Oil markets lurch on new COVID threat

Add Axios as your preferred source to

see more of our stories on Google.

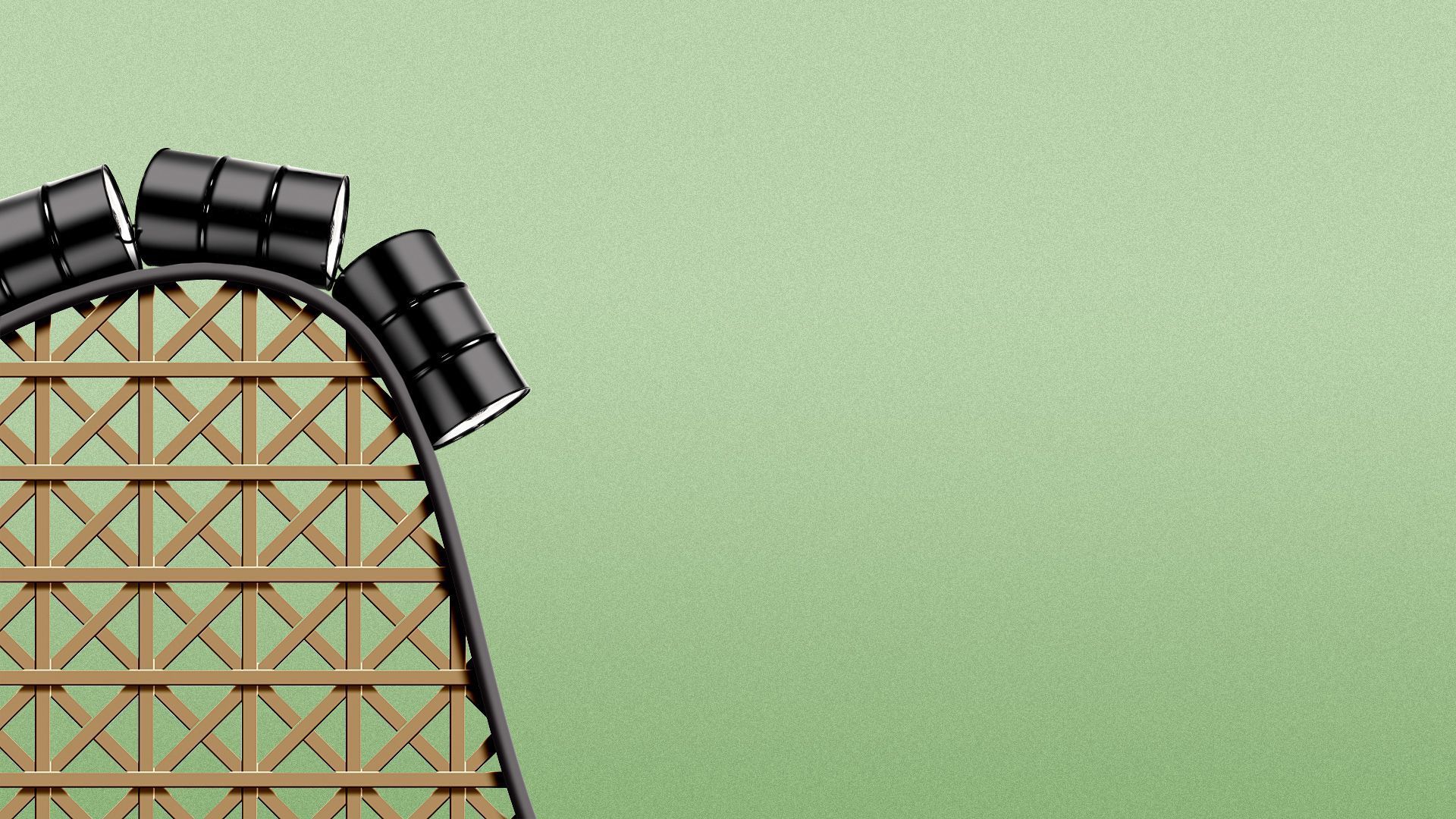

Illustration: Aïda Amer/Axios

Oil prices have swung wildly in recent days as traders grapple with two uncertainties — the Omicron variant's impact and OPEC+ output plans.

Catch up fast: Oil plunged Friday on word of the new variant and travel restrictions, with U.S. prices falling 13% and the global benchmark Brent crude by just slightly less.

- But prices have regained around a third of the decline since markets opened again after the weekend.

What they're saying: "The decline in the oil price, over concerns that any new restrictions could impact demand...appears somewhat overdone, which helps explain this morning’s subsequent rebound," CMC Markets analyst Michael Hewson said in a note via MarketWatch.

- That's the rapidly forming CW. Analysts from "Goldman Sachs to Energy Aspects said that the move was overdone and traders are now waiting to see how severe the variant’s impact will be," Bloomberg reports.

Why it matters: Oil prices affect costs for a suite of goods and services, ranging from gasoline to various manufactured products to shipping costs.

- But their movements are also a window onto how a hive mind — in this case, traders — are viewing geopolitical and COVID conditions.

- The uncertainty could last for weeks as scientists take time to evaluate the new variant and countries make decisions on restrictions.

The intrigue: OPEC+ has moved monthly meetings this week from Monday-Tuesday until Wednesday-Thursday as the coalition evaluates the effect of the new variant, Bloomberg first reported.

- Whether the group would proceed with another monthly output hike was already uncertain amid U.S. plans to release 50 million barrels from strategic reserves alongside smaller releases by several other countries.

Go deeper: Department of Interior proposes raising cost of drilling on public lands