Jan 30, 2019

Fed says it will be "patient" determining future rate hike decisions

Add Axios as your preferred source to

see more of our stories on Google.

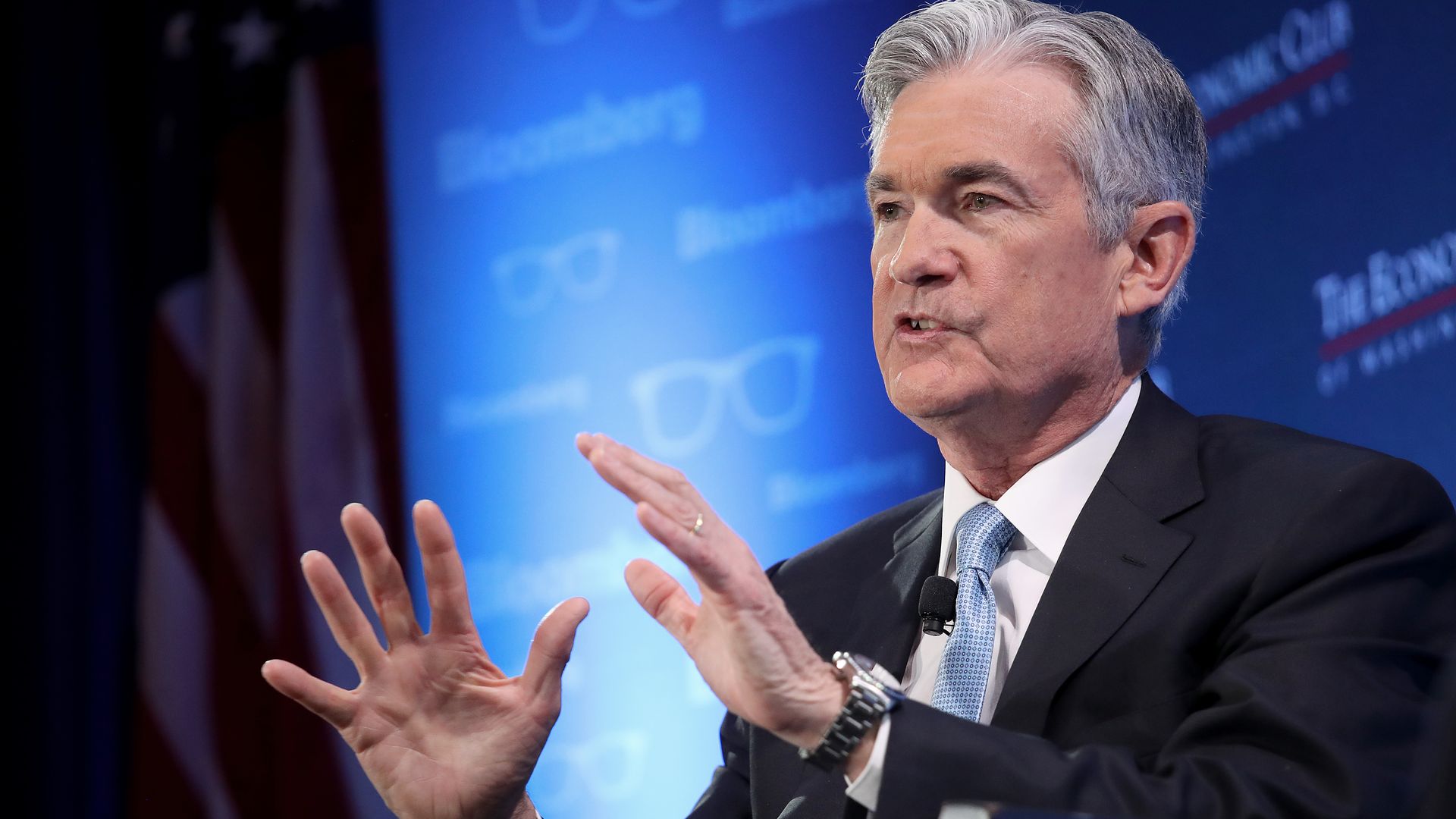

Fed chair Jerome Powell speaks at the Economic Club of Washington earlier this month. Photo: Win McNamee/Getty Images