Axios Generate

September 28, 2017

Good morning! One more Neil Young thing this week: On this date in 2010 he released the album Le Noise. Here is one of the fuzzy album's tracks.

I also buried a song title from another album in today's newsletter. Onward...

Oil industry eyes wins as GOP launches tax battle

The bare-bones GOP tax proposal unveiled yesterday has plenty to make oil-and-gas executives smile even though it proposes to jettison a lucrative deduction that the industry has successfully fought to preserve for years.

What they like: The lower corporate rate of 20% of course, but also the quick write-off of capital investments.

Barry Russell, head of a trade group called the Independent Petroleum Association of America, issued a statement that called immediate expensing "critical to the continued American energy dominance" and boosting jobs.

For companies with overseas operations, Argus Media points out that the industry stands to benefit from the changes to treatment of foreign profits.

What they'll probably swallow: Two industry sources tell Axios that they're ok with the proposal to end the Section 199 deduction on domestic manufacturing income that's worth billions of dollars to the industry.

The Obama administration and Capitol Hill Democrats spent years proposing to end the industry's ability to use the deduction, drawing GOP pushback and fierce industry opposition. But things have changed.

- "The driving number for us is the corporate rate — things become negotiable once that is set low enough and 20% sounds good. This is not to say we can sign off on all trade-offs, but Section 199 starts to pale in comparison to the other fish on the grill," a refining industry source says.

- "I don't see 199 as a deal breaker for oil-and-gas if everything else is a net plus," says another industry source, who notes that the deduction had previously been pared back for the largest integrated companies anyway, so "you're not going to hear the largest voices shouting."

Yes, but: The sprawling oil-and-gas industry has lots at stake in other aspects of the tax code, so there's plenty to haggle about as the GOP tax overhaul push proceeds.

The proposal would limit — how much is TBD — deductions for net interest expenses, which Argus notes that "pipeline owners and other debt-reliant energy companies use to raise capital."

Overall, the plan vaguely proposes to "modernize" the bevy of tax code provisions that govern specific industries. So, stay tuned.

Renewables: The plan is silent on whether Republicans will seek to revisit a late 2015 deal that extended key tax credits for development of wind and solar projects by five years.

Jeff Navin, a senior Energy Department official under former President Obama, tells Axios that he does not expect a major tax package to succeed in Congress. "But if it does move, the wind and solar industries are going to have to fight like hell to protect what they have," said Navin, a partner at the green energy-focused advisory firm Boundary Stone Partners.

