Republicans might stop sweating the debt

Add Axios as your preferred source to

see more of our stories on Google.

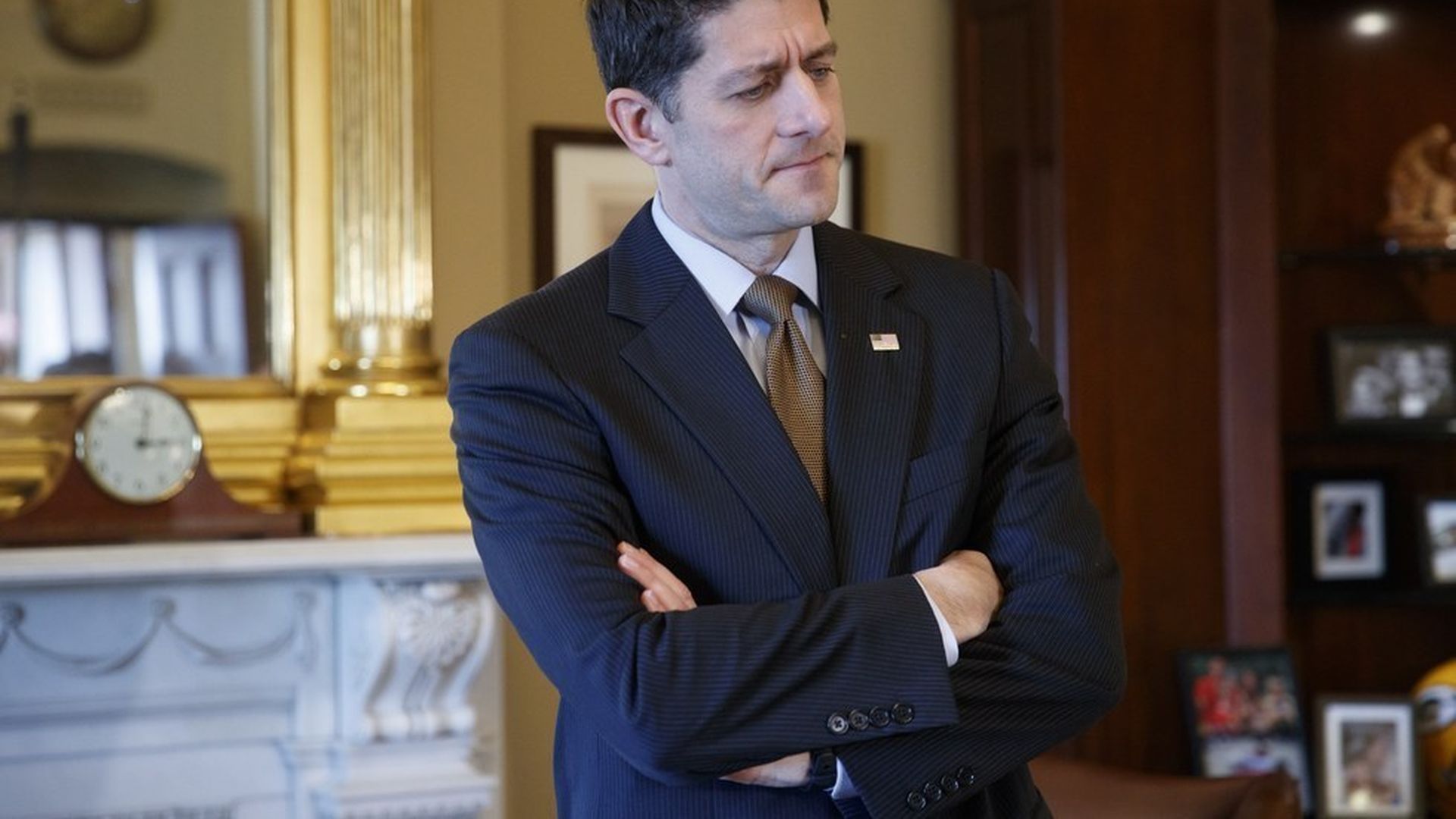

J. Scott Applewhite / AP

Conservative House Republicans, after spending eight years threatening to shut down the government over deficits, are flirting with an idea sure to increase the national debt.

We hear a growing number of the most conservative lawmakers are seduced by the idea of cutting taxes for corporations and individuals — but without paying for it with a tax hike, like Speaker Ryan's trillion-dollar border adjustment plan.

Who lit the fire: Stephen Moore, the Heritage economist and top economic advisor on Trump's campaign, pushed the idea recently to conservative Republicans behind closed doors in New York. Moore argued they should take the short-term hit on higher deficits — and bet economic growth will erase them, with time.

Who's for it: Some conservatives — including a notable number of the hardline Freedom Caucus, and some (but not most) of a larger conservative caucus, the Republican Study Committee — are embracing the idea as the only sure way to nail a massive tax overhaul while they have the chance. Influential conservative groups like Heritage and the Club for Growth will back them. Club President David Macintosh describes revenue neutrality as a "red herring" argument made by Republicans who refuse to shrink government.

Who's against it: We're told that Speaker Ryan and House Majority Leader Kevin McCarthy are sticking with their insistence that rate cuts have to be offset with the border-adjustment tax, which would hurt retailers by making imports more expensive.

Where's Trump? The president loved to leverage debt as a businessman, and has no plans to cut entitlement spending. He remains skeptical about the border-adjustment tax, so we could easily see him backing Moore on this one. Expect a collision with his budget director, Mick Mulvaney.