The mad scramble for electric vehicle batteries

Add Axios as your preferred source to

see more of our stories on Google.

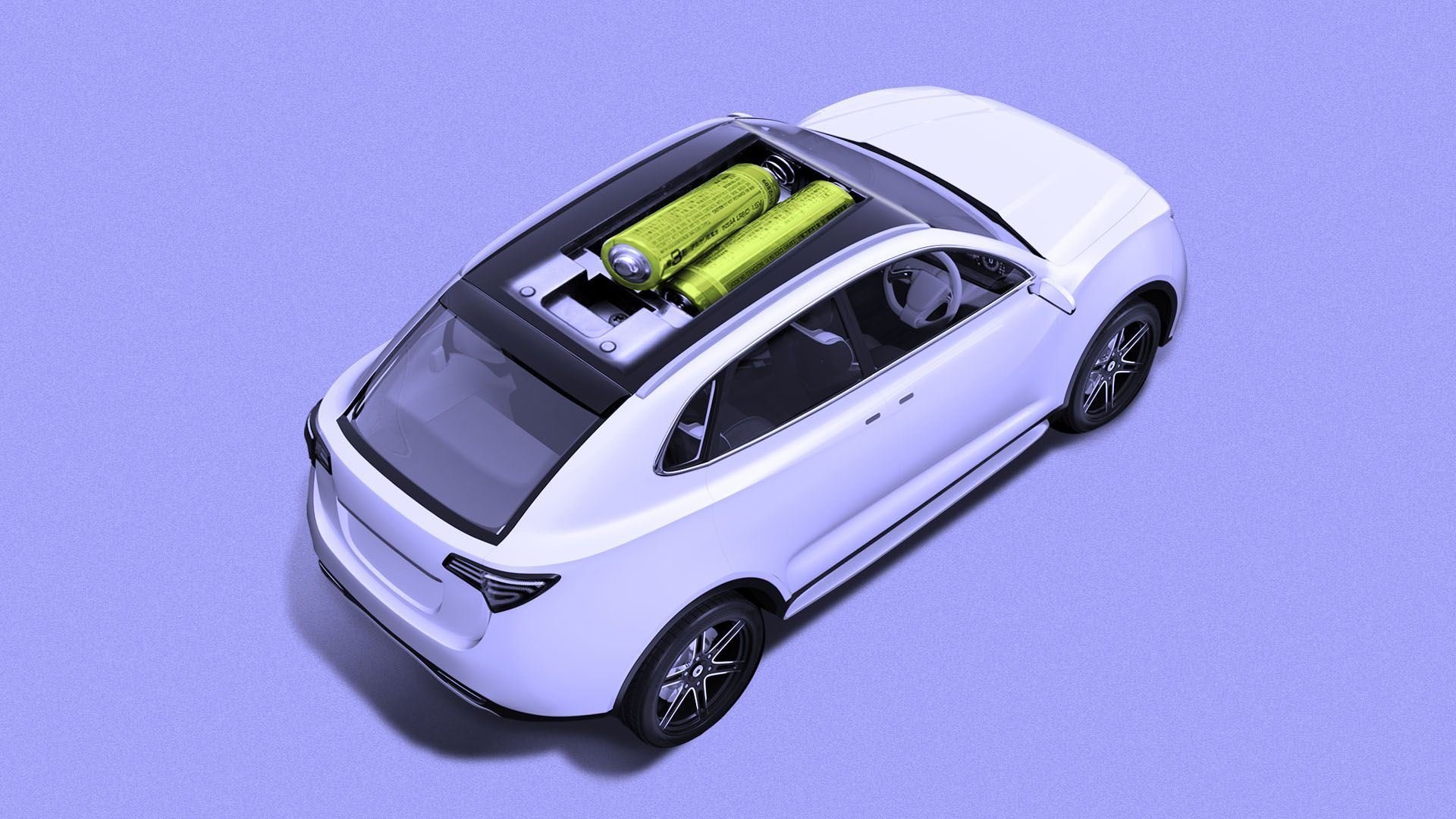

Illustration: Sarah Grillo/Axios

As the auto industry ramps up production of electric vehicles, some big carmakers aren't taking any chances on securing the necessary batteries: they plan to make their own cells.

Why it matters: Efforts to rapidly improve battery technology and make EVs more affordable could be hampered by a shortage of raw materials like lithium, cobalt and nickel. Many automakers are racing to lock up supply chains — and in some cases, to produce batteries themselves.

Driving the news: Volkswagen, the world's second-largest automaker, took the boldest step yet with a plan announced Monday to build six giant battery factories in Europe by 2030.

- Together, the six plants could provide up to 240 gigawatt hours of battery capacity — 12% more than the entire world consumed in 2020, according to Benchmark Mineral Intelligence.

- That's enough capacity just in Europe to build 4 million to 4.5 million electric vehicles, depending on the size of the cars' battery packs, Benchmark says.

- The effort will cost about $29 billion and would make VW (along with its partner, Northvolt) the world’s second-largest cell producer after China’s CATL, according to BloombergNEF.

The big picture: It marks an important shift by automakers to bring battery cell production in-house, Benchmark managing director Simon Moores tells Axios.

- Most automakers, even Tesla, the leading EV company, assemble battery packs from cells imported from Asia.

- But with demand expected to soar as more EVs come to market, manufacturers are taking steps to ensure they'll have the supply they need.

- “Captive battery capacity is now king in the world of electric vehicles,” Moores said.

What's happening: A number of auto manufacturers are getting into battery cell manufacturing.

- Chinese carmaker Zhejiang Geely Holding Group Co. plans to spend almost $5 billion to build a new 42-gigawatt hour battery plant in southern China.

- GM and South Korean partner LG Chem are investing $2.3 billion to build a 30 gigawatt hour factory in Ohio, and are scouting a second location.

- Tesla kicked off the scramble last fall when it announced it would build its own cells for the first time and would produce a staggering 3 terawatt-hours (3,000 gigawatt-hours) a year by 2030.

What's next: The focus now is turning to how quickly the world can scale the raw materials and chemicals that feed all those battery plants, according to Moores.

- VW's six plants alone would consume more than 60% of the lithium produced globally in 2020, Benchmark estimates.

- Robert Friedland co-chair of Toronto-listed Ivanhoe Mines told Benchmark that building the supply chain for key raw materials such as lithium, nickel and cobalt was the equivalent of “putting the entire contents of the Hoover Dam through a garden hose.”

What to watch: China is home to 73 percent of the worldwide capacity for lithium-ion batteries, followed by the U.S., far behind in second place, with 12 percent, which is "simply unacceptable," says Ford Motor Co. Vice President Jonathan Jennings, a supply chain executive scheduled to testify about the issue today at a Senate Finance Committee hearing.