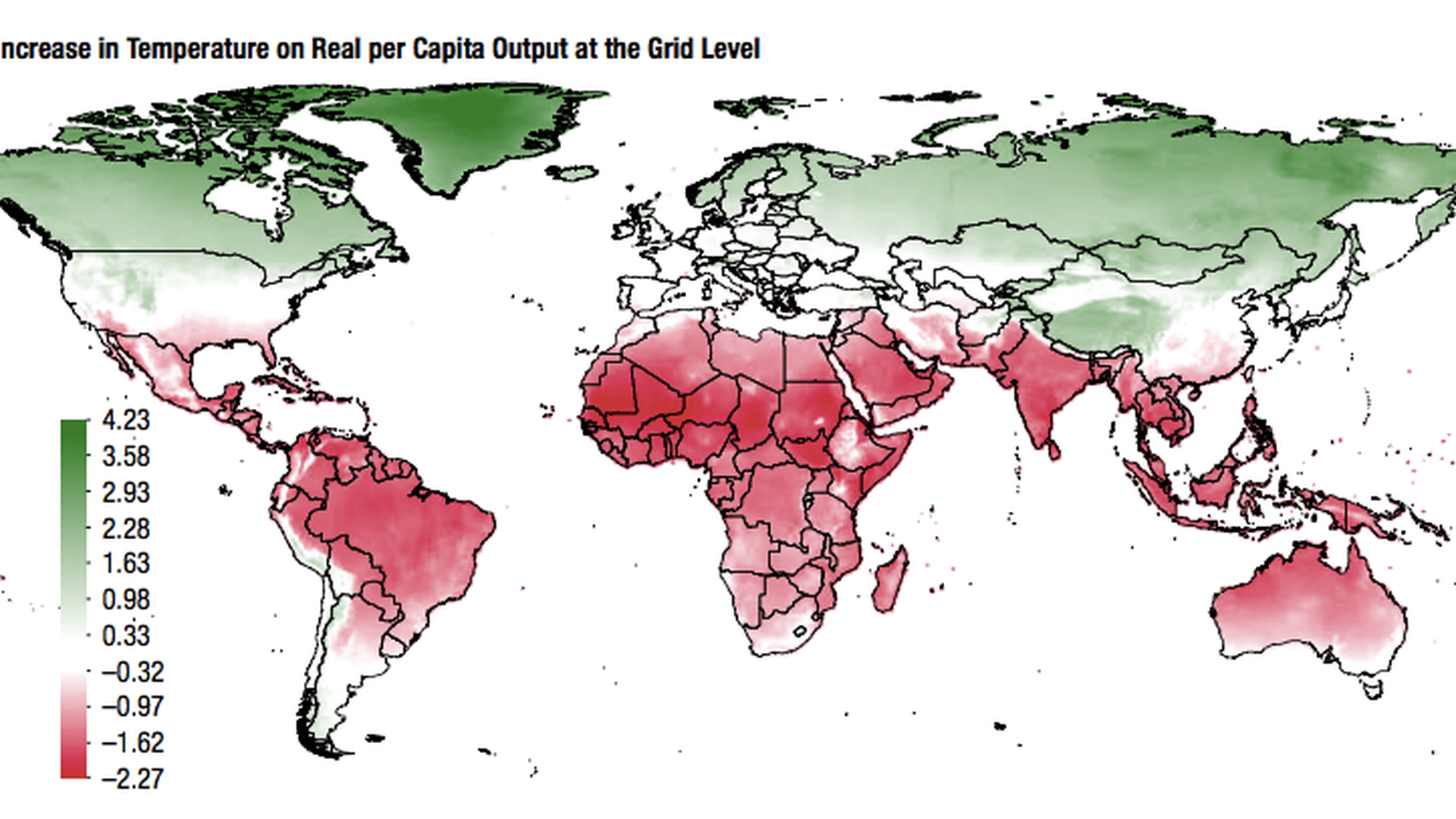

IMF warns of climate impact on poor and hot places

A new International Monetary Fund blog post looks in-depth at a very tough problem — some of the worst effects of climate change will hit people who can least afford it.

Where climate change hits hardest:

- Low-income countries that have spewed relatively little emissions happen to be in some of the world's hottest regions. Higher temps can cut productivity of heat-exposed workers, trim farm output, and damage health.

- The IMF puts some numbers behind the concept, noting that another 1°C rise in temperature in places with an average annual temperature of 25°C (77 degrees Fahrenheit) would cut per-capita output by up to 1.5% for years.

- If global emissions were left unchecked, "the resulting projected increase in temperature would erase close to one-tenth of the per capita output of the median low-income country by the end of the 21st century."

What to do: The IMF says its analysis suggests that nations with "policy buffers" like lower public debt and flexible exchange rates have "somewhat smaller output losses from temperature shocks in the short run."

- They also cite example of successful adaptation strategies, such as programs to diversify income sources and investments in "climate smart" infrastructure.

Go deeper: The post is drawn from the newly published climate change chapter of the IMF's next World Economic Outlook.

Oil patch notes: record exports, Harvey's impact, Exxon

Record exports: New EIA data shows almost 1.5 million barrels per day of U.S. crude oil exports for the week that ended Sept. 22, a new record.

- Why it matters: The data shows how the shale oil production boom, combined with the late 2015 end of the four-decade export ban, is making the U.S. an increasingly important player in global markets.

- More context: "A deepening discount for U.S. grades of oil compared to competing supplies has also made them more attractive to foreign buyers," the Financial Times notes.

Taking the pulse: The Federal Reserve Bank of Dallas is out with its latest survey of oil-and-gas companies in its region on where executives think U.S. oil production will be by the end of 2018.

A plurality agree with the Energy Information Administration forecast of record-breaking output of slightly over 10 million barrels per day. A couple other takeaways...

- Price prediction: Over half the execs surveyed predict WTI crude to be in the $50-$55 range at the end of this year, with roughly 30% expecting $45-$50.

