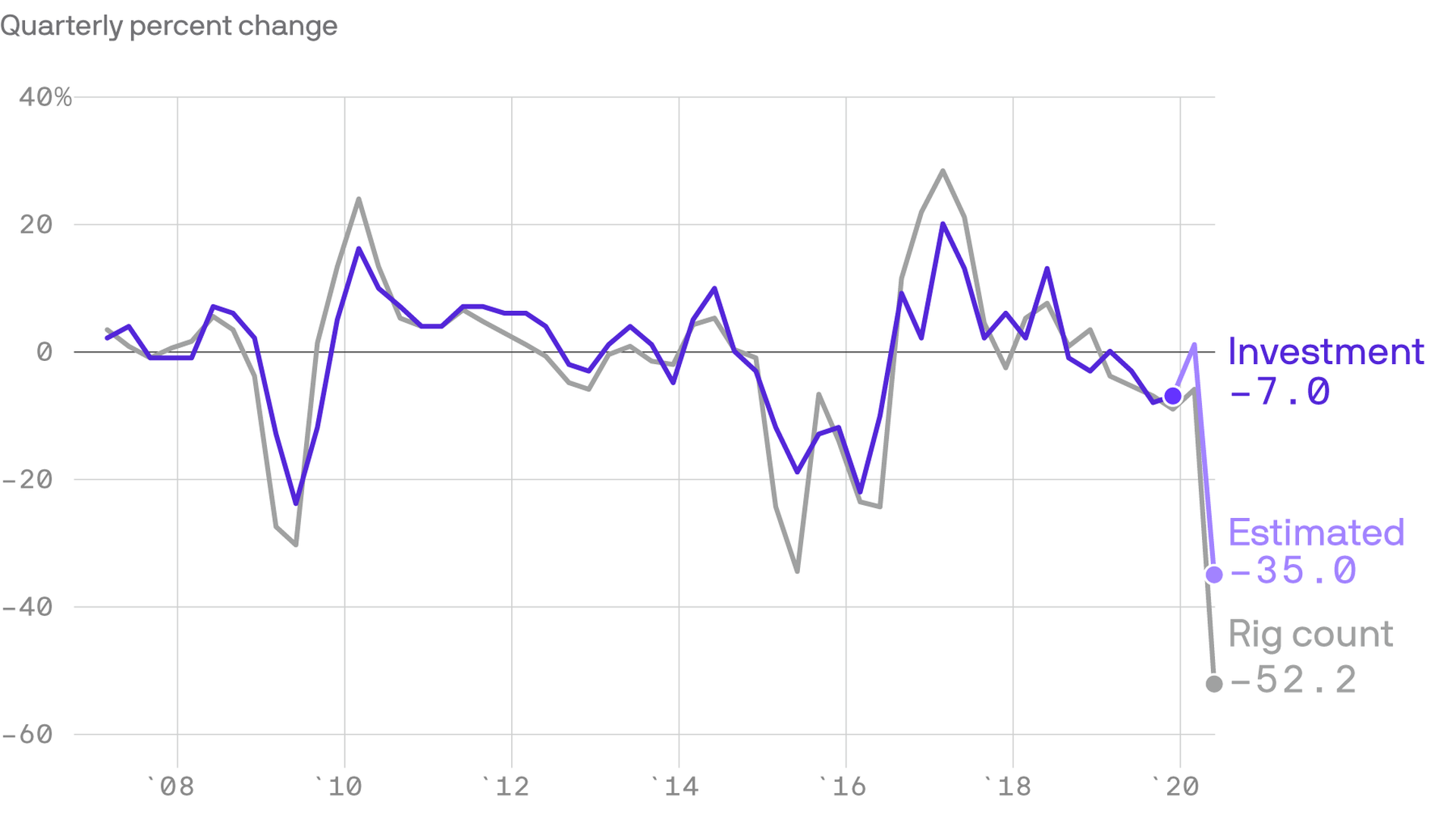

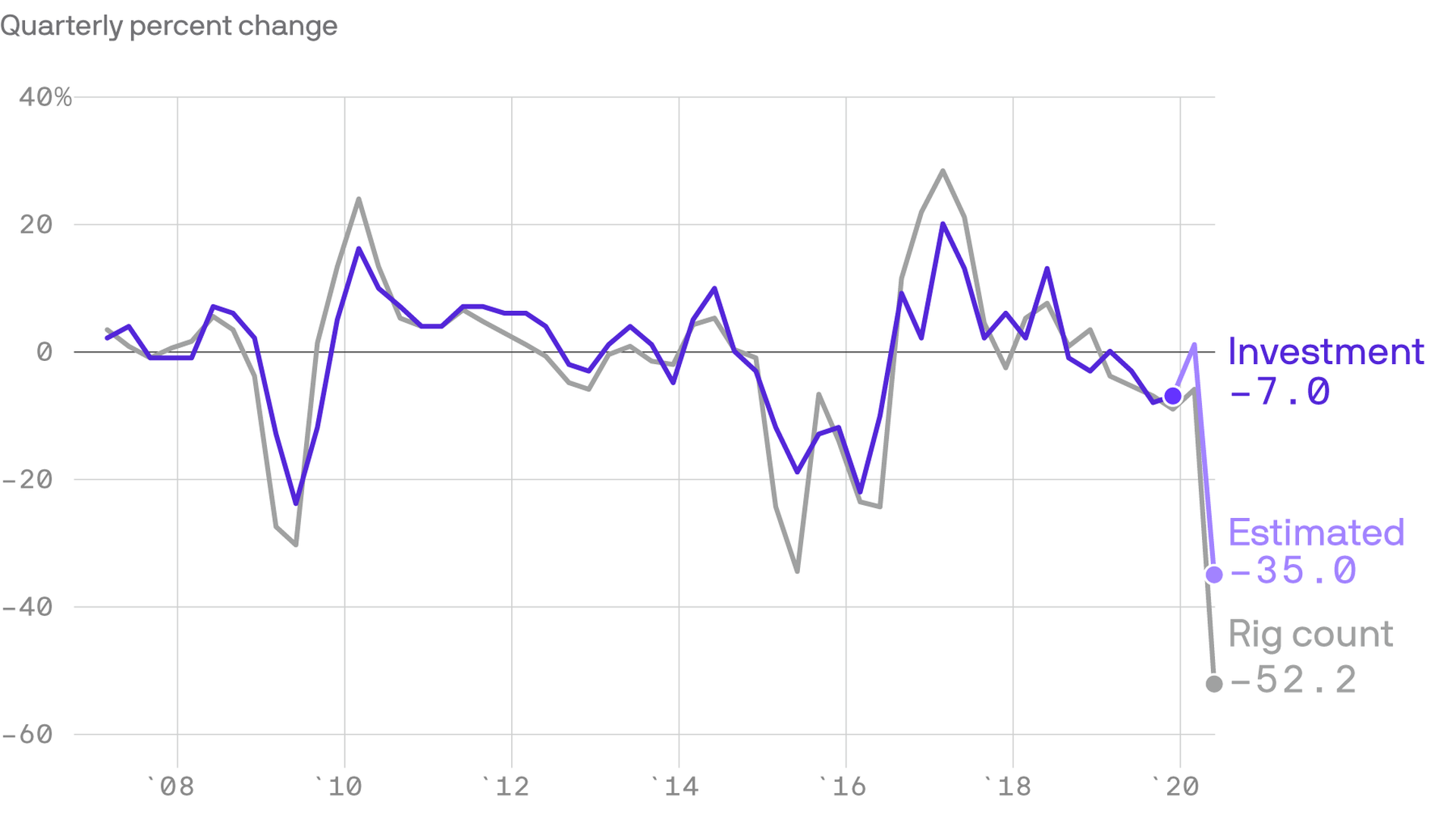

May 15, 2020 - Energy & Climate

U.S. oil producers to see bigger capital spending drop than 2008

Add Axios as your preferred source to

see more of our stories on Google.

Data: Federal Reserve Bank of Dallas; Chart: Sara Wise/Axios

Add Axios as your preferred source to

see more of our stories on Google.

Data: Federal Reserve Bank of Dallas; Chart: Sara Wise/Axios