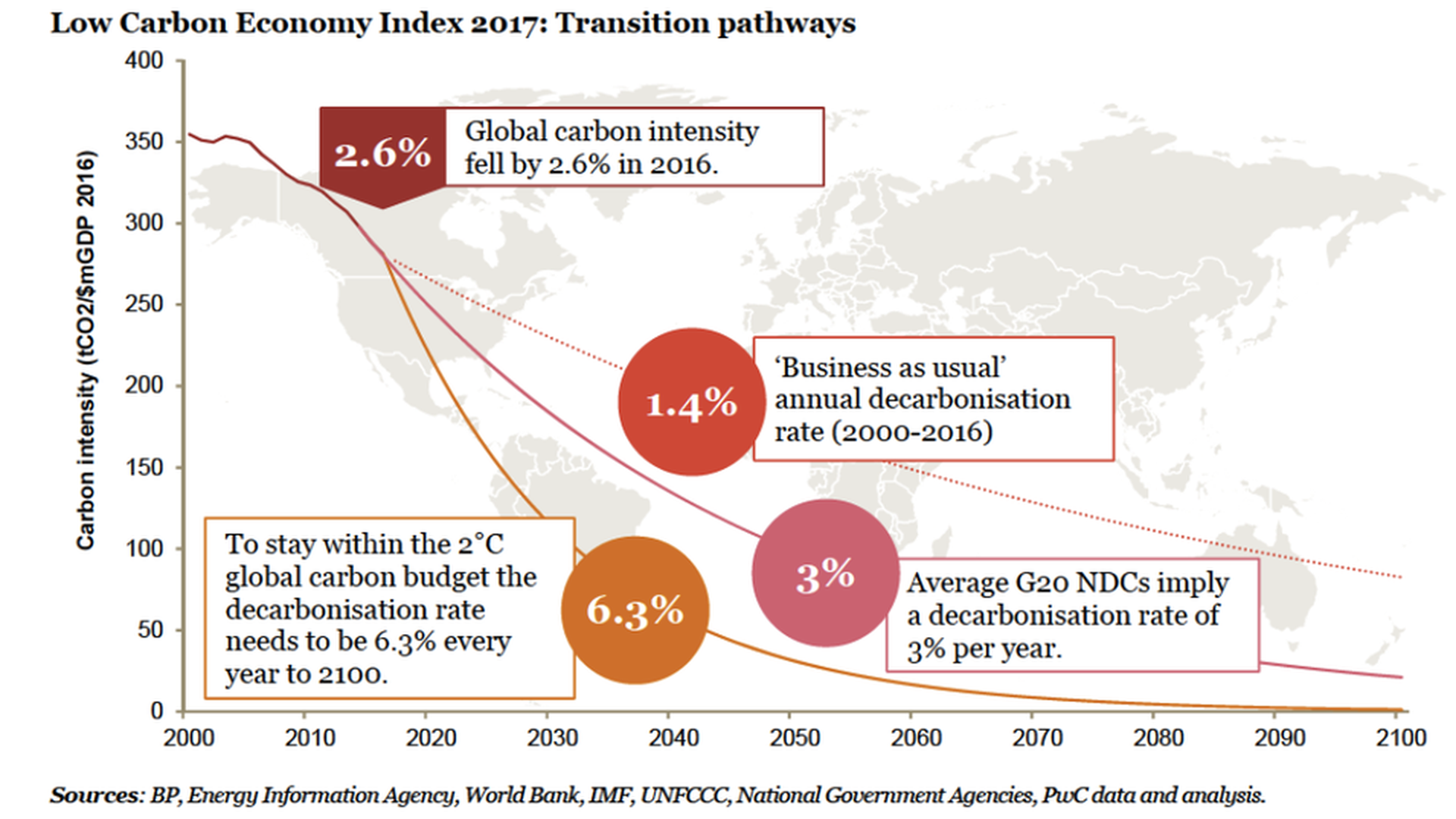

Wait, there's more: A separate PwC UK report released yesterday looks at the big picture too. It notes that last year global GDP growth was 3.1% but emissions grew by only 0.4%. So carbon intensity — that is, emissions per unit of GDP — fell by another 2.6%, a drop consistent with the last few years.

- Yes, but: That's not even the 3% average rate of decarbonization needed to meet the existing national pledges in the Paris deal. And it's less than half of the 6.3% annual level needed to stay well below the 2°C ceiling, PwC said.

Go deeper:

Read my full story here

.

Oil market notes: ANWR, BP profits, shale forecast, Trump's China trip

ANWR Senate fight takes shape: The Senate Energy and Natural Resources Committee just released the witness list this morning for Thursday's hearing on the new GOP push to allow oil drilling on the coastal plain of Alaska's Arctic National Wildlife Refuge. A dozen people will testify in one of the opening stages of what's slated to be an intense political and, eventually, legal battle.

BP beats expectations: The Financial Times dives into the oil-and-gas giant's third-quarter earnings.

"The UK group reported underlying profits on a replacement cost basis — the measure watched most closely by the market — of $1.87 [billion], compared with $933 [million] in the same period last year. This was much better than the $1.58 [billion] consensus forecast by analysts, according to RBC Capital Markets," the paper reports.

- The company said that its daily oil and gas production in the third quarter averaged 3.6 million barrels of oil equivalent a day, which is 14% more than the same period last year.

As Trump approaches: "China's state oil major Sinopec is evaluating two projects in the United States that could boost Gulf Coast crude oil exports and also expand storage facilities in the Caribbean," Reuters reports ahead of President Trump's visit to China next week.

- Their piece notes that "U.S.-China energy trade likely to feature prominently during Trump's visit."