- Harvey's toll: 53% said the storm had a "slight" impact on their business, while 18% listed a moderate effect. (Editor's note: they survey exploration-and-production and oilfield service firms, so this doesn't address refiners and other sectors hit harder by Harvey.)

Walk like a giant: Let's check in on the latest moves by ExxonMobil, the largest U.S.-based multinational oil company. Domestically, Exxon announced Wednesday that it has acquired another 22,000 acres in the Permian Basin shale region in recent months. The Houston Chronicle has a little more.

- And outside the U.S., Reuters reports that Exxon "vastly expanded" its presence in Brazil yesterday, "winning 10 blocks in the country's 14th round of bidding for oil exploration and production rights."

Amy’s notebook: Cutting through "clean" energy

My Axios colleague Amy Harder sends along this analysis…

In Washington, deeming an energy resource "clean" depends on who you ask, but ultimately all resources have environmental impacts.

Driving the news: The question is on my mind as we're nearing the end of what numerous trade groups are dubbing "National Clean Energy Week." The trade associations behind the push represent nearly all resources except for traditional coal, drawing criticism from a collection of environmental groups that argue fossil fuels and nuclear power shouldn't be included.

Here's a quick primer to cut through the "clean" noise:

Fossil fuels: Coal is the dirtiest, oil is in the middle, and natural gas is the cleanest among traditional fossil fuels. Gas burns 50% less carbon than coal, though environmentalists have raised concerns about inadvertent emissions of methane, a potent greenhouse gas that's the primary component of natural gas.

Fossil fuels + emissions-capturing tech: This technology, technically viable but not widely commercially available, can capture up to 90% of a fossil fuels' emissions, upping the potential for fossil fuels to be a lot cleaner than they are today.

Nuclear power: Nuclear plants provide 60% of America's carbon-free electricity, but other environmental worries persist over long-term storage of radioactive waste, potential meltdowns or attacks, and mining of uranium, which is used as fuel.

Wind, solar and hydropower: These resources don't emit pollution or greenhouse gases, but environmentalists and others have voiced concerns about other issues like: wildlife impacts, potential water restrictions with hydroelectricity, and the sheer land space they occupy.

Ethanol: Corn-based ethanol is controversial for its environmental impact. Biofuels from non-corn sources don't have the same concerns, but they're also not nearly as commercially available.

On my screen: big nuke deal (maybe), EVs, efficiency, Congress

Nuclear: An interesting scoop from Reuters last night...

- "Private equity firms Blackstone Group LP and Apollo Global Management LLC have teamed up to bid for the business of bankrupt U.S. nuclear power plant services firm Westinghouse Electric Co."

China market for electric cars: CNBC looks at a new analyst's prediction that the Chinese market could eventually be Tesla's biggest source of revenue.

Toyota's new JV: Toyota announced it will partner with Mazda and Denso to form a joint venture called EV Common Architecture Spirit to develop electric vehicles, according to Automotive News.

Efficiency: Later this morning the American Council for an Energy-Efficient Economy will release its annual, in-depth report that provides a state-by-state ranking of energy efficiency policies and takes stock of the latest developments.

- A couple of teasers: The report will show that Massachusetts has taken the lead in efficiency after being tied for the top spot with California in last year's ranking.

- Idaho, Florida, and Virginia are the most improved states, with Idaho climbing from 33rd in 2016 to 26th this year, thanks to enhanced resources for demand management, increased electric vehicle registrations, and new building codes that take effect soon.

- The whole report is scheduled to be available here at 11 a.m.

Congress: Rep. Lamar Smith, the GOP chairman of the House Science, Space and Technology Committee, is pressing the heads of major tech and social media companies for info on purchases of anti-fracking ads and promotions by Russian interests.

His letters to the heads of Facebook, Twitter, and Google are here. Smith's letters say he's trying to gauge the scope of Russian efforts to spread sentiment against fracking — the technique that has enabled the U.S. oil and natural gas surge — as a way to protect its energy market influence.

- Go deeper: My Axios colleagues Sara Fischer and David McCabe have a wider look here at Russia's use of social media to influence the U.S.

Sign up for Axios Generate

Untangle the energy industry’s biggest news stories