Jan 29, 2019 - Energy & Climate

Tesla stock has 4 weeks to rally before a big bond is due

Add Axios as your preferred source to

see more of our stories on Google.

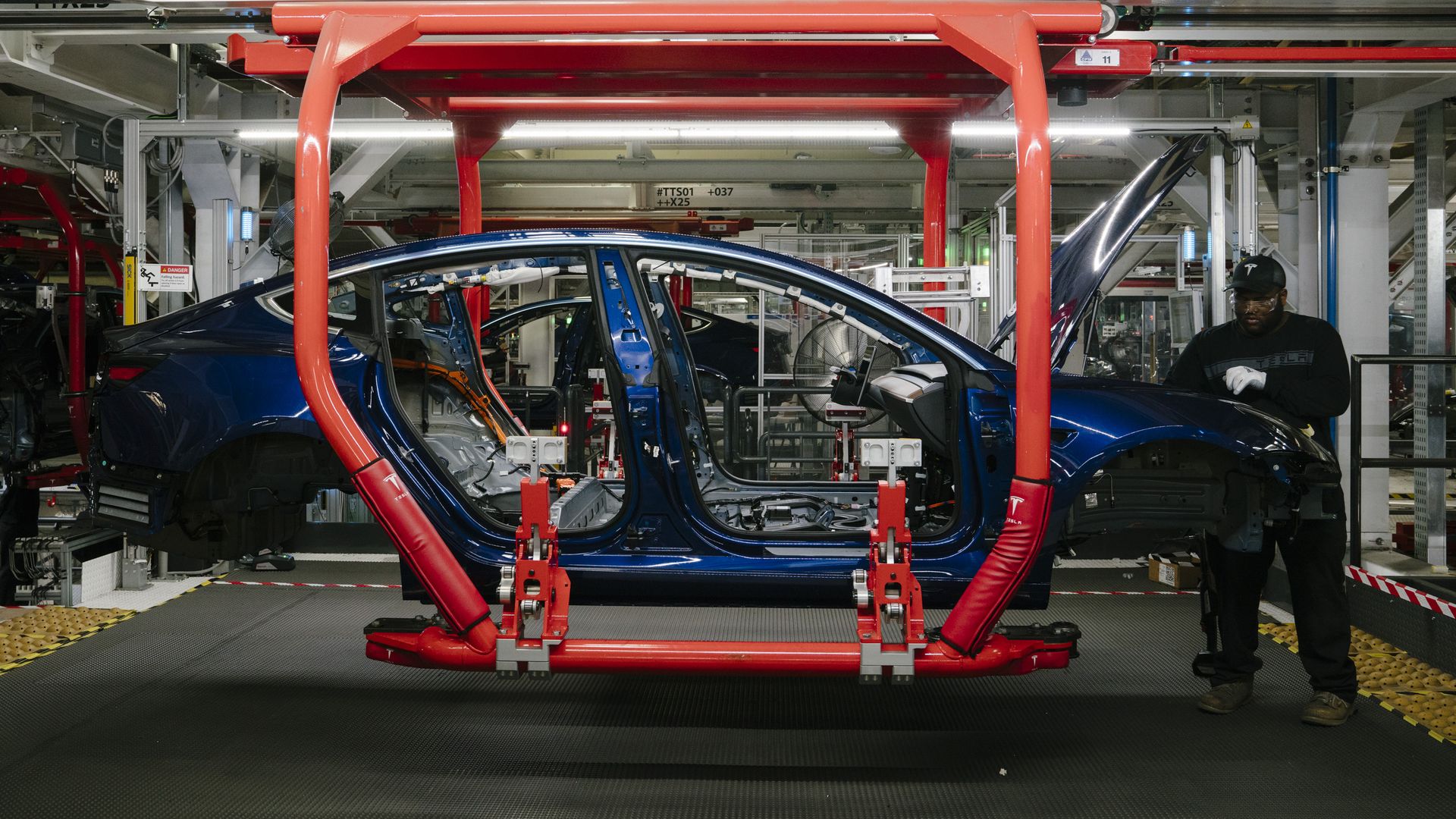

A Tesla factory in California. Photo: Mason Trinca for The Washington Post via Getty Images