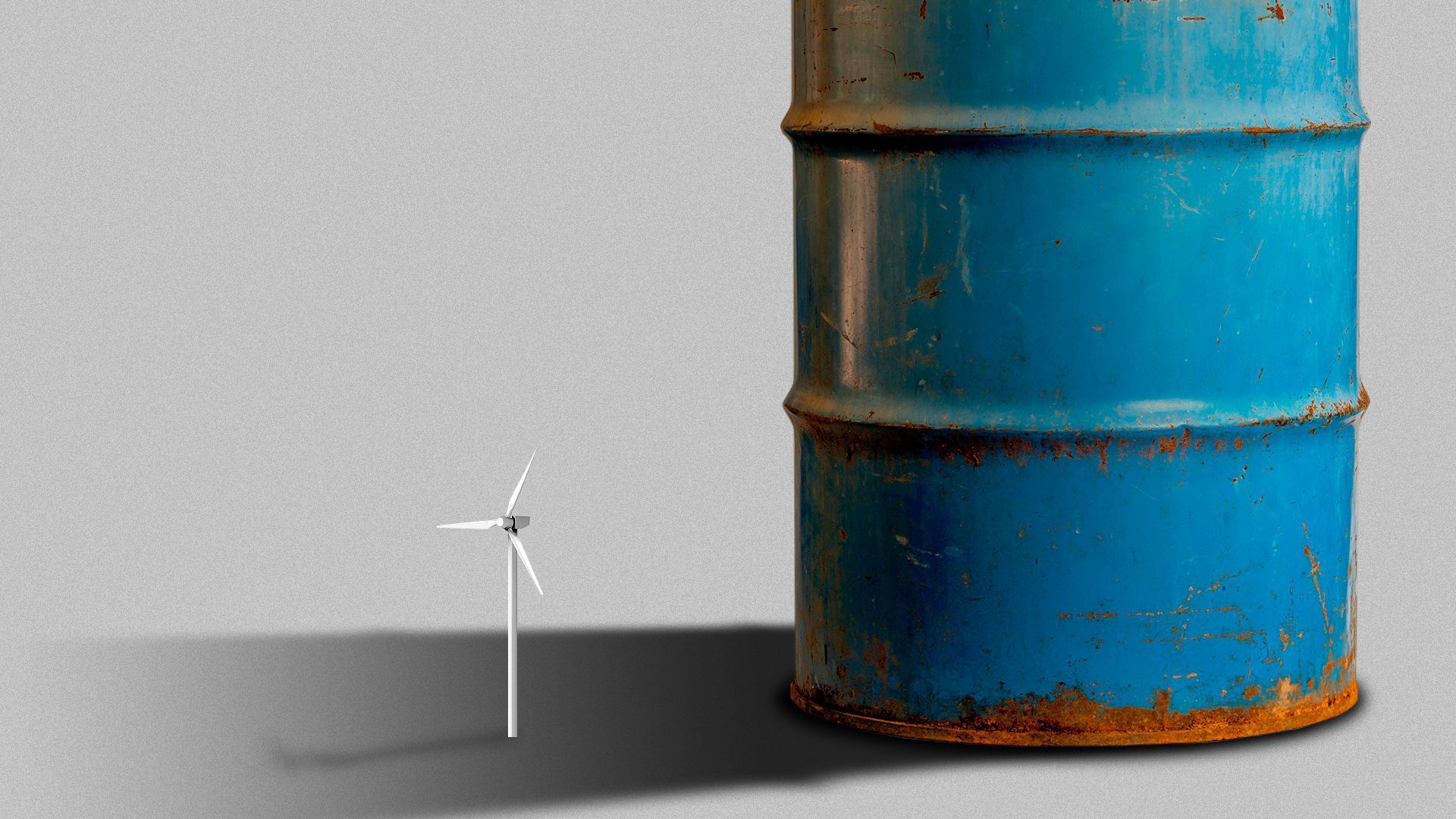

The rocky path into a lower carbon world

Add Axios as your preferred source to

see more of our stories on Google.

Illustration: Aïda Amer/Axios

Two huge oil companies charting different paths through the industry's uneven movement toward lower-carbon sources are both coming under fresh — but different — forms of pressure and scrutiny.

Driving the news: The Financial Times scooped yesterday that several clean energy executives have left Shell "amid a split over how far and fast the oil giant should shift towards greener fuels."

- Meanwhile, ExxonMobil, which rejects the emissions targets and diversification of European peers, faces a new push by outside investors seeking stronger steps on climate — including new board members.

Why it matters: Oil giants' balance sheets and power mean that their decisions will influence the pace of the global movement toward cleaner sources (though it's also easy to overstate their sway).

Where it stands: Shell months ago pledged to become a "net-zero emissions" company by 2050, and for years has been moving into renewables, EV charging and other spaces outside oil and gas, which remain its dominant products.But Shell intends to remain a massive oil and natural gas producer for a long time.

- The FT reports: "Some executives have pushed for a more aggressive shift from oil but top management is more inclined to stick closer to the company’s current path."

- Departures include: "Marc van Gerven, who headed the solar, storage and on-shore wind businesses at Shell, Eric Bradley, who worked in Shell’s distributed energy division, and Katherine Dixon, a leader in its energy transition strategy team."

Quick take: One trend in recent years is employees within corporate giants including Amazon and Microsoft pushing for stronger climate policies — and going public with criticisms.

- So keep an eye on whether and how much this becomes a thing within the oil and gas sector.

The intrigue: This week is also bringing new pressure on Exxon that's due to investor pique over its financial performance in recent years and related concern that its climate posture leaves it poorly positioned.

- The investment group Engine No. 1 just launched a shareholder push to place four new directors on Exxon's board. One is Anders Runevad, former CEO of wind turbine heavyweight Vestas, and another is Alexander Karsner, a senior strategist with X, the "moonshot factory" of Google parent Alphabet.

- The big California State Teachers’ Retirement System, which Engine No. 1 says holds over $300 million in Exxon shares, is backing the effort.

If changes happen...

Speaking of pressure on oil majors, it'll be interesting to see if this effort around Exxon gains traction.

Between the lines: Shareholder bids to force big changes in energy companies' direction are usually batted aside and voted down.

- One thing to watch is whether other major shareholders, such as BlackRock (which declined comment), get behind it.

What's happening: A growing number of big financial players have joined the umbrella group Climate Action 100+, an investor network that pushes companies to make new disclosures and emissions commitments.

- But membership doesn't require them to support specific shareholder resolutions.

What they're saying: Mindy Lubber, CEO of the sustainable investment group Ceres that works with Climate Action 100+, says the Engine No. 1 effort is "consistent" with the umbrella group's goals.

- "[W]e anticipate that Climate Action 100+ investors will welcome the opportunity to scrutinize a new slate of directors and their plans to address the significant risks of climate change to shareholder value," she tells Axios.