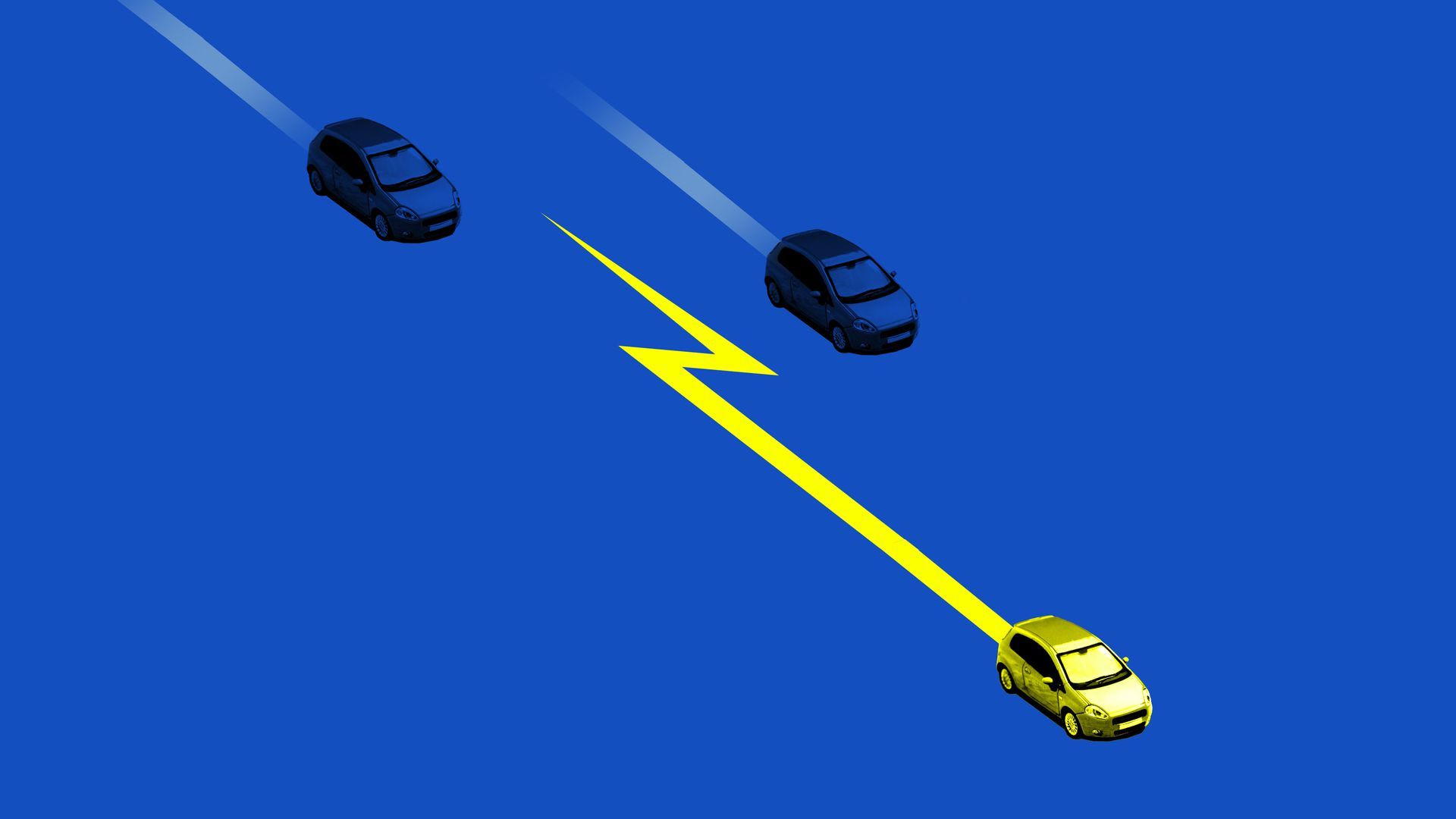

Autonomous vehicles are taking a back seat to their electric peers

Add Axios as your preferred source to

see more of our stories on Google.

Illustration: Lazaro Gamio/Axios

Automakers are beginning to make strategic tradeoffs between investing in electric vehicles or self-driving car technology because they can't afford to do both.

Why it matters: Investors reward autonomous vehicle developers with higher valuations, but it'll be years — maybe decades — before the technology is ready and it's not clear the public even wants them. People aren't clamoring for electric vehicles, either, but to meet looming emissions standards, carmakers will need them.

It makes sense to prioritize EVs over AVs, given the relative time horizons and the costs involved. Plus, EVs will ultimately become the basis for most self-driving cars because they can best supply the necessary power to all those AV sensors and computers.

"Wall Street wants everyone to focus on AVs. The really expensive, nearer term problem to solve is how to make EVs profitable. AVs don't have to be solved in the next couple of quarters."— Reilly Brennan, founding general partner at Trucks Venture Capital

Where it stands: Companies have already committed huge amounts for both technologies — $225 billion on electrification between now and 2023, and another $85 billion so far on autonomous vehicles, according to a study by AlixPartners.

- The future will be even more capital intensive, and most automakers now "realize doing both powertrain development and creating AVs is simply impossible for one company," says Brennan.

- "You're talking about green-lighting projects that are going to be tens of billions of dollars. The reality is most CEOs aren't used to [that]. Neither are their boards. Very few have the stomach for it, and even fewer have the cash."

- "If you get it wrong the company is, no question, out of business."

Driving the news: Last week's big tech-sharing deal between Volkswagen and Ford illustrates the point.

- VW is already going huge on EVs — they've committed €30 billion ($33.7 billion) through 2023 with 22 million battery-electric vehicles planned by 2028. The company decided the smart play was to invest $2.6 billion in Argo AI, a Ford-backed AV startup, rather than try to keep funding its own autonomy efforts.

- Ford, meanwhile, found an expedient way to meet rising emissions standards: it will use VW's electric vehicle platform to produce 600,000 EVs for Europe — worth up to $20 billion in future sales.

- "The more cars that are manufactured using this platform, the cheaper they become, and the faster the penetration of e-mobility is driven," VW CEO Herbert Diess said at a press conference last Friday.

Yes, but: It will be 8–10 years before automakers begin to see any return on their investment in EVs, warns Arun Kumar of Alix Partners. But with battery costs coming down and government mandates driving demand, at least there's hope for a payoff in sight.

Go deeper: Automation in mobility is outpacing skills re-training programs