Trump's wild OPEC weekend

Add Axios as your preferred source to

see more of our stories on Google.

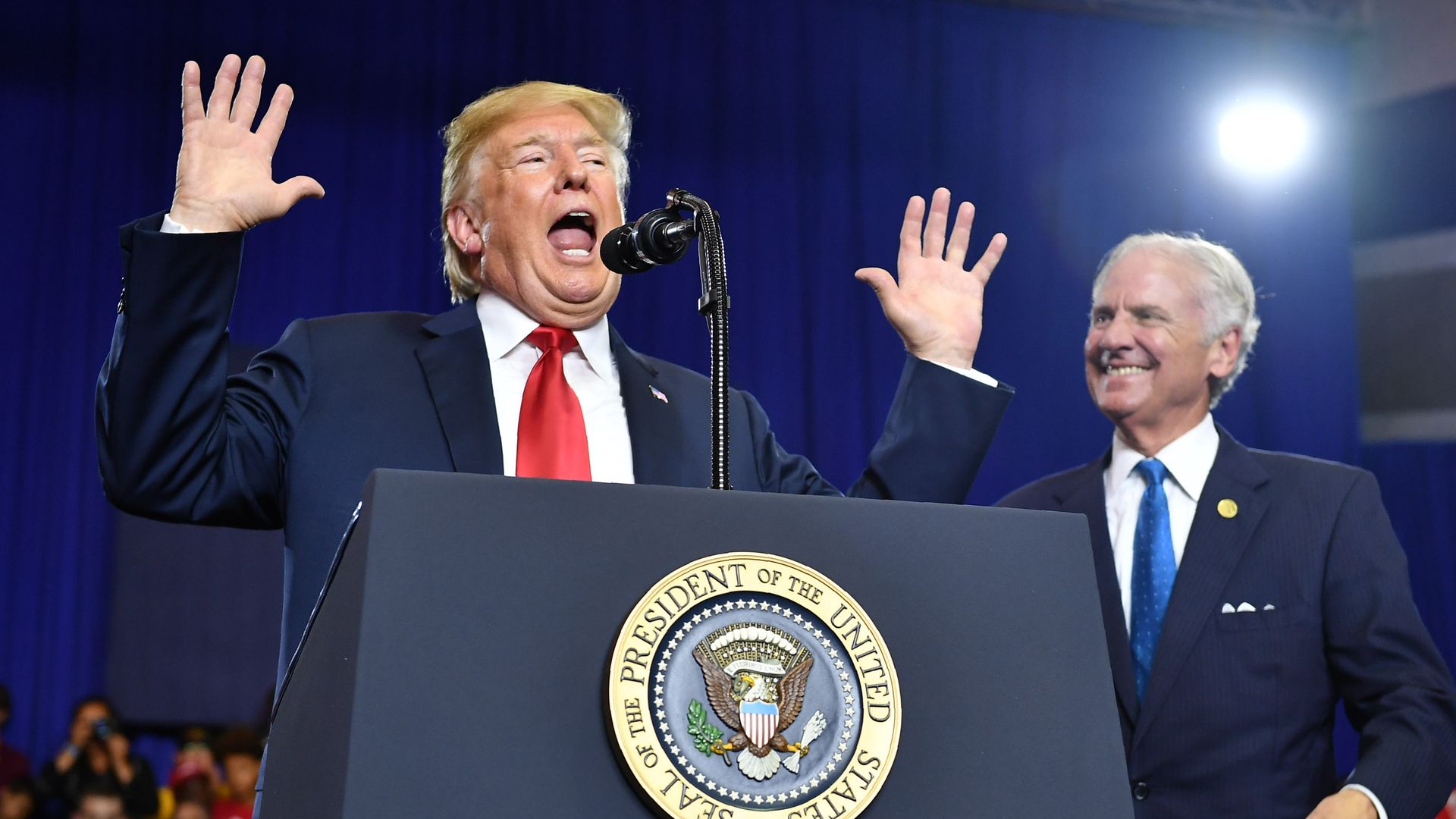

President Trump with South Carolina Governor Henry McMaster last week. Photo: Mandel Ngan/AFP/Getty Images

A series of weekend statements about OPEC and Saudi Arabia from the Trump administration are helping to put downward pressure on oil prices.

The latest: Oil prices dropped slightly Monday, and MarketWatch notes one reason is that investors were "rattled" by President Trump's weekend tweet suggesting Saudi Arabia may sharply boost output.

The big picture: More broadly, the comments signal White House unease about the election-year state of oil markets and the limits to what they can do about it, despite the surge in U.S. shale production.

- Trump's statements also highlight the tricky dynamic he faces of trying to force sharp cuts in Iranian exports, while also ensuring enough supplies in global markets to avoid price spikes.

Head-spinning: To recap the weekend action...

- Early Saturday morning, Trump tweeted that Saudi Arabia's king pledged to boost production by up to 2 million barrels per day. That's a level that would go beyond the recent OPEC-Russia agreement in late June.

- Late Saturday night, the White House softened the comment, noting King Salman reaffirmed the Saudi's readiness to use some of its 2 mbd spare capacity to help balance the market.

- Sunday morning on Fox News, Trump took a critical posture, claiming OPEC is "manipulating" the market; "has to" pump more; and that the 1 million bpd increase OPEC and Russia agreed to last month is too low.

Thought bubble: As Axios' Steve LeVine noted yesterday, Trump's talk with Salman put the U.S. back in the pre-shale age, when presidents routinely went to the Saudis asking and sometimes pleading for boosts or cuts in production for U.S. economic purposes.

Yes, but: The White House may have yielded some benefit from the busy weekend. The Wall Street Journal reported Sunday afternoon that White House aides saw the call as helpful...

- "One measure of the call’s value is that it provoked a hostile reaction from Iran, which sees the president’s intervention on global oil production as a threat to their interests, administration aides say. On Saturday, Iran accused Riyadh of doing Washington’s bidding."

- But the WSJ piece warns, "a boost in Middle East production may not be enough to stem the price rallies that have hit consumers."

Go deeper: Trump says OPEC "has to" pump more oil.