Shale's behavior: Via the National Bureau of Economic Research, Duke University experts, including former Energy Information Administration chief Richard Newell, look at how the U.S. shale patch might respond to varying levels of price increases. They see potential for big production gains relatively fast, but not enough to make the U.S. a true "swing producer" in the way that Saudi Arabia traditionally has been. Bottom line...

- "Our simulations suggest that if oil prices were to rise from $50 to $80 per barrel, U.S. production could ramp up production by 0.5 million barrels per day in 6 months, 1.2 million in 1 year, 2 million in 2 years, and 3 million in 5 years."

- "These represent significant increases in context of the global market, suggesting a significantly larger role for U.S. incremental supply than before the shale revolution. However, the response still takes more time to arise than is typically considered for a 'swing producer,' referring to a supplier able to increase production quickly, within 30 to 90 days."

Exxon: "Federal officials are close to a settlement with Exxon Mobil Corp. over air pollution charges against the oil giant," AP reports, noting a settlement could come as soon as this week.

EPA official: Obama's team had legal basis for methane rule

Axios' Amy Harder follows up her latest column with at look at some developments on the administration's efforts to repeal an Obama-era methane rule...

Former President Obama had a strong legal case to limit emissions of the potent greenhouse gas methane from new oil and gas wells, according to a senior Environmental Protection Agency official.

Why it matters: President Trump's EPA is trying to repeal that methane regulation, so the official's comment suggests the agency could eventually issue a replacement rule, which itself would trigger a legal opening to regulate hundreds of thousands of existing oil and gas wells. As with many other regulations, the Trump administration is grappling with whether to repeal only, or repeal and replace this particular methane rule.

Between the lines: A senior EPA official told Axios the two main pillars behind Obama's rule — a 2007 Supreme Court case and a subsequent 2009 EPA scientific finding that greenhouse gas emissions, including methane, endanger public health and welfare — indicate "a level of responsibility for the agency to consider" as it moves forward on repealing the Obama-era methane rule.

What's happening: EPA is preparing to release as soon as this week a proposal explaining the legal rationale for why it's seeking a two-year delay of the regulation that Obama had issued. That proposal doesn't make a commitment either way, the official said.

- "There is a justification for it [methane rule for new wells] being on the books," the official continued. There's a very extensive record, and any change in approach or application will require an equally robust record."

More: Read Amy's full story here.

In my ear: IEA head talksTrump policy, peak demand and EVs

On the record: The latest episode of the Columbia Energy Exchange (their 100th!) is a wide-ranging chat with Fatih Birol, executive director of the International Energy Agency. Birol is very cautious when commenting on individual governments, but with that caveat...

- Birol says he's still evaluating the Energy Department's push for new wholesale power market rules that boost compensation for coal-fired and nuclear plants, but adds: "I expect renewables under any circumstance to grow significantly."

- U.S. policy matters...to a point. "I would expect that whatever the policies coming from the new administration, we will still see strong growth of natural gas, we will still see strong growth of renewable energies."

- Birol says he'd like to see the U.S. fill what he calls a global leadership void in the development of carbon capture, storage and utilization technology.

And a few other notes...

Peak coal use? Pretty much: "Global coal demand, in the last two years there's a decline. We don't know if there will be a rebound significantly, which I wouldn't think is very likely. There may be zig-zags...but a strong rebound? No."

Peak oil demand? Not anytime soon: Birol notes that despite the rise of electric vehicles and greater efficiency of internal combustion engines, other big sources of oil demand — petrochemicals, trucks and shipping — mean that oil thirst will remain robust for a long time.

- "When you look at the future, trucks play a much more important role than cars," he says.

Fiscal warning on EVs: Deployment will grow a lot and he's happy about that, but says it's important to understand the implications of policies that are currently driving growth of electric vehicles.

- "They require substantial amount of subsidies. So you can subsidize 10,000 cars, 20,000 cars, 30,000 cars, but if the number of cars increases, the subsidy you will give may have implications for your government's budget."

More: He also sizes up some oil majors' turn toward electricity; reiterates warnings about the lack of investments in new oil supply projects; and, surveys the state of global LNG markets.

On my screen: "Unprecedented" EPA move, Exxon's EV outlook, Tesla

EPA and science: A big Washington Post story says EPA is about to make "unprecedented" changes to a major body of outside science advisers. The lede:

- "Scott Pruitt, the head of the Environmental Protection Agency, is poised to make wholesale changes to the agency's key advisory group by jettisoning scientists who have received grants from the EPA and replacing them with industry experts and state government officials."

EVs: Via Bloomberg, Exxon does not see much of a threat from the rise of electric vehicles. The oil giant predicts they'll be just 6% of the worldwide vehicle fleet in 2040, according to VP Jeff Woodbury, who said that even doubling that amount would only cut oil demand by a half-million barrels per day, a tiny fraction of global consumption.

- Yes, but: Exxon's projection of EV deployment is pretty conservative. Consider that the Energy Information Administration's base case sees EVs making up 14% of vehicles on the roads in 2040, and their "high" penetration case puts them at 26%. And for that matter, EIA is often knocked for being too conservative about its forecasts of energy sector transformation.

Tesla: MarketWatch previews tomorrow's third-quarter earnings report from the Silicon Valley electric vehicle company. "All eyes will be on whether the company can make a good case that it has worked out all the kinks with the production of the Model 3, its first electric car aimed at the masses," their story notes.

Solar: Reuters sets the table for today's U.S. International Trade Commission vote on proposed remedies, including potential tariffs, to its September finding that solar panel imports from Asia and elsewhere are badly hurting domestic panel manufacturers.

- "[F]ears of steep new tariffs on imports have sparked widespread nervousness among solar developers and installers that have benefited from a 70 percent drop in the cost of solar since 2010," they note.

Sign up for Axios Generate

Untangle the energy industry’s biggest news stories